On the Hunt for Germany’s Gold

Bloomberg has published a feature-length article about the history of the German gold repatriation movement partly led by Peter Boehringer. The piece is unusual for the mainstream American media in that it actively entertains the possibility that foreign gold stored in the New York Federal Reserve may not be the same gold originally deposited. Even worse, some of the gold could be missing, which might be the reason so many European central banks have begun to show interest in repatriation.

We live in an era of unprecedented sovereign debts and extraordinary monetary manipulation by central banks. There’s never been a more important time for both individuals and governments to protect themselves with gold reserves. However, it appears that Germany has always been a bit blasé about its reserves:

Boehringer cites an anecdote from almost a century ago to argue that Germany has failed to zealously protect its gold holdings. In the 1920s the president of the German central bank, Hjalmar Schacht, paid a visit to the New York Fed and its founding president, Benjamin Strong. In an episode recounted in his 1955 autobiography, Schacht wrote, “Strong was proud to be able to show us the vaults which were situated in the deepest cellar of the building and remarked: ‘Now, Herr Schacht, you shall see where the Reichsbank gold is kept.’ “

“The two bankers waited as New York Fed staff sought the German stash. “At length we were told: ‘Mr. Strong, we can’t find the Reichsbank gold.’ ” Schacht comforted the flabbergasted Fed banker: “Never mind; I believe you when you say the gold is there. Even if it weren’t you are good for its replacement.” The men left without the German seeing his bars, instead accepting their existence as a matter of trust.”

It’s no wonder Boehringer is so concerned about Germany’s gold reserves today. If German central bankers were willing to overlook a physical audit of their gold mere years after World War I, why would they suddenly make it a priority after decades of peace?

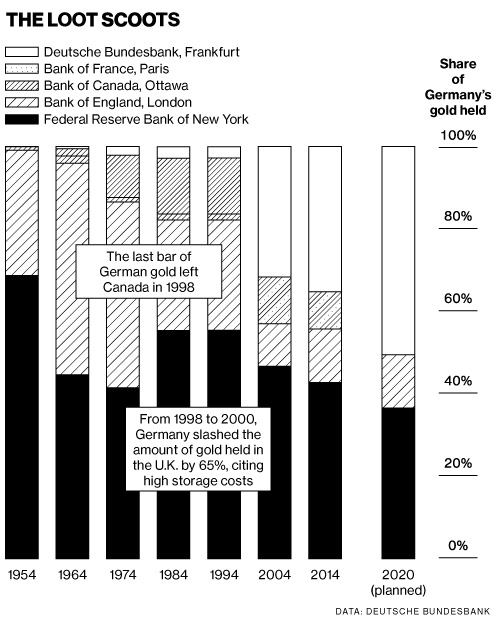

Boehringer became an outspoken proponent of hard money in the early 2000s and is the founder of the Germany Precious Metals Society. His media and public outreach about the dangers of fiat money and the importance of gold reserves attracted the Taxpayers Association of Europe, which wanted Germany’s central bank (the Bundesbank) to publicly report where its gold reserves were stored. It wasn’t long before the German Audit Court demanded similar accountability from the Bundesbank. In 2013, the Bundesbank announced an official repatriation schedule, which would see half of its foreign gold holdings returned to Frankfurt by 2020. 300 of those tons will come from New York.

In the first year, Germany moved only 5 metric tons of gold back home from New York. Concerned citizens like Boehringer were alarmed that the Bundesbank was so far behind schedule. The international media was awash with allegations that the Fed’s vaults did not contain the physical bullion everyone had assumed existed for decades.

Germany has ostensibly taken its gold reserves more seriously by ramping up the repatriation efforts in 2014. However, Boehringer is still not certain we can trust either the Bundesbank or the Fed. His latest concern is that the Bundesbank recast the gold bars it repatriated so that they would meet London good delivery standards. It did this without first publishing the serial numbers of the repatriated bars. Essentially, the German central bank destroyed the only evidence that would have proved that the repatriated gold was the same gold originally deposited at the Fed.

Both the Bundesbank and the Fed have assured the public that nothing fishy has taken place. The Bundesbank provided adequate excuses as to why the recasting was necessary.

Boehringer still doesn’t buy it. ’Why, of all the possible bars—120,000—it chose to repatriate, did it choose bars that were nonconforming?’ He also questions why the Bundesbank doesn’t publish lists of bar numbers, which would allow other depositors to see if there’s any double counting of the same gold under multiple owners. The Bundesbank says it has such lists for all the gold it keeps in custody at the New York Fed but that “security reasons” prevent it from making those lists public.

“‘Why is a bar list a security risk?’ Boehringer says. It reminds him of the 1920s visit the Reichsbank president paid to the New York vault. ‘That’s the culture of ‘I don’t want to know,’ ‘ he says.

Boehringer speculates that individual bars may have several owners, perhaps as the result of bars being leased, sold, or subject to complicated financial arrangements. ‘I can’t prove it,’ he adds, saying the onus of proof should be on the central bankers, not him. He isn’t alone in raising doubts. John Hathaway, co-manager of the $1.3 billion Tocqueville Gold Fund, says Germany might need the slow, seven-year repatriation window to unwind complex financial arrangements by which the gold was loaned out, perhaps several times. Their questions about multiple owners aren’t completely out of left field, as there is a loan market in which gold bars are put up as collateral and then sold to third parties for the duration of the deals.”

It’s well worth reading this full story from Bloomberg. Investors serious about physical precious metals will be watching the developments of the German gold repatriation for at least another five years. Central banks will also be looking for any signs that the Fed’s gold vaults don’t contain the right amount of gold. In fact, many countries are already joining the repatriation movement:

In May 2014, the Bank of Italy, which has the third-biggest gold reserves after the US and Germany, ended years of secrecy by disclosing the locations of its holdings. Citing the German repatriations, the central bank said about half its gold is in Rome and most of the rest is beneath the New York Fed. Then in November, the Dutch central bank announced that it had secretly moved 122.5 tons of gold from New York to Amsterdam. In apparently just months, the Dutch had shipped almost 25 times the gold that Germany moved in all of 2013. ‘Beyond realising a more balanced distribution of the gold stock across the different locations, this may also have a positive effect on public confidence,’ the Dutch bank said in its announcement. Soon after, the leader of France’s anti-euro, anti-immigration National Front party, Marine Le Pen, asked the Bank of France for an independent audit of its gold and to reveal any lending or financial commitments related to the reserves.”

For more content from Boehringer, check out this Euro Pacific Capital exclusive interview by Andrew Schiff from last year. Andrew spoke with Boehringer about the Bundesbank’s repatriation schedule and the German public’s perception of the controversy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

[…] READ MORE […]

Does anyone understand loaning gold? Isn’t that how bankers thrusted fractional reserve phoney

money into gold which used to be a 100% solid money and now a large percent of it doesn’t really exist?