John Williams of Shadowstats.com appeared on USAWatchdog.com earlier this week to give his financial outlook for the US economy in 2014, and it wasn’t bright.

We have all sorts of things coming together that will give us a confluence of economic, political, and financial crises. You’ll see early on a crisis in the dollar, which will start to trigger the inflation… and as inflation picks up, that is going to savage the economy, which is already in a depression – it never recovered.”

[youtube http://www.youtube.com/watch?v=dQt-FFDM_5k&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Jim Rickards is on a roll this week, with another interview on Bloomberg TV in which he tells some skeptical hosts that the Fed’s policies are a disaster and that the stock market is a bubble. He also stuck by his commitment to long-term gold, insisting that he’s bullish on it because of his fundamental analysis that the US dollar is going to collapse.

Gold correlates to one thing: the dollar… When gold goes up, what it really means is the dollar is down. So for gold to go to $7,000 – which I expect – what that means is that the dollar will lose 80% of its value, which it did in the 1970s… A gold rally is really a dollar collapse, and we should expect a dollar collapse.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

There are two types of gold investors: those trying to make money on short-term market timing and those looking for long-term asset preservation. It was the fear-driven trading of the former that helped gold break $1900 in 2011, and for good reason – stormy markets steer investors to safe havens.

But gold’s fortune has shifted in the past two years, and finishing 2013 down 28% seems to have sealed its fate – at least in the eyes of the short-term speculators. In reality, the same forces that are stabilizing stocks and suppressing gold are also the fundamental reasons long-term investors have been buying gold since the turn of the new millennium. The so-called recovery we’re now experiencing is just a lull in a storm that hasn’t yet abated.

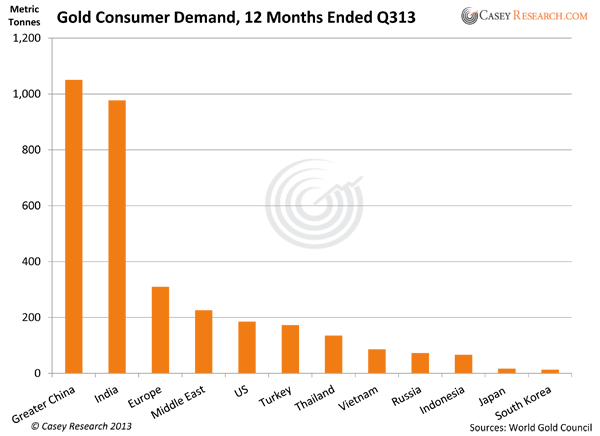

By Laurynas Vegys from Casey Research

It’s been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold has taken in 2013.

Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It has felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs (which is not a bad thing, by the way).

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!