American Middle Class Disappearing Thanks to Government Policies

The US middle class continues to shrink, squeezed by government policy and an ever-increasing burden of debt.

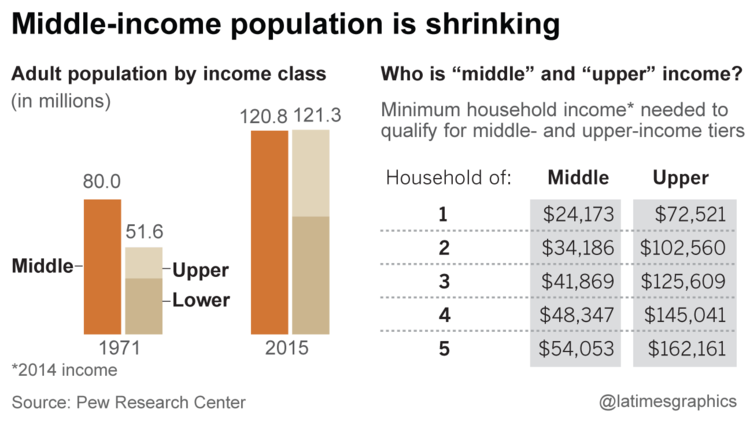

According to a recent Pew Research report, the majority of American adults no longer are part of the middle class.

The middle class accounted to 61% of the population in 1971. The most recent figures put the middle class at just below 50%, according to a report in the Los Angeles Times:

Pew defined middle class as households earning two-thirds to twice the overall median income, after adjusting for household size. A family of three, for example, would be considered middle income if its total annual income ranged from about $42,000 to $126,000. Pew analyzed data from the Census Bureau and the Labor Department, as well as the Federal Reserve.”

Interestingly, many Americans falling outside of the technical definition of middle class have historically identified themselves as fitting into that category. According to the LA Times, that self-perception is also changing, with more people no longer viewing themselves as part of the middle class:

Most Americans have traditionally identified themselves as middle class, even those at the top and bottom, reflecting a kind of cultural heritage tied to the American dream of self-reliance…A Gallup survey this spring showed that just 51% of U.S. adults considered themselves middle or upper middle class, with 48% saying they are part of the lower or working class. As recently as 2008, 63% of those polled by Gallup said they were middle class.”

Mainstream pundits always seem to want to spin the shrinking middle class in terms of “income inequity,” focusing on “the growing gap between the rich and poor.” Indeed, the LA Times article reporting the Pew results fits into this traditional frame. But this type of class warfare analysis misses the bigger picture, and does nothing to help us understand why the middle class is continuing to shrink.

As Peter Schiff pointed out on his radio show back in 2013, government policy drives these dynamics. Taxation and regulation are killing the middle class by hamstringing wealth creation. Peter explained that when you wreck the apparatus that generates wealth, wealth will inevitably disappear:

We don’t have a strong economy because we have a strong middle class; we have a strong middle class because we have a strong economy… The reason the middle class is shrinking is because you destroyed the incentives for people to create wealth and to employ people. It’s because of the policies that were targeted at the so-called rich. That’s why the middle class is disappearing…We’ve destroyed the capital base. We’ve destroyed the wealth creation, so it’s natural that the wealth has disappeared.”

Simply focusing on income inequality also misses another important part of the picture. Debt is a major factor in the shrinking middle class, especially when it comes to American’s perception of their place in the economic pecking order. Even families with relatively healthy incomes often struggle to make ends meet due to a mountain of consumer and student loan debt. As a result, they are less likely to view themselves in a positive economic light. Back in 2013, the median net worth for an American family, defined as assets minus liabilities, ranked a miserable 27th in the world, coming in at only $38,786. Clearly, debt is a weight crushing the American dream.

Peter put things in stark terms in a recent video, pointing out just how much the definition of middle class has changed.

We’ve really lowered the bar on the definition of middle class. Middle class lifestyle in America used to be something that the rest of the world couldn’t even aspire to. If you remember the sitcom the Brady Bunch… Mike was an architect. He had a job, and his wife Carol didn’t have a job. She stayed at home; she worked with charity events; she worked with school events. One thing she didn’t do was the housework, because they had a full-time live-in maid name Alice. And they were able to support six kids. That was middle class. They had two cars… That was middle class life in America. Your dad worked; your mom didn’t; you had a housekeeper; you had lots of savings; you had no debt. Today, you’re talking about that family of three. The reason it’s three is because they’re too broke to have any more kids; one is all they can afford. You probably have the husband and wife both work, and together they’re probably making $40,000 a year. They’re probably up to their eyeballs in debt…”

Class warfare rhetoric and redistribution policies will do nothing to change the underlying dynamics. The middle class will continue to feel the squeeze until regulation, taxation and monetary policies change. It’s also imperative to take a good hard look at the issue of debt, including government, consumer and student loan.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

absurd