In a new commentary published by The Gold Republic Journal, renowned author and economist Jim Rickards explains why the Federal Reserve cannot safely exit its quantitative easing program. Rickards argues that the supposed strength of the US markets is a complete mirage created by the Fed’s policies.

The Federal Reserve, the central bank of the US, is nearing the end of its ability to manipulate the US economy without producing consequences worse that those it set out to avoid in 2008. The Fed has no good exits from seven years of market manipulation. If it continues its current policy of reducing purchases of assets, the so-called ‘tapering,’ it risks throwing the U.S. into a recession. If it reverses course and pauses the taper and later increases asset purchases, it risks destroying confidence in the dollar among foreign creditors of the U.S. Both outcomes are potentially disastrous, but there are no good outcomes on the horizon. This is the result of manipulating markets to the point where they no longer function as markets providing useful price signals and guiding the efficient allocation of capital. Today markets are a mirage, created by the Federal Reserve, which is caught in a prison of its own device.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

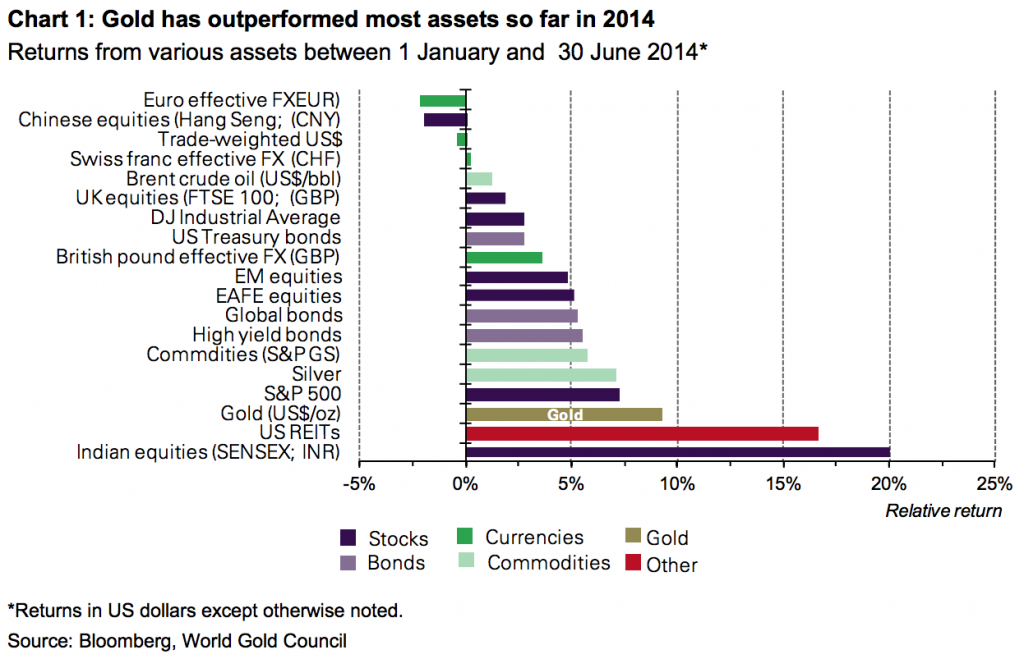

In its latest Investment Commentary, the World Gold Council explains why gold outperformed most assets in the first half of 2014, contrary to many analysts’ predictions. The report also shares the latest research on why gold is an essential asset for protecting your portfolio from high-risk debt and potential market volatility. The big takeaway – when it comes to risk protection in the second half of 2014, gold is one of your cheapest and most reliable options.

Gold is up by 9.2% so far this year. This surprised many market participants as most analysts predicted lower prices. Some investors took advantage of last year’s price correction to buy gold but investment demand has remained tepid. We consider that the current environment of high bond issuance, tight credit spreads and record low volatility continues to offer a prime opportunity for investors to add gold. In our view, gold can reduce overall portfolio risk and it is cheaper to implement than many volatility-based strategies.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold Interested in learning about the best ways to buy gold and silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In the first edition of the new Gold Videocast, Peter delivers his verdict on the gold market for the first half of 2014, analyzes Janet Yellen’s performance so far as Fed Chair, and makes some contrarian forecasts for the rest of the year.

In this long segment on CNBC’s Futures Now, Peter Schiff, Marc Faber, and Dennis Gartman discuss the massive bubbles forming in almost every asset class. Faber called for a potential bear market correction of 30% in US stocks. All three agreed that gold is the best option for retail investors to protect themselves from the Federal Reserve’s inflationary monetary policy.

The only place there’s not a bubble is in gold, and that’s the only place that most people on Wall Street think they see one. They’re oblivious to the actual bubbles, but they’re overlooking the value in gold…”

Marc Faber, Schiff, and Gartman talk markets from CNBC.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Russia Today spoke with Peter Schiff about the United States’ international spy activity and what effect it will have on the strength of the US dollar.

[Europe is not economically dependent on the US.] I think it is the other way around – the US is very dependent on the rest of the world. It is just incumbent on the rest of the world to figure that out. But the US dollar is still functioning as a reserve currency, so the dollar is a part of larger transactions but there is no reason for the dollar to be at the center of these transactions because the dollar shouldn’t be a reserve currency. Maybe at one time when we were the world’s largest exporter, as far as biggest trade surpluses, we had high savings rates, and the dollar was backed by gold. [At] one time maybe the dollar deserved to be a reserve currency, but certainly those conditions have changed dramatically.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The June edition of the Silver Institute’s Silver News is now available. This issue is full of news from the silver industry, highlighting some of the most interesting inventions and applications using silver today. Silver’s natural anti-microbial properties are being explored by industries around the world, ensuring demand for the white metal for many years into the future. Among other news, you’ll learn about:

- A new “drinkable book” that uses silver to filter water with its pages.

- Silver for use in bone implants.

- Cyanide-free, silver-based finishes from Dow.

- The rapidly growing market for silver inks and pastes.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The news came out last week that Germany has changed its mind and will allow its foreign gold reserves to remain in the vaults of the New York Federal Reserve. Read the story here. With the World Cup occurring simultaneously, Lampoon the System couldn’t help but poke a little fun…

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In case you missed the news, SchiffGold is now the world’s first major gold dealer to accept bitcoin, the digital currency that has been called the biggest innovation since the internet. We’ve partnered with industry leader BitPay to securely process your bitcoin payments when buying gold and silver. Whether you choose to pay in dollars or bitcoin, our prices remain the most competitive in the marketplace today.

Bitcoin has already generated fortunes for its early adopters, but it remains a new technology. Those seeking to protect their savings from the US dollar’s decline must consider building a healthy allocation of physical gold and silver in their portfolios. Precious metals remain history’s most reliable store of wealth. We are pleased with the bitcoin community’s response to our announcement, and we hope to serve as a valued resource in the months and years to come.

Bitcoin payments may be most useful to international customers who are concerned about the expense and difficulty of sending currency across borders. We ship to Canada and worldwide, and using bitcoin is the fastest way to receive your order.

¿Habla español? Ahora puedes pagar con Bitcoin a través de nuestra pagina SchiffOro.

Director of Marketing Mike Finger sums up our philosophy:

Bitcoin offers tremendous benefits as a medium of exchange for both our domestic and international customers. A wire transfer of fiat funds can be slow and expensive for the customer, and credit card fees are too high to absorb at the low premiums we offer. Not only does BitPay’s service make business sense, but we are excited about giving owners of bitcoin the opportunity to inexpensively and reliably convert any excess holdings into precious metals rather than back to fiat currency.”

Interested in learning more about bitcoin?

Do you own bitcoin and want to diversify into precious metals?

Our friendly Precious Metals Specialists are available

to answer all your questions:

Call 1-888-GOLD-160 (1-888-465-3160)

Request a Callback

Chat Online

Click here to chat with a Specialist right from your web browser.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!