US Debt Balloons to $18 Trillion and Will Continue to Grow

The national debt of the United States officially surpassed $18 trillion this past week. The news has been making the rounds of every media outlet, with many economists reminding us of the very shaky footing of the US economy. However, there are other analysts who play down this outrageously irresponsible amount of debt.

In his latest in-depth commentary, David Stockman explains the larger narrative of US fiscal policy that delivered this growing debt load. Stockman should know something about the topic. He was Director of the Office of Management and Budget under Reagan back in the early 1980’s, which is when US debt passed $1 trillion for the first time.

Think about that – it took more than 200 years for US debt to reach $1 trillion. But as Stockman points out, the last $1 trillion of debt accumulated in about 1 year.

Stockman looks back at that period in the 80s, and answers two important questions: how was US debt allowed to get this large, and what does the future hold?

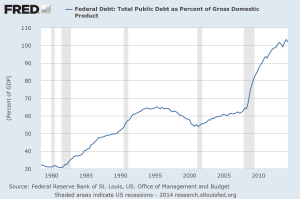

What this means is that the $18 trillion of public debt outstanding today is the real debt—–not the convenient illusion peddled by Washington and Keynesian economists that the “publicly held” debt is only $13 trillion and therefore a “manageable” 75% of GDP.

Nope, the nation’s true leverage ratio today is 106% of GDP. Thirty-three years on from the first trillion dollar crossing, the public debt burden on national income has tripled. And when you add the $3 trillion of state and local debt, the total public sector debt ratio is nearly 120% of GDP.

And that gets to the final question. How did we get away with this vast fiscal debauch? The short answer is that we didn’t.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

Leave a Reply