A new poll by McClatchy-Marist reveals that Americans are increasingly aware of the inequality of the US economic system. Further, they don’t think it’s getting any better. They expect the next generation to be worse off than they are, and the majority doesn’t think the government’s policies are helping.

Peter Schiff has no love notes for the US economy this Valentine’s Day. On CNBC, Peter tears into the atrocious policies of Fed and the phony recovery in the United States. One of the only bright spots is the recovering gold market.

[The gold market] has really turned around in the last week or two, and I expect to see much higher gold prices in the weeks ahead as people get their arms around the true predicament that we have in the US, which is that we’re headed right back into recession.”

[youtube http://www.youtube.com/watch?v=AXxkLXjBV80&w=460&h=345]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In his latest video blog post, Peter Schiff looks at last week’s jobs numbers and gold’s rally thus far in 2014. He also comments on Janet Yellen’s press conference and her obvious lies about the effects that Fed policy is having on the economy.

Wall Street is still extremely skeptical of gold’s rally. Everybody expects that this rally is a head fake, that it’s going to reverse, and that gold is still headed much lower in 2014. I think that a lot of people that are anticipating lower gold prices are going to be surprised.”

For More Information on Investing in Gold

Call 1-888-GOLD-160 (1-888-465-3160)

Talk now to a Precious Metals Specialist who will be happy to answer your questions.

Request a Callback

Click Here and a Specialist will call you back at your convenience.

Chat Online

Click Here to chat with a Specialist right from your web browser.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Famed economist Marc Faber gave an interview to The Australian Financial Review and had no compunctions about tearing into the horrible policies of central banks around the world. Like Peter Schiff, Faber doesn’t see any real tightening happening in the near future.

CNBC expressed some surprise at Peter Schiff’s prediction that the Federal Reserve under Janet Yellen will be forced to resume quantitative easing later in this year. Peter reminded them that the Fed has always maintained that continued tapering is dependent upon positive economic indicators.

I am not benefiting [from QE] as an American. I would much rather prefer the government to pursue policies that benefit my country, so maybe I can bet on it, instead of betting against it. Which ultimately, I’m doing by owning gold, owning commodities… to try to escape the damage that the Fed and the government are doing to our currency and to our economy.”

[youtube http://www.youtube.com/watch?v=KoEAK2iL1_o?rel=0&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

Gold is the simplest of financial assets – you either own it or you don’t. Yet, at the same time, gold is also among the most private of assets. Once an individual locks his or her safe, that gold effectively disappears from the market at large. Unlike bank deposits or stocks, there is no way to tally the total amount of gold held by individual investors.

I like to call this concept “dark gold.” This is the real, broader gold market that exists below the surface-level transactions on the major exchanges. It’s impossible to know precisely how much dark gold exists around the world, but we do know that it is enough to render “official” gold holdings insignificant. That’s why I don’t buy and sell gold based on the decisions of John Paulson, or even J.P. Morgan Chase. It is a long-term investment that requires a deep understanding of the nature of money – and how little Wall Street’s media circus really matters.

By Bud Conrad of Casey Research

Gold has been in a downturn for more than two years now, resulting in the lowest investor sentiment in a long while. Hardcore goldbugs find no explanation in the big-picture financial numbers of government deficits and money creation, which should be supportive to gold. I have an explanation for why gold has been down – and why that is about to reverse itself. I’m convinced that now is the best time to invest in gold again.

GoldSeek Radio spoke with Peter Schiff last week about the state of the gold market in 2014. Peter explains that now is the time to buy physical gold, before the market wakes up and realizes it isn’t going down much further.

I think the Chinese officials are being dishonest with respect to their holdings. I don’t think they want to tell the world how much gold they own, because then they won’t be able to buy much more of it. Because no one will want to sell it to them once they appreciate how much they have and how much they want to buy. So I think they want to keep their asset size under wraps.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

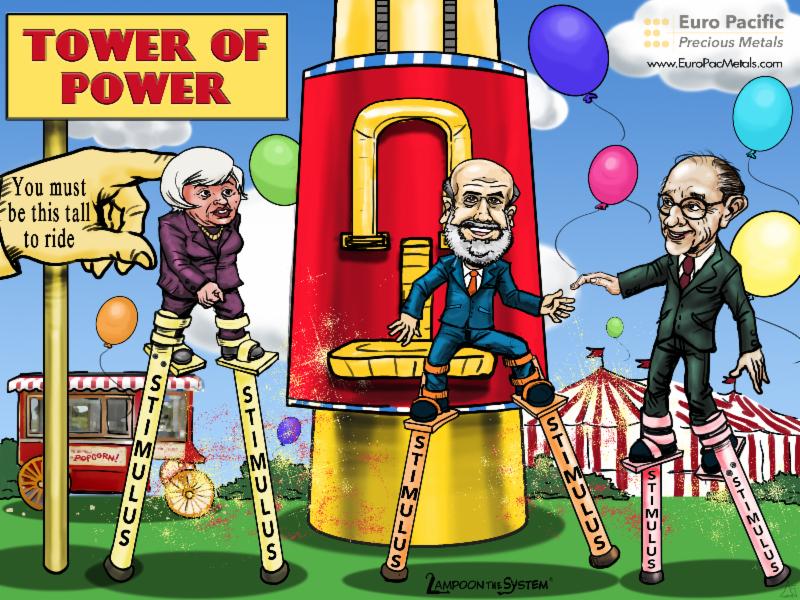

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

World Gold Mints Slammed with Demand

Bloomberg – Increased global demand for gold coins has world mints struggling to produce enough and maintain supplies. Austria’s mint, which saw a 36% increase in Philharmonic coin sales in 2013, is operating 24 hours a day. Purchases from Australia’s Perth Mint rose 20% YoY from the beginning of 2014 to January 20th. The US Mint is expecting its best month of sales since April 2013, when the gold price plunge triggered a surge in demand. The UK Royal Mint ran out of 2014 Sovereign gold coins by January 8th and took nearly a week to replenish supplies. In spite of gold’s overall price slump, mint managers expect physical demand to remain strong in the coming months. Read Full Article>>

US Silver Coin Premiums Expected to Rise

Bloomberg – Due to lack of supply and record demand, wholesale premiums on silver American Eagle coins may rise as high as 17%.