Buffett’s Bursting Bubble

By Peter Schiff

The gold doomsayers have found their champion in the media’s favorite financial advisor and one of the world’s richest men. Warren Buffett, the man dubbed the “Oracle of Omaha,” has repeatedly and publicly denied that gold is an investment, and called gold buyers “speculators” and people “who fear almost all other assets.” In fact, Buffett claims that gold’s rise has the same characteristics as the housing and dot-com bubbles, and it is only a matter of time before it reverses course. He doesn’t mean that the price will decline because of austerity measures and a free-market interest rate, mind you. He just asserts that because he’s deemed it a bubble, it will inevitably burst.

The financial world by-and-large views Buffett as an objective observer, a rare investor who still considers the best interests of common man when he speaks. Each year, there is much hullabaloo over the letter Buffett writes to the shareholders of Berkshire Hathaway. When Buffett makes a claim, the financial world coos and repeats it without question.

I concede that Buffett is a talented investor and a great communicator. He clearly has had great success and has much to offer. But that shouldn’t blind anyone to the fact that Buffett is not a trusted observer. He’s a crony capitalist who bends the truth to serve his long-held ideological commitment to big government.

In the early stages of the financial crisis, when I was writing and promoting my first book Crash Proof to warn private investors about trouble ahead, Buffett was accumulating shares in companies such as Goldman Sachs, Wells Fargo, Bank of America, and General Electric. I knew these companies were insolvent, so I wouldn’t touch them with gardening gloves on. When the credit markets seized up, Buffett worked behind the scenes and in public to make sure each of his pet companies were bailed out. This was not by coincidence. Buffett actually stated in September 2008 that he would not have invested in Goldman Sachs if not for the implicit guarantee of federal assistance. As a result, he profited at the expense of taxpayers at the very time when they were losing their savings in the markets. Meanwhile, many “in the know” politicians bought Berkshire stock during the height of the crisis, making a profit from their votes, and giving them incentive to revere Buffett all the more. Buffett once said if that if the government didn’t bailout failed companies, he would be “having my Thanksgiving dinner at McDonald’s instead of having a big dinner at my daughter’s.” Seems like there were two bloated turkeys at that meal.

If Buffett were a true capitalist, he would be in favor of gold. He has noted that the value of the dollar has fallen 86% since he took over Berkshire Hathaway in 1965 and even said in his latest shareholder letter that investors are “right to be fearful of paper money.” But he continues to harp on gold. It seems the only unit of account Mr. Buffett approves are shares of his own company!

The adoption of an independent measure of value like gold presents two problems to Buffett. First, it would reduce the nominal returns of his dollar-based investing strategy. Second, it would restrict Washington’s ability to goose the financial system in his favor.

In the 19th century, when gold and silver were legal tender, the outsized returns to which Buffett has become accustomed were much harder to earn. Most people kept their money in physical bullion or bank deposits – and earned a real rate of return. Now, under the fiat system, working folks are forced into the more complicated world of equity investing. This, too, can generate real returns, but it’s a tougher playing field for the inexperienced.

Also, the fiat system artificially balloons the financial services portion of the economy. In the 19th century, fortunes were made more often by business owners than simple equity investors. People were more likely to rewarded for providing a productive service than having direct access to the Fed’s discount window.

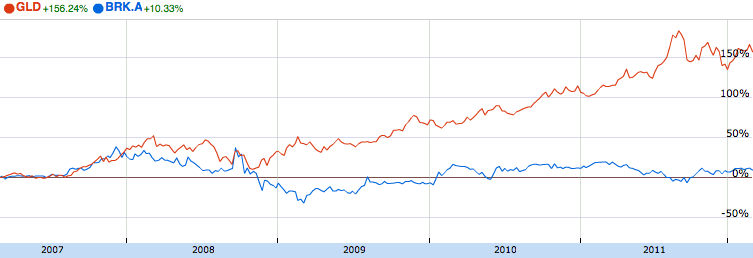

A quick look at Berkshire’s performance verses gold since the Credit Crunch goes a long way to explaining Buffett’s antipathy toward the yellow metal:

Gold vs Berkshire Hathaway

Source: Google Finance

But Mr. Buffett’s lack of credibility goes deeper than a differing monetary philosophy. He has been in the press since last August claiming that he pays less taxes than his secretary – and urging Congress to pass a “Buffett Rule” mandating a 30% minimum tax on millionaires. The natural reaction is to say, “If you want to pay more, go ahead.” But Buffett has gone on record saying that it’s not enough for him to lead by example, and demanding that all of America’s well-off bear the burden of Washington’s reckless spending binge.

The problem is that Buffett’s entire argument is constructed on deception. Buffett is rated as the third richest man in the world for managing the nearly $393 billion in assets, and he highlights that he pays only pays 17.4% of his income in taxes. But this is because he earns less than 1% of his annual wealth from his salary, while over 99% is earned as the largest shareholder of Berkshire Hathaway. Buffett claims that he discounts his Berkshire holdings because he plans to give it all to charity when he dies. So, it’s not that the tax rates are so low, it’s that Buffett plans to give away 99% of his wealth.

But even accounting for this clever accounting trick, Buffett is still grossly understating his personal tax burden. He owns roughly 1/3 of Berkshire’s outstanding shares, the profits from which are subject to a 29% corporate tax rate. Last year, Berkshire paid $5.6 billion in taxes – and the IRS says they owe $1 billion more! In addition to corporate taxes, Buffett is also subject to an additional 15% capital gains tax on his stock when he cashes out, not to mention any future estate tax, leaving many to conclude that his share of taxes is certainly higher than his secretary’s.

You might wonder what Buffett would hope to gain by understating his own tax rate. To answer that, you have to understand Buffett’s ideological background. His father, Howard Buffett, was a US Congressman known for his staunch libertarianism. As has been recounted by biographers, Buffett resented being uprooted from his Omaha, NE home to move to Washington, DC and felt estranged from his stoic father. That is to say, Buffett’s commitment to the nanny state runs very deep.

But also, as mentioned earlier, Buffett personally benefits from the current corrupt state of affairs. He gets prestige from nominal gains in his stock price. He gets bailout money to guarantee the insolvent companies in which he invests. Even that estate tax that will hit him when he passes currently allows him to buy out other businesses at a steep discount.

It also shouldn’t be a surprise that humble Howard was a staunch advocate of gold and silver as money – nor that wealthy Warren rejects precious metals as having “no utility.”

The media has built Warren up to be a demigod, a straight-talking Nebraska boy that can hold his own against the vipers of Wall Street. But he is just a man with a talent for making money, and his motives should not be beyond reproach. Is he advocating the use taxpayer money to bailout his business interests so he can profit? Is he being honest about what money is? Does he even understand the business cycle?

Gold prices will only go down when governments change course and make significant cuts. Until then, gold is not in a bubble. It’s the only way to protect your wealth; and in the current economic condition, it’s poised to go much higher. I think it’s high time Buffett takes to heart his father’s wise words: “For if human liberty is to survive in America, we must win the battle to restore honest money.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Innovation has a silent killer… a scourge that America has aided and abetted for over a century. Innovative activity is the backbone of the economy. Because of Google, Honda, and Netflix, life is easier for billions of people around the globe. A Stanford study found that up to 85% of economic growth is due to innovation. But what if all […]

Innovation has a silent killer… a scourge that America has aided and abetted for over a century. Innovative activity is the backbone of the economy. Because of Google, Honda, and Netflix, life is easier for billions of people around the globe. A Stanford study found that up to 85% of economic growth is due to innovation. But what if all […] In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […]

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […] Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

Leave a Reply