Most people have a sense of history that goes back about two weeks. This is especially true in the world of investing and finance. As a result, people have a hard time seeing the big picture. For instance, a lot of people think the current inflation crisis was only due to the Fed failing to respond fast enough. As Peter Schiff pointed out, this inflation was in fact decades in the making.

And as James Anthony pointed out, the current inflation problem along with all of the big economic crises that occurred in the 20th and 21st centuries have one commonality — progressive government coupled with monetary policies run by the Federal Reserve.

In an article we published last week, Peter Schmidt highlighted what he called the “fatal conceit” of modern Keynesian economics. These economists, central bankers and politicians think they can plan, direct and guide the economy through their great wisdom and application of their economic models. But as economist Friedrich Hayek explained, the central planners’ arrogance ignores the knowledge problem. No individuals or groups of individuals, no matter how many PhDs they have among them, possesses the knowledge necessary to foresee all of the consequences of a given policy.

As financial guru Jim Grant once put it, “We are the prisoners of the very dubious set of pseudo-scientific pretentions that are part of the people who manage our monetary affairs.”

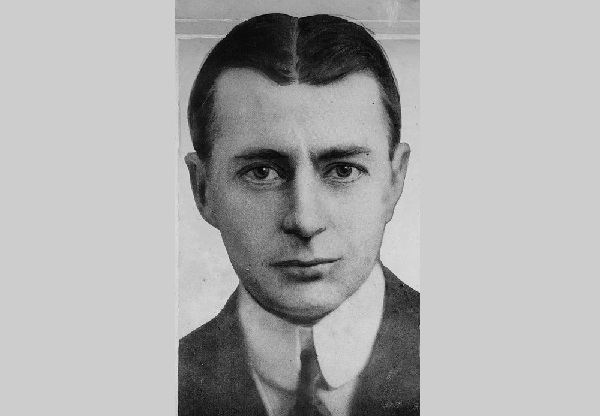

In a follow up to his last article, Schmidt puts an exclamation point on this idea of fatal conceit, recounting the maneuverings of Benjamin Strong, New York Federal Reserve governor from 1914-1928.

The following article was written by Peter Schmidt. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

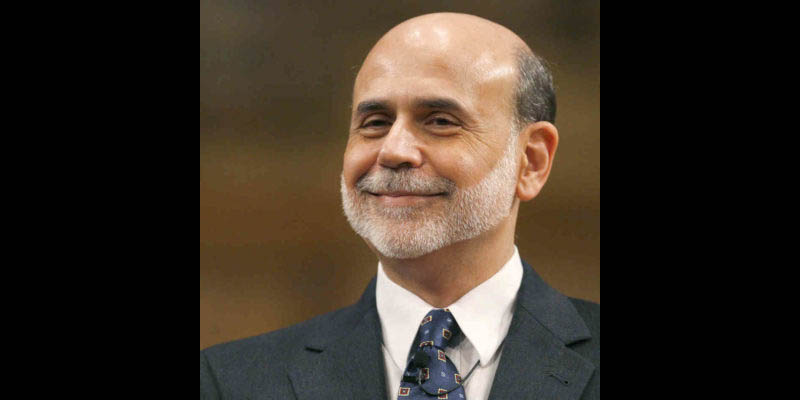

When Nixon closed the gold window in August 1971, the US found itself in exactly the same economic circumstances as Britain had in September 1931 when she reneged on her gold standard obligations. If Ben Bernanke’s theory on the Great Depression is correct – namely, that ‘countries that left gold earlier also recovered earlier’ – the United States should have received an enormous economic shot in the arm after finally freeing itself from its formerly golden fetters.

So what has all the resulting money creation and credit expansion from the Fed’s PhD economists with total freedom of action wrought since 1971? A cursory review of the automobile industry, which is not an unreasonable proxy for the entire US economy, reveals that the economy did not receive a shot in the arm by freeing central bankers from their “golden fetters”– unless of course the shot was loaded with some sort of highly-toxic economic poison.

A 1980s era Far Side cartoon featured a veterinary student named Doreen studying equine medicine in Chapter 9 of her textbook. On the left-hand side of the page was a list of horse ailments. They included things like a broken leg, infected eye, runny nose, and a fever to name just a few. On the right-hand side of the page, the treatment for each ailment was “Shoot.” The caption read, “Like most veterinarian students, Doreen breezed through Chapter 9.”

Ben Bernanke, Milton Friedman and the Ivy League economics departments that all regurgitate the same theory on the Great Depression pretty much treat the economy as simple-mindedly as Doreen’s textbook treated equine medicine.