Many Americans are concerned about their privacy today. And rightly so. The NSA and governmental authorities maintain their policies are ultimately for the safety and security of the American people. We will leave that debate in the capable hands of others, but where is this same concern when it comes to money? Have central governments given us a safe, secure, and stable money in the dollar system lead by the Federal Reserve? In this article we will compare the dollar to gold and even throw in the most popular cryptocurrency Bitcoin (BTC) to spice things up a bit.

First, let’s define what we mean by security.

Whether intuitively or analytically, we all know that the dollar is not such a great form of money. That’s putting it lightly though. The dollar is a terrible form of money when you take a closer look. Those who have lived longer on this earth tend to grasp this reality more clearly. Like trying to walk up a downward-moving escalator, the momentum of a falling dollar is always against you. This becomes clearer when engaging in economic planning. Whether it’s starting a business, making an investment, saving for retirement, putting something away for a rainy day, or simply making ends meet on a week to week basis, all of us have to work against a falling dollar (or fill in the blank with your fiat currency of choice.)

If that’s true, why do we keep using it?

The monetary landscape of today looks pretty grim. We are in the middle of the perennial decline in the rate of interest. Central bankers are convinced they can get us all out of this mess. But can they really?

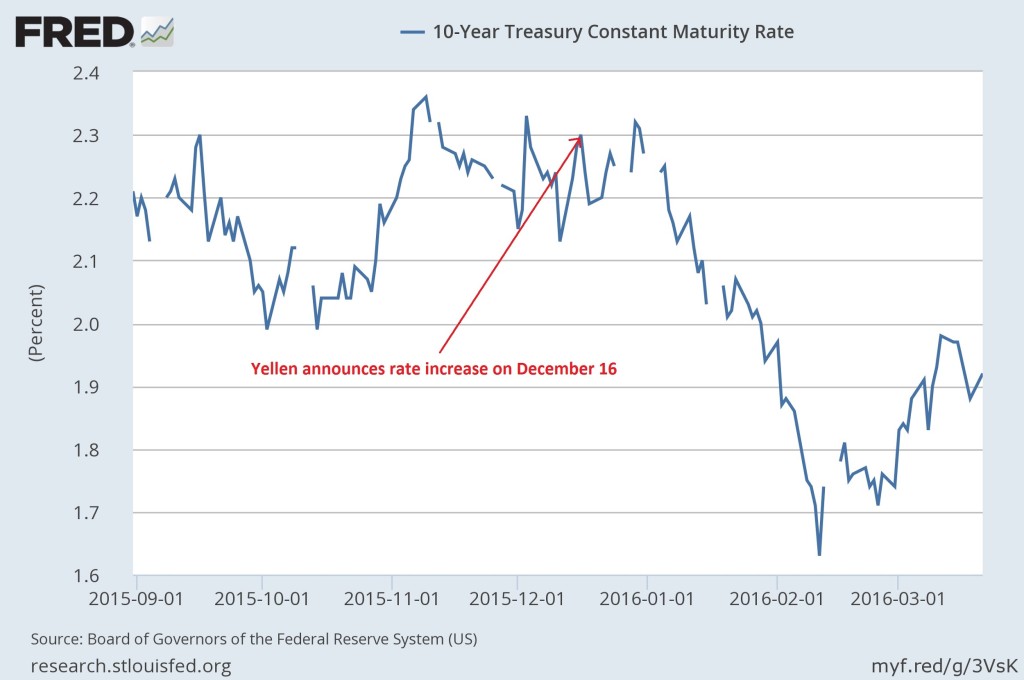

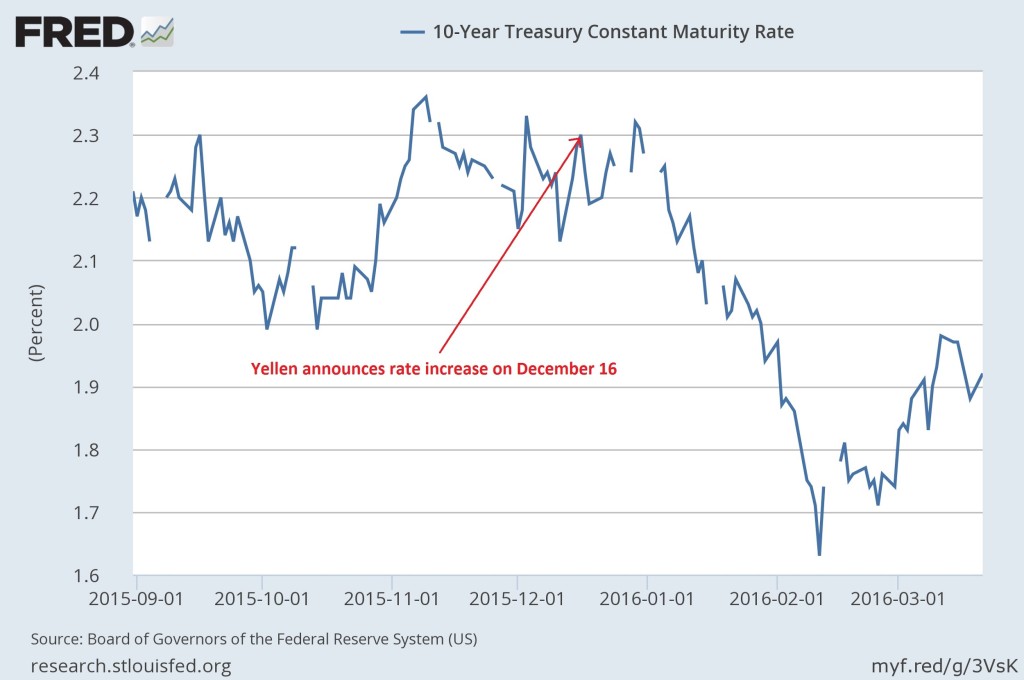

Janet Yellen timidly tried to go against the decade long trend by raising rates at the end of last year. It has not panned out so well. In fact, rates actually declined despite her announcement and subsequent plan to keep raising rates throughout the year.

Zooming out a bit we get a much clearer picture of the long term trend.

Due to the high level of response from our readers to the first article we posted on the benefits of our low cost vault storage solutions, we wanted to follow up and delve into the details of how to buy and sell gold and silver stored in a domestic or international vault.

To begin with, creating a storage account through our storage partners is a simple and easy process. Individuals as well as corporations, LLC’s, trusts, partnerships and other legal entities, can open an account. There is a one-page form to fill out, a couple of identification documents to provide, and in about two to three business days, your storage account will be opened. As our website details, we have domestic storage locations here in the US in addition to strategic international jurisdictions abroad.

Once the storage account is created and you have your assigned account number, you can then proceed to buy your physical metals from our firm.

Last week, I published an article on the causes and consequences of negative interest rates. In it, I talked briefly about how negative yields hold significant implications for gold as an asset class. In this followup article, I will explain why that is.

Capital and Negative Yields

Capital in waiting – capital sitting on the sidelines waiting for a good investment opportunity – typically gets parked in government bonds. This is true for a number of reasons. Bonds are less speculative compared to most assets. The only risks are a sudden rise in yields or a fall in the denominated currency if it’s a foreign bond. Of course, some governments and jurisdictions are less appealing than others, as anyone with exposure to Greek bonds will tell you.

Despite a less than perfect track record, government bonds are still considered the “risk free” asset. Setting aside whether they truly are“risk free” (they aren’t) they are certainly less risky than buying a stock, or trading a commodity or a piece of real estate. In the former two options you risk immediate price exposure with every tick, and in the latter, there are natural liquidity restraints. Additionally, the bond market is the only market big enough and liquid enough to absorb this kind of capital. If you are thinking about money in the bank, make no mistake, there are little to no physical cash reserves sitting in the bank. All the deposited funds are moved into another asset at the bank’s discretion within regulatory restraints.

Central Banks are under the mistaken belief that negative interest rates could be the magic kiss which turns their toad economics into Prince Charmings. Why exactly do they think this? What makes Draghi, Kuroda, and others think imposing negative interest rates will stimulate credit and lending in their respective economies?

It is important to understand the logic behind this historic moment in global monetary history. Negative interest rates are unprecedented and show how far we have gone off course in terms of policy related to money and credit markets. They are already having a tremendous effect in several European countries and Japan, and they may eventually be coming to the US. Negative rates hold significant future implications for gold as well.

For international customers who want to invest in physical gold and silver, taking delivery of metals can be an irksome situation.

The cost of shipping isn’t the problem. Shipping and insuring gold internationally is actually quite affordable, and SchiffGold offers low international shipping rates to over 60 different countries.

However, the real problems occur at the border of the receiving country. Despite international customs regulations which allow .9999 pure gold to remain free from value added taxes or duties, many customs officials will charge a fee to have the metals released. Sometimes this fee is as large as 20% of the total value of the package. This is particularly a problem in Central and South America where corruption at the border is rampant.

Money is not a collector item, and buyers should beware of Scammers trying push buyback guarantee contracts on customers for products they should never be considering in the first place.

Despite our efforts to reveal the most common gold scams, there always seems to be a new trick up the gold scammer’ sleeves. At this time, we are hearing about a lot of companies offering special buyback guarantees or special contracts that “ensure” clients a buyback price on the products they are selling.

At first glance, this is all sounds good. Who doesn’t want the added security of a contractual agreement to buy back a certain product at a later date? However, upon closer inspection, such an agreement is a proverbial wolf in sheep’s clothing.

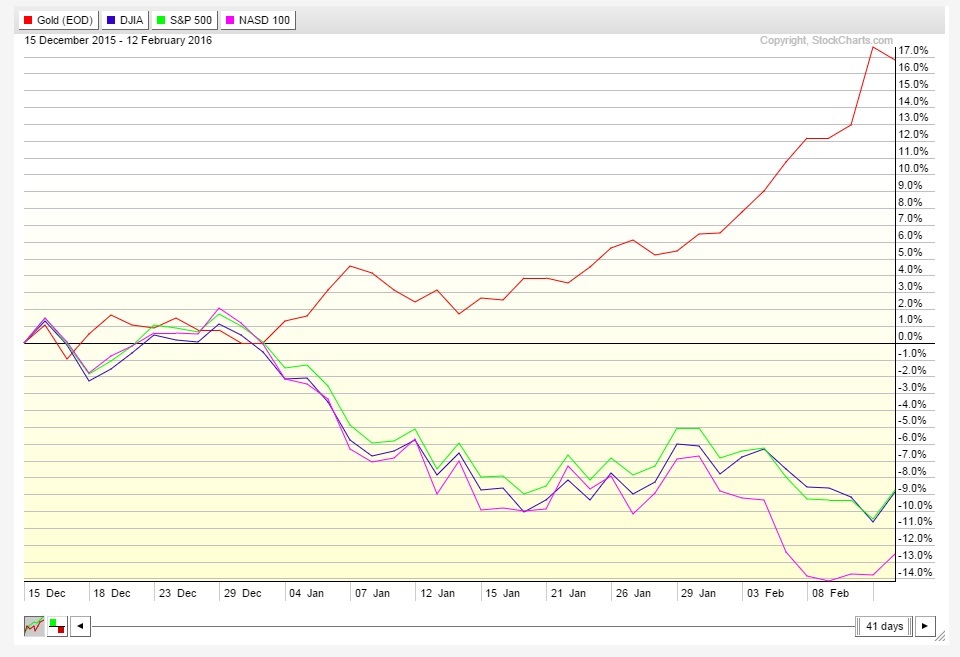

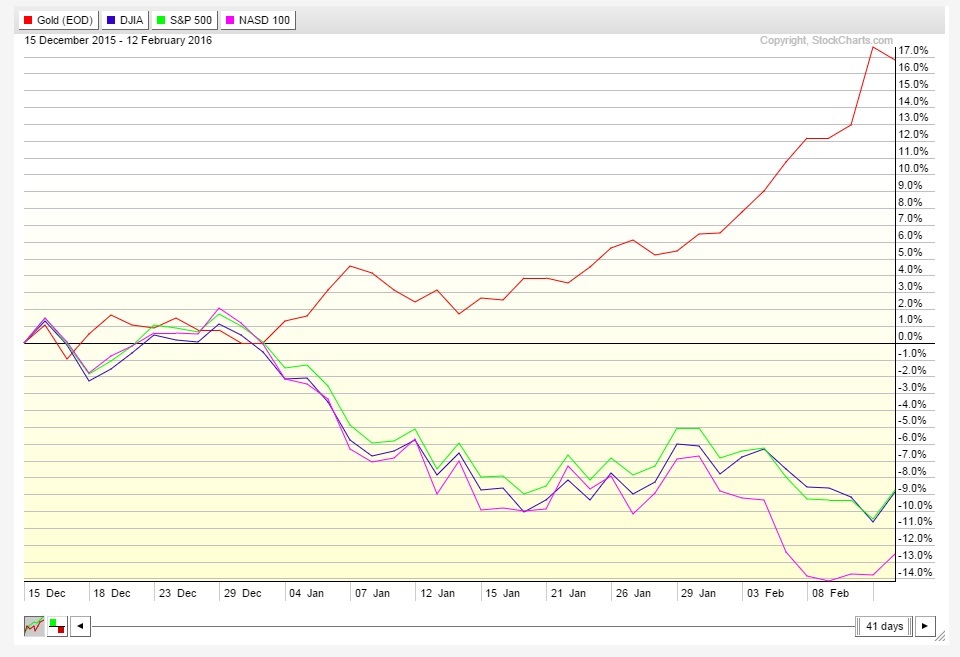

Mainstream media pundits, economists, and journalists alike love to lump gold in with other commodities. They put it in the same category as oil, copper, wheat, natural gas, and other things that come out of the ground. But while gold is in fact a metal you must dig up, it is a mistake to call it “just another commodity.” Gold’s recent price performance shows that it is anything but. Gold is a superior safe-haven asset to own in times of financial duress and uncertainty.

Since the beginning of 2016, the market has demonstrated that gold is a unique asset we should approach differently than other commodities. Here is a chart comparing the price of gold against major US domestic indices since the beginning of the year.

To hike or not to hike – that question continues to swirl around the Federal Reserve. But it obscures an even more significant question: what difference does it really make to the gold investor?

As I explained last week, the Fed finds itself in a damned-if-it-does, damned-if-it-doesn’t scenario. Regardless of whatever economic news spins out of Washington D.C. in the next few weeks, the central bank has plenty of reasons not to raise rates. As we’ve argued for months, the economy simply can’t sustain a rate-hike of any significant amount over the long-haul. But if the Fed balks at a rate hike yet again, its credibility takes another shot on the chin.

So, it might try to nudge rates up this month. Or, it may well put it off again. But what does this mean for gold? Does it really matter in the long run?

Not really. There are more important fundamentals to consider.