May Jobs Report Shockingly Bad

This article was submitted by JD Bauman, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Last Friday, the BLS released its jobs report for the month of May.

It was shockingly bad.

In light of the strike on Verizon, a relatively weak report of 170,000 jobs was expected; however, the report delivered far below expectations with just 38,000 jobs created. The new data, detailing the worst jobs numbers in nearly six years, is also accompanied with downward revisions of earlier numbers. The BLS revisions of employment figures for March and April puts the economy with 59,000 less jobs than previously reported.

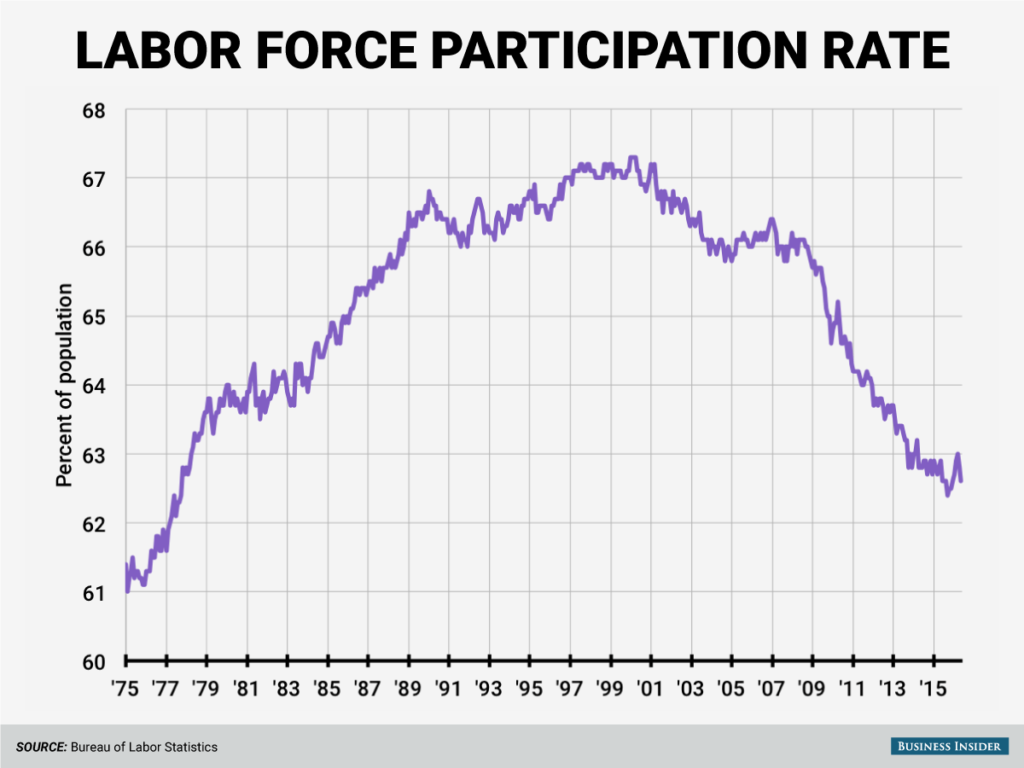

The labor force participation rate also decreased as 660,000 more workers left the labor force. The current participation rate of 62.6% is nearly the lowest the US has seen in the last four decades.

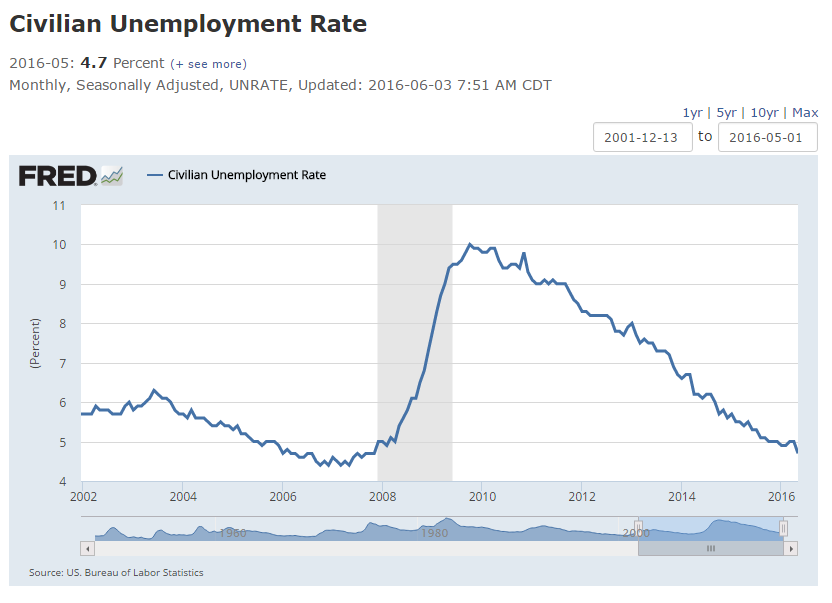

Amazingly, following this dismal report the official government unemployment rate went down to 4.7%, the lowest since the Great Recession of 2008. A smaller workforce, of course, means a lower unemployment rate. It just goes to show how unhelpful these statistics are in actually gauging the true health of an economy—and how deliberately deceptive the government and media are for using them.

Keep up with the latest trends and their impact on the gold market. Subscribe to Peter Schiff’s Gold Videocast

The weak jobs report also sheds light upon macroeconomic projections, indicating serious weakness in economic growth and a high likelihood that the Fed will not raise rates this summer, despite its previously hawkish remarks in the April minutes announcement.

“This was quite shocking – it’s way under expectations,” said Christopher Sullivan, who oversees $2.3 billion as chief investment officer at United Nations Federal Credit Union in NY. The Fed “will postpone a nearby rate hike for sure — maybe they’ll be forced to look beyond the summer.”

In reaction the jobs report, Bloomberg reports a fall in the dollar and stock prices, accompanied by a rise in both bond and gold prices. Following the release of Friday’s jobs report, the gold spot price rose $33.10 and closed at $1243.50 an ounce for the weekend. With new evidence of a faltering economy, investors are continuing to reallocate their portfolios into safer assets like gold.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

Leave a Reply