ETFs No Substitute for Physical Gold in a Crisis

Gold-backed exchange-traded funds (ETFs) generally follow the price of gold. As a result, they have been underperforming relative to the general stock market this year.

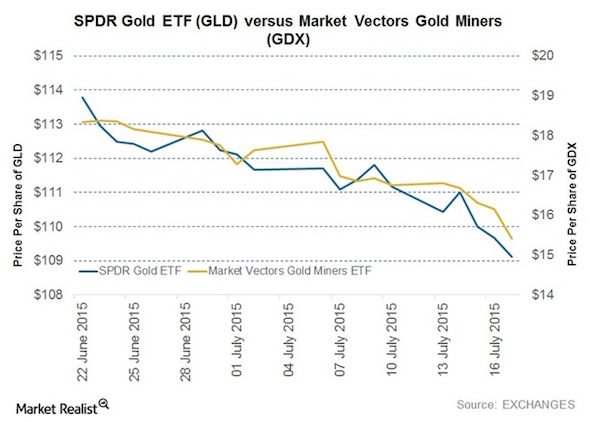

For instance, SPDR Gold Trust (GLD) lost about 28.3% of its value in 2013, fell another 2.2% in 2014 and yet another 3.8% so far this year. It was recently trading at $109.72 per share.

ETFs are backed by physical gold held by the issuer, and are traded on the market like stocks. They allow investors to play gold without having to buy full ounces of gold at spot price. Since their purchase is just a number in a computer, they can trade their investment into another stock or cash pretty much whenever they want, even multiple times in the same day. Many speculative investors appreciate this liquidity.

There are also gold mining ETFs that track the value of gold mining companies and also generally follow the price of gold. These are very popular with speculative commodity investors and some of the most popular hit record lows this past summer, like the Market Vectors Gold Miners ETF (GDX).

With gold ETF prices being so low, many of Peter Schiff’s clients have asked if they should be investing in these ETFs.

There are good reasons to invest in ETFs, but they aren’t a substitute for owning physical metal. In an overall investment strategy, SchiffGold recommends buying gold bullion first.

When considering gold-backed ETFs, you should always keep in mind that you don’t actually own the gold. Buying the most common ETFs does not entitle you to any actual amount of the precious metal.

Having physical metal in your possession is particularly important in the event of an economic meltdown. Think about it: what would you rather have in your possession during a crisis – a piece of paper, or a physical asset recognized as real money all over the world?

Gold-backed ETFs are prized for their liquidity and ease of transfer, but during a period of economic chaos, those characteristics would likely vanish. Crisis creates uncertainty. Panicked people won’t value paper that may or may not represent a tangible asset. But they will value physical metal that they can hold in their hands.

In the event of an economic collapse, barter could become an important means of conducting business. That’s exactly what happened in Greece during its economic meltdown. You can use gold coins and easily barter in an emergency. People all over the world recognize gold as money. It’s much less certain that you would be able to liquidate an ETF during a time of crisis.

Consider a case a dollar collapse and hyperinflation. The rapidly rising price of consumer goods, from groceries to gasoline, would make day-to-day living very difficult. Even if you managed to liquidate your gold-backed ETF, the currency you pull out would rapidly lose value. Physical gold, in your hand, would be immune to the government’s printing press. In all likelihood, your gold would buy you the same basket of goods and services a month, or even a year later. The cash you pulled from your gold-backed ETF would likely purchase far less as time goes on.

Although gold-backed ETFs offer an easy way invest in the precious metal, you always have to remember that you don’t actually own what you can’t hold in your own hands. There is always “counterparty risk.” The fact you possess an ETF does not give you the right to redeem it for actual gold. The owner of the gold is backing your investment, and promising to pay you dollars.

Physical gold offers stability and certainty in your investment. You can put a gold coin in your pocket. With a gold-backed ETF, all you really have is a piece of paper representing a legal promise. That’s well-and-good in normal market conditions – but in a real emergency, promises are easily broken.

Gold-backed ETFs have a place in an overall investment scheme. But for security in the event of a crisis, they simply cannot replace physical gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Politicians parrot on about small businesses being the backbone of the economy, only to pass the regulations that stifle them. In 2024, several federal agencies instituted new regulations on small businesses. These agencies included the Financial Crimes Enforcement Network, the IRS, and the Consumer Financial Protection Bureau. The new restrictions add to an exponentially increasing mountain of […]

Politicians parrot on about small businesses being the backbone of the economy, only to pass the regulations that stifle them. In 2024, several federal agencies instituted new regulations on small businesses. These agencies included the Financial Crimes Enforcement Network, the IRS, and the Consumer Financial Protection Bureau. The new restrictions add to an exponentially increasing mountain of […] The US national debt is so out of control that, ironically enough, even the Federal Reserve chair has expressed concern about the problem. And while America is among the top contributors, it isn’t just the US that’s spending money it doesn’t have: after briefly declining in 2023, the global debt-to-GDP ratio is again at an all-time high.

The US national debt is so out of control that, ironically enough, even the Federal Reserve chair has expressed concern about the problem. And while America is among the top contributors, it isn’t just the US that’s spending money it doesn’t have: after briefly declining in 2023, the global debt-to-GDP ratio is again at an all-time high. The percentage of U.S. adults holding an advanced degree increased by over 3% from 2011-2021. This increase in education is assumed to have a crucial role in America’s increasing economic strength over that time period. The expertise gained from such degrees is supposed to be valuable enough to outweigh the time and money put into grad degrees, […]

The percentage of U.S. adults holding an advanced degree increased by over 3% from 2011-2021. This increase in education is assumed to have a crucial role in America’s increasing economic strength over that time period. The expertise gained from such degrees is supposed to be valuable enough to outweigh the time and money put into grad degrees, […] Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC).

Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC). American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […]

American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […]

EXCELLENT CLARITY

Mr. Schiff,

Have Followed your On Target Valuable EDUCATIONAL Tools for Myself My Clients and My Family.

Your Single VOICE HAS AND STILL Impacting All of Us.

Thank You

Gail Cipolla, RDH,and Business Owner GMCGlobal Solutions

Abington, MA