2011: Dud or Springboard?

Casey Research’s Gold Commentary

2011 was remarkable in many ways for the precious metals markets. Gold soared to new highs in early September, hitting at an intraday record of $1,920/ounce on the 5th. Silver screamed to within a hair of $50 on April 28. Corrections ensued, and the metals ended the year on a disappointing note for silver and an underwhelming note for gold. Equities for the sector were down, to way down for junior ventures, logging their worst annual return since 2008.

Here’s a table of 2011 returns from most major asset classes:

Gold registered its eleventh consecutive annual gain, extending the bull market that began in 2001. The yellow metal gained 10.1% – a solid return, though moderate when compared to previous years.

Silver lost almost 10% year-over-year, due primarily to its dual nature as a monetary and industrial metal. Currency concerns lit a match under the price early in the year, while global economic concerns forced it to give it all back later.

Gold mining stocks couldn’t shake the need for antidepressants most of the year, and another correction in gold in December dragged them further down.

Meanwhile, those who sat in US government debt in 2011 were handsomely rewarded, with Treasury bonds recording one of their biggest annual gains. In spite of the unparalleled downgrade of the country’s AAA credit rating, Treasuries were one of the best-performing asset classes of the year. The driving force there seems to be expanding fear about the sovereign debt crisis in Europe.

But perhaps it would be more accurate to look at 2011 in a larger context. How did these investments perform over the past three years?

There’s a lot to be said about the chart above, but we’ll cut to the chase: despite the higher volatility, we’d much rather be investing in the assets on the left side of the chart than those on the right.

2011 is now part of the history books. The important question before us is: is gold still one of the best places for your savings going forward? Let’s take a look at what we might expect in 2012 based on what we just left behind…

The fundamental case for gold remains rock solid

Gold demand from investment and central banks grew tremendously last year. Further, the geography of gold buying was widespread, with big purchases coming from Europe during the initial bouts of their crisis and Japan after the Fukushima accident. Small investors and monetary authorities alike purchased gold due to economic, financial, monetary, and political concerns. Quite frankly, we see none of these factors changing anytime soon.

Further, many countries continue to debase their currencies at phenomenal rates. While US Treasuries may be a good temporary parking spot for cash, don’t kid yourself about what’s behind it all: nothing. The dollar is a fiat currency, that’s all. A true safe haven is something that cannot be debased, devalued, or destroyed by any government. After accounting for inflation, your dollars are worth less every year.

The reasons for gold’s bull market aren’t going away anytime soon. Make sure you have enough exposure to make a material difference to your portfolio.

Don’t be deceived by promises of economic growth

The US economy ended the year on a high note – the job market is improving, gas is cheaper, consumer confidence grew, real estate showed signs of recovery, and the holiday shopping season turned out better than most economists expected. So, can the US grow its way out of the debt burden? Can we forget about further money-printing schemes that are bullish for gold?

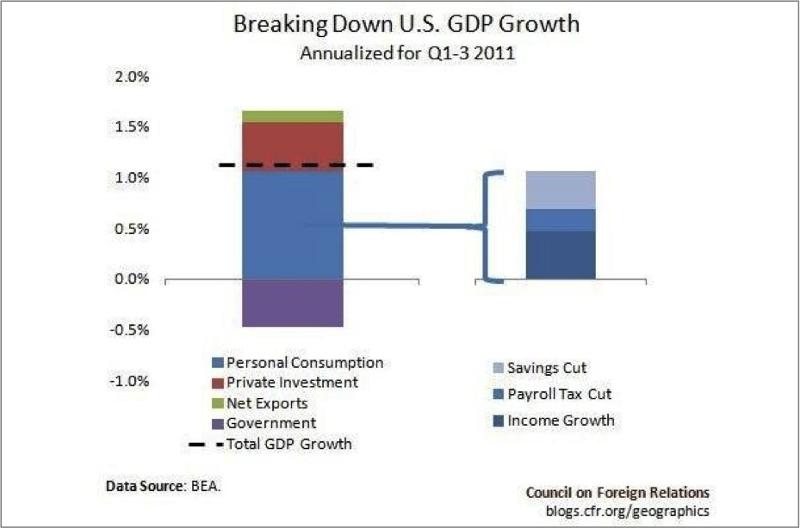

We think there’s little chance that growth will be sustainable in 2012. First, the biggest chunk of GDP growth in 2011 came from personal consumption – savings cuts and income growth in particular.

Strong GDP growth comes from production, not consumption. As Doug Casey has stated many times, it’s also the secret to personal wealth: “Produce more than you consume, and save and invest the difference.”

Second, according to a recent Time Magazine article, “The government says that once you adjust for inflation, weekly earnings dropped 1.8% from November 2010 to last month” [November 2011]. As a result, “Consumers have used savings or credit cards to finance their purchases.” This is hardly a sign of a strong economy.

Combining these facts with surging government debt and ongoing deficit spending means the “growth” in GDP is largely supported by… debt. US debt surpassed GDP last year for the first time since 1947, and if the Keynesians get their way, the cure for our massive debt overhang will be… more debt. Any such scheme, regardless of its name, is very bullish for gold.

The gold price will continue to be volatile

The average annual gold price in 2011 was $1,571.50/ounce, which was 28% higher than the prior year’s average. As we outlined in our last article about gold corrections, the average retreat in gold since 2001 (of those greater than 5%) is 12.5%. Declines of this degree are normal. They will happen again. Thus, expected price behavior leads us to get excited when gold and related stocks go on sale, not depressed about the dips.

If you buy gold during corrections, your gain by the end of the year will be higher than the annual advance.

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

Leave a Reply