Ron Paul: We Have the Biggest Bubble in the History of Mankind.

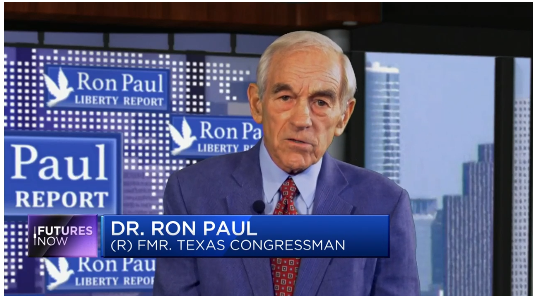

The mainstream is giddy about the “booming economy.” We have rising stock markets, continued job creation and solid GDP growth. But Ron Paul recently appeared on CNBC Futures Now and threw a big bucket of cold water on the mainstream narrative. He said we are barreling toward a recession.

Ron said he thinks a big crash is coming. He’s not saying it will necessarily happen in the next six months, but the groundwork is already in place.

The recession is set in place by the inflation and the distortion of interest rates which have been going on now for too long – historically larger than ever before. So there is no avoidance of a correction.”

Ron said that the central bankers and politicians never let the debt and malinvestment cleanse itself, so we just keep blowing up bigger bubbles. The result?

We have the biggest bubble in the history of mankind.”

Ron picked up on one of the major themes we’ve been harping on – the economy is built on debt. He said the only thing the government can seem to do is “print money and spend money and teach everyone to ignore the deficit.”

Republicans and Democrats are alike. They don’t concern themselves with deficits and it just can’t work. It’s never worked before.”

Of course, there are always naysayers. Ron has been talking about the massive debt and bubbles for years. He was asked what makes him think it’s going to all come unraveled now.

When you say ‘now,’ I don’t put a date on anything because markets will decide it, governments will decide it, geopolitical events will decide it. Who knows what will do it? But it will come and the bubble is bigger than ever before.”

As Ron put it, over the long term, you can’t disprove fundamentals.

If you run up debt, and print money, and distort interest rates, you get distortions and they have to be corrected. You can’t do that forever. That was what the housing bubble was all about, and we have a lot of that in there now.”

So, how bad is it going to be?

Well, because it’s the biggest bubble ever, I think it’s going to be very bad. I think you’re going to see payback. People are going to have to pay for living beyond our means.”

Ron said ultimately, history tells us we’re heading for disaster.

It can be pretty well validated by looking at monetary history that when you inflate the currency, distort interest rates and live beyond your means and spend too much, there has to be an adjustment. But you don’t know exactly when. But I think we’re getting awfully close. I’d be surprised if you don’t have everybody agreeing with what I’m saying next year sometime.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar. Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data.

Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data. Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […]

Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […] During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.

During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.