Europe’s Largest Gold Dealer Targets Asian Demand & $1,500 Gold Price (Video)

The CEO of Degussa Golchandel, the largest precious metals bullion dealer in Europe, explained why he disagrees with the mainstream market sentiment concerning the price of gold. Rather than dropping to $1,000 an ounce, Wolfgang Wrzesniok-Rossbach expects a $1,500 price point in the near future. He has three core reasons for this analysis: speculative investors have largely stopped selling paper gold, physical demand for both jewelry and bullion is rising, and mine production and supply is not increasing.

He also explained why Degussa has just opened its first Asian retail bullion store in Singapore, which is the latest evidence of the trend of physical gold moving from West to East:

when a market has a certain size we are perfectly fine with it, and Singapore has that size with 5.5 million people, 50 million tourists a year. [It has] a very stable environment, actually, politically as well as economically… Plus, there’s a lot of support from the government to create a vibrant gold market in Singapore…”

Highlights from the interview:

“I think if you look at the development in the last couple of years, we have seen a lot of selling, especially in ETFs – paper-traded gold. That is mostly through now. There is some selling, but not to the extent that we have seen. That’s the first reason. Demand is rising both for jewelry and for retail investment. Lastly, mine production is not really rising on the supply side – not rising that fast anymore. And the scrap supply is down. If you take everything into account, there’s no reason we should go [down] to $1,000. In my point of view, $1,500 is more in the cards…

“Yes, [chances are that gold might drop after a Fed rate hike], but the question really is to what extent and when actually will the rate hike come? It might come, but at the same time we might end up globally – even in Europe – for many, many years to come in a Japanese like situation here with very, very low interest rate environment. So a 25 basis point [rate hike] here and there wouldn’t make a difference…

“Our clients disagree [that gold is no longer a safe haven]. They show every day, coming into our stores throughout Europe and now also in Asia. We see very strong buying of investment gold – bars, coins. This is clearly safe-haven buying. People are not panicking. That was the case in 2008, but it’s more like a quiet accumulation of some gold stock these days…

“We are a retailer. To us, when a market has a certain size we are perfectly fine with it, and Singapore has that size with 5.5 million people, 50 million tourists a year. [It has] a very stable environment, actually, politically as well as economically… Plus, there’s a lot of support from the government to create a vibrant gold market in Singapore…”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Last week, Peter debated Steve Hanke, professor of economics at Johns Hopkins University, on inflation, the debt crisis, and the future of the dollar. David Lin hosted the debate on The David Lin Report and provided moderation for the event. While Peter and Hanke have their disagreements, both ultimately agree that the United States is in rough fiscal and monetary shape, and terrible monetary […]

Last week, Peter debated Steve Hanke, professor of economics at Johns Hopkins University, on inflation, the debt crisis, and the future of the dollar. David Lin hosted the debate on The David Lin Report and provided moderation for the event. While Peter and Hanke have their disagreements, both ultimately agree that the United States is in rough fiscal and monetary shape, and terrible monetary […] Paul Buitink, host of the Reinvent Money show, recently interviewed Peter on debt in Europe, possible futures for various currencies, and government monitoring of crypto and gold.

Paul Buitink, host of the Reinvent Money show, recently interviewed Peter on debt in Europe, possible futures for various currencies, and government monitoring of crypto and gold. Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.

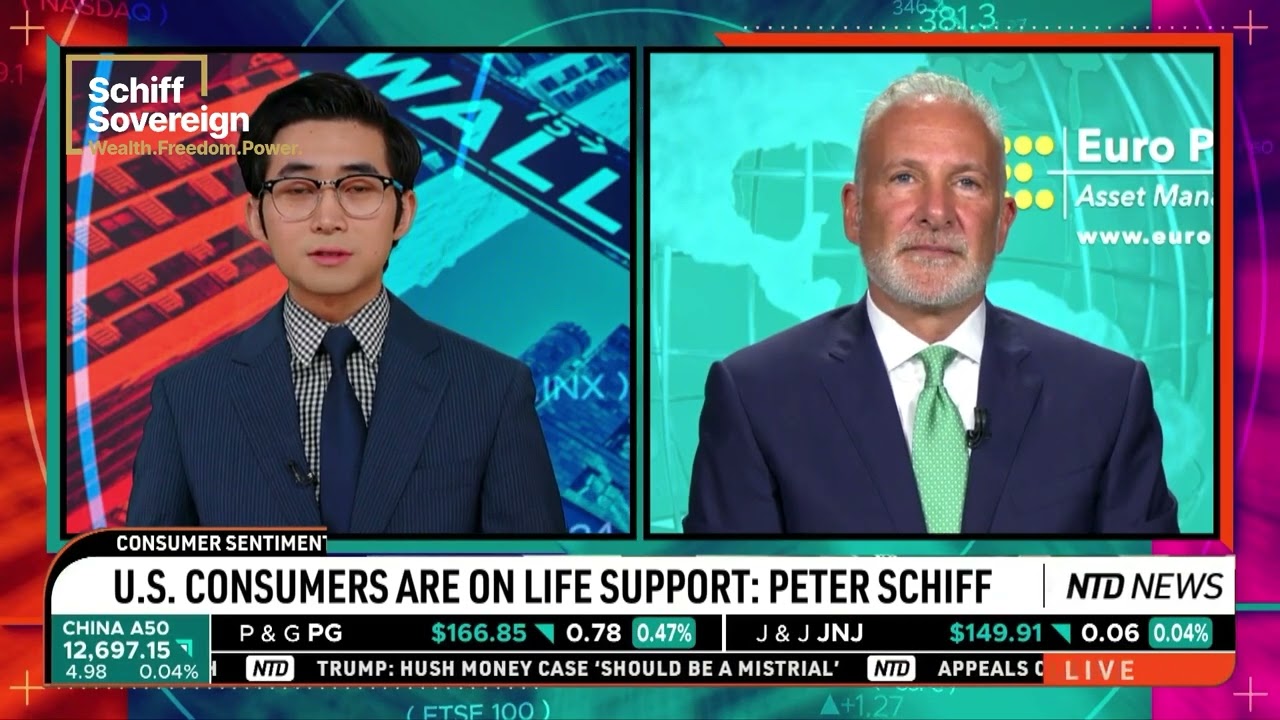

Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.  On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy.

On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy. While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

What happen to America,that we see this collapse coming and Singapore doing so well,and most of gold moving from west to east,and we are going to start to be fighting for our life because we aloud our three fed chairman print all this fiat money,and nobody wants to hold them accountable for,and Jimmy Rodgers moved out of New York City to live in Singapore a few years ago and he saw this happening to America then.So not only the fed chair people,what about our congress people taking bribes to look the other way while America goes down hill and over a cliff,and we become a socialist nation,with the help of the democrat party and others,and one will be very happy about this Bernie Sanders,who wants to be the President?