Does the Fed Have the US Economy on Life Support?

The Fed did exactly what markets expected during the September FOMC meeting and lowered interest rates another 25 basis points. It was the second cut of the year and pushed the interest rate down to the range of 1.75 – 2%.

And yet we’re told that this is the economy is “great.”

What gives? Economist Robert Murphy said things might not be so great. In fact, it appears the central bank has basically put the economy on life support.

Despite the Fed’s short-lived effort to normalize rates in 2018, they remain historically low. And the central bank is already back to cutting. In a post published on the Mises Wire, Murphy said the Federal Reserve has effective “boxed itself in.”

He used three charts to demonstrate his point.

The first chart puts the current interest rate in historical context.

As the chart shows, the (effective) fed funds rate was in this range back during the early 2000s, which helped spawn the housing bubble and bust (as I predicted in this Mises.org article which ran 11 months before the financial crisis). Before then, we have to go all the way back to the early 1960s to see rates this low. And furthermore, to the extent that Mises was right, and artificially low interest rates lead to an unsustainable boom, then the seven years of virtually zero percent interest rates (from December 2008 – December 2015) have fostered a plethora of malinvestments.”

Here’s the irony. The Fed has implemented two rate cuts this year, and two weeks ago, it began repo operations to tamp down a spike in short-term rates. And yet as far as the economy goes, everything looks fine – as Murphy put it, at least on paper.

Specifically, consumer price inflation is a bit lower than the Fed’s desired level but is still at a ‘healthy’ 1.8% (year over year, as of August), while the official unemployment rate is still at a 50-year low.”

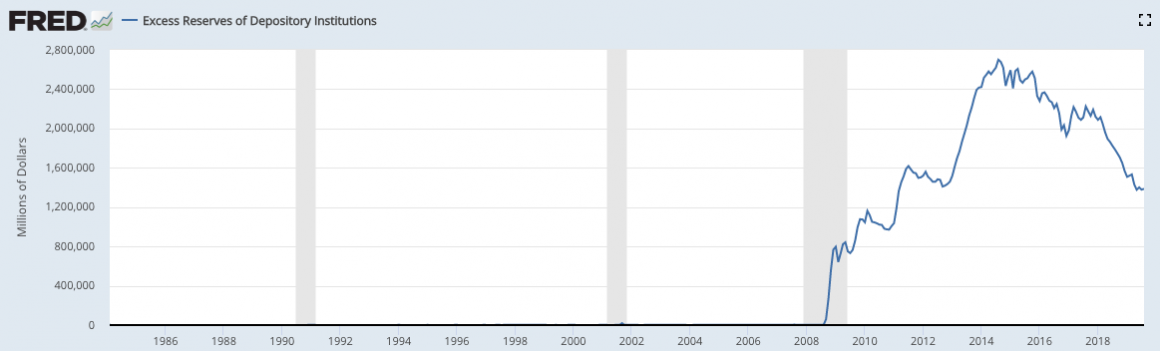

And despite the apparently healthy economy – at least based on the Federal Reserve’s “dual mandate” there is still a huge stockpile of excess reserves in the banking system compared to the pre-crisis era. In fact, this was by design. The Fed incentivized banks to hold cash rather than loan it out and circulate it in the economy.

So, what kind of conclusion can we draw from this? Murphy uses a metaphor from the world of medicine.

Medical metaphors for economics are never perfect, but we can certainly say this: Far from being in the midst of a robust ‘recovery,’ the patient–i.e. the US economy–is still incredibly weak, needing constant infusions of medicine to stave off a crisis in its circulation.”

“On the one hand, it’s refreshing that Fed officials don’t think the economy can be summed up in two numbers, namely the official unemployment and consumer price inflation rates. But on the other hand, the fact that the Fed is cutting rates now, in spite of the ‘healthy numbers,’ is an ominous indication of just how deep the rot goes in the economy’s capital structure.

“Unfortunately, the world may soon see exactly why 7 years of unprecedentedly loose monetary policy was a very foolish idea.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]