Why the Fed Cannot Raise Rates

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

After Federal Reserve Chairwoman Janet Yellen’s congressional testimony, the markets are still convinced the Fed could begin to raise rates sometime this summer. This is just plain wishful thinking. The Fed can no more raise rates than it can borrow money into oblivion. The reason is simple: the Fed must maintain the pretense of being solvent to maintain its credibility as a financial institution.

Think about the balance sheet of the Fed. Its assets are a mixture of government bonds, Treasury notes, and mortgage-backed securities. The dollars that the Fed issues to purchase those assets are its corresponding liability. Needless to say, it has purchased a lot of bonds since 2008 (QE1, QE2, QE3). So since 2008, its balance sheet has expanded on both sides.

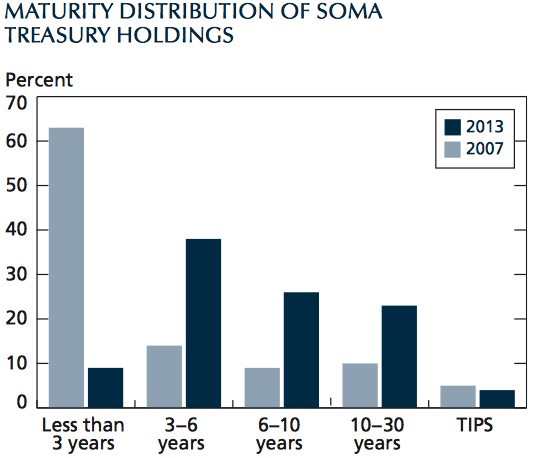

This isn’t yet a problem, because of the duration of its assets and liabilities. Most of its assets – the bonds and mortgage debt – are long-term, with a rough average duration of over 10 years. Meanwhile, its liabilities are all short-term, current liabilities. These are deposited at the Fed by various banks, and the banks can demand them at any time.

Longer duration loans pay a higher yield than short-term loans and deposits. Since interest rates are at historic lows, the Fed can continue to borrow short and lend long – and it makes a nice profit doing so.

Here’s an example with some simple math. The yield on a 10-year bond is 2%. This is the interest the Fed receives on its loans, which are its long-term assets. On the other side, the Fed owes no more than 0.25% on its short-term deposits, which are its short-term liabilities. That’s a year-over-year profit of 1.75%. It has bought roughly $2.8 trillion of long-term debt, so that equates to approximately $49 billion in yearly profits. Not bad – as long as rates are kept low.

But the Fed wants to raise rates (or so it claims). The market is also expecting a rate hike. What happens to this game of monetary musical chairs if the Fed does deliver the higher interest rates it’s been promising?

Dan Oliver Jr., President of the Committee for Monetary Research and Education, put it succinctly in the Wall Street Journal last August:

The enormous maturity mismatch between the Federal Reserve’s assets, which are now mostly long term, and its liabilities, which are all current liabilities, promises large losses when interest rates finally rise.”

Look a little closer at how this works. Suppose the Fed funds rate was raised to 1%. Instead of owing 0.25% on its short-term liabilities, it would now owe 1%. This would give it a 1% year-over-year profit if 10-year bonds still yielded 2%. That equates to more than a 40% drop, but it would still have a positive net income.

What if rates continued to rise back towards their historic norms, from 1% to 2.5% or even higher? Then the Fed has a big problem. If its assets pay 2%, but it owes 2.5% on its liabilities, then it has a negative cash flow and is illiquid. Instead of clearing a cool $49 billion a year, it now owes $14 billion.

That’s just the beginning of the Fed’s problems if rates rise. Far more devastating would be the effects on the value of its assets. To grasp this, you must understand that the market price of a bond runs inverse to its yield. So when the yields on new 10-year Treasury bonds go up, the price of your existing Treasury bond that you acquired at a lower yield goes down. This is because previously purchased bonds must be discounted to the current market rate if sold into the market – not the rate at which you originally bought it.

If the Fed were to raise rates, the entire yield curve would rise in tandem, which means yields on every kind of bond would rise. So a bond that the Fed originally bought with, say, a 2% yield must now be discounted compared to the market with bonds that delivered a higher yield. If the Fed were to try to sell this bond on the market, it would suffer a capital loss on its balance sheet. At the same time, the short-term liabilities of the Fed would remain, and it would be required to pay them. So if rates rose enough, the Fed would incur losses on both sides of its balance sheet.

The common rebuttal to this scenario is that the Fed can simply borrow more money to pay what it owes. This is certainly possible, but is it really an advisable solution to the problem? If the Fed were to have negative cash flow on top of a portfolio of falling assets, borrowing more to service the losses only exacerbates the problem. Adding debt to an illiquid portfolio increases the pain; it doesn’t end it.

Even worse – how would the rest of the world respond to a financial institution caught in this position? The Fed would lose all credibility in the eyes of the world’s financial system. In turn, the US dollar would lose credibility, because it is the liability of the Fed. Not only would world banks run from and possibly dump US government bonds themselves, but they would likely also abandon the dollar.

The Fed cannot allow this to happen, so it cannot raise interest rates. At least, not to any significant degree.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

[…] READ MORE […]

I agree that the Fed probably won’t raise rates but I think for slightly different reasons. Mainly because politicians always take the path of least resistance and it is easier for them to keep the party going than to take away the punch bowl.

Shouldn’t you say “The common rebuttal to this scenario is that the Fed can simply PRINT MORE MONEY.”? I guess I’m not clear on how the Fed “borrows.” Don’t they just print any money they need out of thin air like they’ve been doing up to this point? And I’m not sure why they’d be concerned about negative cash flow and they don’t seem to care about credibility or else it wouldn’t have gone this far. They know that the price they paid for their assets was way over the actual market price – they’re not worried about making sound investments like private institutions.

Somewhat agree with Dave.As long as the investment community wants to see the game continue and most Americans,who don’t even understand or care about the game aren’t complaining,the Fed can do whatever it pleases.The game can/will continue until the Dollar crashes/inflations soars.

Very well written. Fed needs to start selling its mbs. Any buyers?