Gold Is Defying Conventional Wisdom; Maybe Conventional Wisdom Is Wrong

If you believe the conventional wisdom, gold should be languishing right now.

It isn’t. People are buying gold.

So, what gives? Could it be that the conventional wisdom is wrong?

The stock market seems to break records on a daily basis. It has been on a generally upward trajectory for several years and has skyrocketed over the last 12 months.

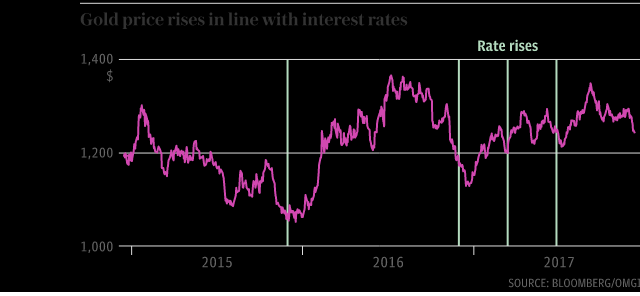

Meanwhile, the Federal Reserve started nudging interest rates up in December 2015 and boosted rates three times in 2017. Most analysts expect the Fed to hike rates three more times this year. Conventional wisdom tells us gold should be way down. Since gold doesn’t pay dividends or interest payments, investors typically shed non-yielding assets like gold.

So, with the stock market booming and interest rates rising gold should be falling. But with the rate a full 100 basis points higher than it was in December 2015, the price of the yellow metal was up better than 12% last year and finished above $1,300 for the first time in five years. Gold has climbed more than 2% just since the first of this year.

So, is this some kind of weird anomaly, or is the conventional wisdom just plain wrong?

AJ Bell analyst Russ Mould told the Telegraph that the conventional wisdom is “a total fallacy,” and he cited data to back up his claim.

During the seven cycles of higher US interest rates the metal has on average gained 86% between the first increase and the last – and gold is already up by 23% since the first rise of this cycle, in December 2015.”

What we really have is a sell the rumor buy the fact phenomenon. If you chart gold against US 10-year Treasury yields, gold tends to sell the rumor of rate hike increases and buy the fact. Every time yields have peaked north of 2.5% over the past five years, gold has promptly rallied. Economists predict that yield barrier should be broken sometime in the first quarter of 2018.

As the Telegraph pointed out, conventional wisdom leaves out a key variable in the equation – inflation.

This year is also expected to see higher inflation in America – and gold is often bought as protection against that environment. As gold is not pegged to a currency and cannot be produced at the whim of central banks, it is seen to be inflation-proof.”

In fact, central banks won’t generally raise rates unless they believe inflation is approaching their 2% target. In other words, rate hikes signal the existence of, or at least the expectation of, inflation.

As Peter Schiff has explained, inflation is key when it comes to gold.

Rising interest rates are not negative for gold. I mean, the main reason that interest rates are rising around the world is because inflation is picking up around the world. Higher inflation is positive for gold. I mean, it is the most bullish thing for gold. And in fact, when inflation rates are rising, that means money is buying less, right? The purchasing power of money is going down. And that’s when you want to own gold.”

And while higher rates tend to boost bond yields, inflation is not a friend of the bond market. Bonds lose value as inflation increases. That is bullish for gold because gold is something you would own as an alternative to bonds.

A bear market in bonds is bullish for gold. But for some reason everybody just thinks, well, if interest rates are going up, that just makes gold less attractive because you’re giving up the opportunity cost. It makes bonds less attractive, because bonds are falling in value. It makes currency less attractive because interest rates are rising because currency is losing value. But gold won’t be losing value. Gold is going to be storing value.”

So when you see the guys on CNBC and Fox Business running down gold because the stock market is booming and the Fed is going to be raising rates, just remember that they are parroting the conventional wisdom.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]