The Fed Is Limited in How Much It Can Tighten: Here’s Why

The Federal Reserve claims to be tightening. According to the conventional wisdom, the Fed will raise interest rates at least three times in 2018 – maybe even four. And last fall, the central bank announced its plan to begin shrinking its balance sheet.

But have you actually looked at the Fed’s balance sheet? Dan Kurz of dkanalytics.com has. In fact, he has dug deep into the Federal Reserves opaque world of financing and concluded all of this talk of shrinking balance sheets and normalized interest rates is pure fantasy.

As sure as night follows day, before all too long the world’s leading central banks will be abandoning both fledgling interest rate increases and QT fantasies (reducing the size of their balance sheets by selling bonds and stocks) out of ‘status quo necessity.'”

The following analysis is by Dan Kurz. Views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

![]()

It really is absurd, isn’t it, the Federal Reserve cabal’s balance sheet? 0.9% equity capital or debt that is 111x equity. A closer and broader look (and a follow-up of sorts): That leverage spells huge Fed exposure to rising bond yields/falling bond prices. Same bonds’ durations — how long it takes for an investor to be repaid the bond’s price determined by the bond’s total cash flows — are particularly lengthy given (artificially) low interest rates and the associated lofty valuations or “bubbles.” Those bubbles, or valuations divorced from constructive capital preservation and sound return prospects, are thanks to nearly a decade of globally-orchestrated financial repression that has pushed bond yields to historic lows, in the process eviscerating price discovery and thus free market capitalism-based pricing.

In the ultimate financial deformation, as of January 2018, globally speaking there was over $7trn in negative yielding “Frankenstein” bonds; in other words, creditors who are PAYING for the right to lend their money to debtors! Those bonds’ twilight zone valuations stand to be crushed by a sustained rise in interest rates given their extreme valuation sensitivity to rising interest rates; call them “zero-coupon bond bastard cousins,” i.e., bonds were YTM would move to zero from a negative return!

Leading central banks (CB) have “printed the money” to purchase bonds to (initially) restore liquidity and then to ensure leading financial institution solvency (the “too big to fail” doctrine) by “hoovering up” toxic mortgage-backed securities and other junk bonds. This has effectively nationalized a sizable clutch of junk bonds while bolstering what would have otherwise been insolvent balance sheets of leading financial institutions.

In so doing, central bankers have decadently rewarded moral hazard and bad capital allocation decisions while further debasing fiat currencies in the process. To add insult to profound misallocation injury, the Fed made billions of dollars in risk-free interest payments to banks on their reserves (money not lent out to private sector) during the QE/ZIRP era.

Concurrently, the ludicrous taxpayer-financed (TARP) P&L vigor of leading banks reflected US taxpayer property rights transferred to stockholders and to senior management, its executive compensation, and especially its huge, dilutive executive stock options, many of which would otherwise have been rendered worthless. Combine TARPfinanced P&L vigor and CB-enabled toxic asset (bad loans) balance sheet purging and you get the ultimate transfer of wealth from Main Street to Wall Street; the definitive and criminal crony fix. Vibrant P&Ls and sounder balance sheets despite managements’ speculations gone awry! What a racket. What a payday.

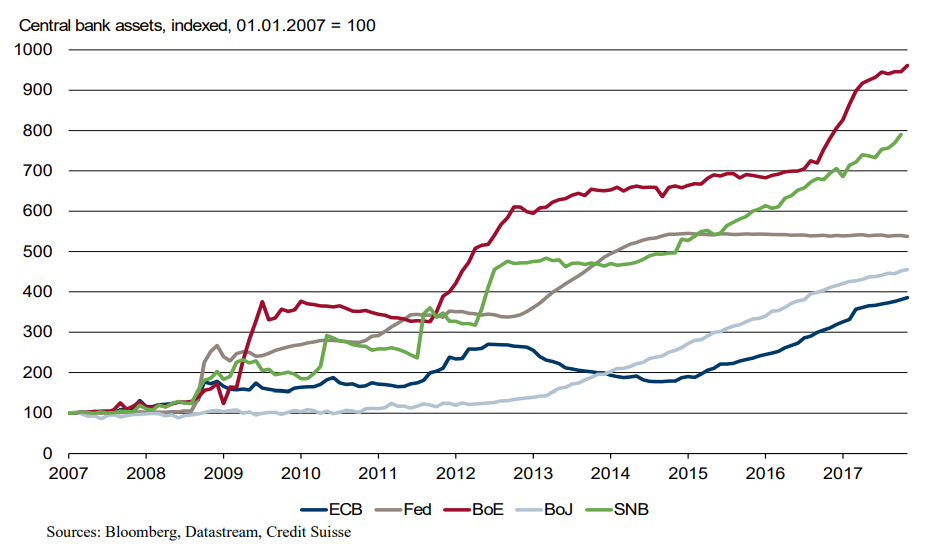

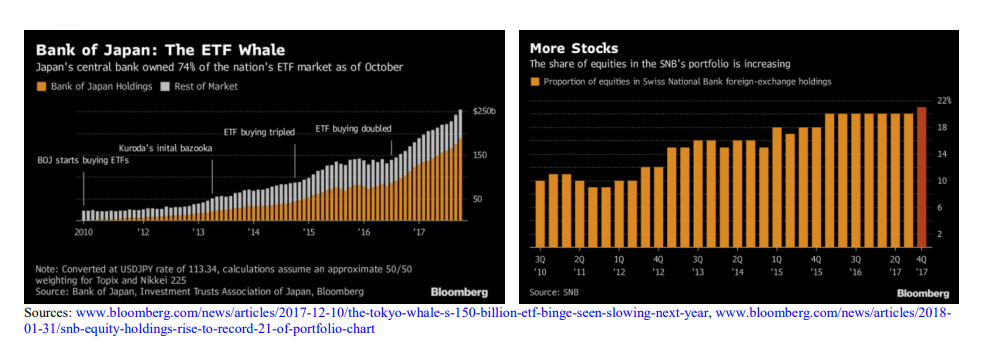

Meanwhile, in Japan and Switzerland, courtesy of the Bank of Japan (BOJ) and the Swiss National Bank (SNB), respectively, equity bubbles have been stoked for seven years in a totally unprecedented fashion (more twilight zone stuff). In turn, the equity-defined balance sheet expansions that have ensued have de facto underpinned bond bubbles.

This is thanks to “relative valuations.” Or, as we often state, bond and stock valuations “travel together (figure 8).” Said differently, continued “QE” pushdowns of stock earnings yields (E/Ps) ultimately exert downward pressure on bond yields. How so? When share P/Es get driven into even more pronounced bubble territory thanks to sustained central bank purchases, bubbly bond valuations can get, well, even bubblier, which is expressed in even lower yields. For flavor as to the scale and longevity of BOJ and SNB stock market intervention, please see below:

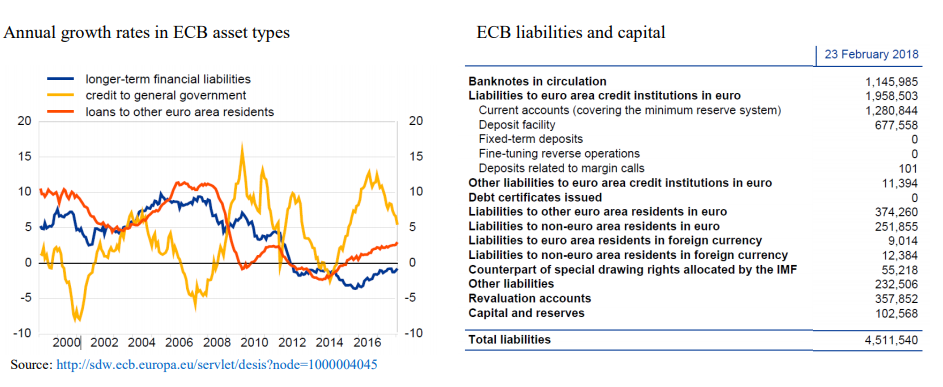

Not to be left out, the world’s second biggest balance sheet central bank after the $5.0trn balance sheet BOJ, the 4.5trn euro European Central Bank (ECB), has also been very engaged in “asset price levitation.” The ECB has purchased more than 2.1trn euros of bonds since its 2008 balance sheet expansion began. As of last year, the ECB became increasingly interested in purchasing European corporate bonds (so-called “loans to other euro area residents”), including junk bonds. Accumulation of same has been accelerating, as is evident in the chart on the left below. Why? The ECB’s multiyear public government bond purchases, which have averaged about 55bn euros per month since 2015 (aggregate purchases have been between 50bn – 85bn euros per month over the same period), have resulted in a shortage of European sovereign bonds. This, in turn, has triggered a sharp reduction in ECB QE on the one hand — to 30bn euros as of this January — and to increased purchases of corporate bonds on the other hand.

That shortage has predictably brought about 10-year government yields in France, Spain, and Italy — arguably even more substantial credit risks than US government bonds — that recently have offered between 33% and 66% lower yields than 10-year Treasuries. Upshot: the ECB has significant sovereign bond risks and rising corporate bond solvency exposure. And, like the Fed, its current equity capitalization is wafer-thin at 2.3% (103bn euros) of its 4.5trn euro balance sheet (chart on the right)! Translation: any material realized loss-type of portfolio valuation hit that makes “historical cost accounting” impossible threatens the viability of the ECB’s balance sheet. Sound familiar?

In light of the above, what about that Fed — and later a global — transition from QE to QT?

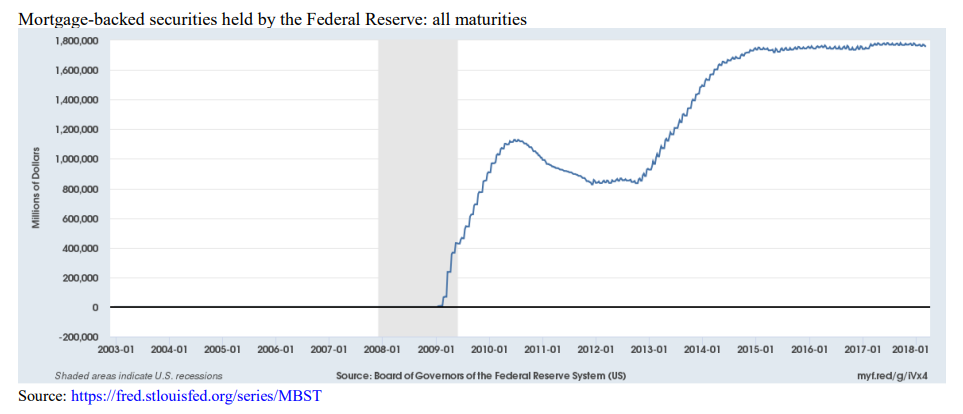

As regards the Fed’s assets and thus its balance sheet, bankruptcies or deeply distressed debt in its $1.76trn mortgagebacked securities position is still a good bet, particularly if rising interest/mortgages rates rise and property values fall:

The Fed’s liquidity injection was made by issuing credit to banks and simultaneously buying back troubled (i.e., subprime) banking sector assets. While the banking sector’s balance sheet ballooned with cash and cash equivalents, the Fed’s own balance sheet witnessed a sharp rise in the very troubled assets it was removing from the banking system. As Philipp Bagus recently noted, the Fed had become exactly the type of “bad bank” it had tried to rescue. (August 4th, 2010)

Sometimes a picture is worth a thousand words:

Of course, “market-to-market” can be avoided with the Fed’s historical cost/face value accounting standards. Therefore, the Fed’s $2.3trn in Treasury security holdings will not be negatively impacted should investors demand higher yields/higher interest rates; i.e., if they are not sold below face value, they will be carried at face value. Plus, if the Fed’s mortgage-backed securities experience defaults or non-performance (mortgage payments in sustained arrears) issues, those same securities are guaranteed by either Fannie Mae, Freddie Mac, or Ginnie Mae (GSEs).

Those same “private when profitable, public when not” GSEs, in turn, are backed by the US government. In plain English: by the American taxpayer. Nevertheless, unless losses on the Fed’s mortgage-backed securities portfolio are to be fully covered by taxpayers, the Fed’s hugely leveraged balance sheet features material exposure. And despite the Fed’s opaque and GAAP disingenuous bookkeeping, a realized loss (sale) or ownership transfer of impaired mortgage-backed securities below their value on the Fed’s balance sheet should generate a commensurate, albeit potentially delayed, writedown depiction:

The primary difference between the accounting principles and practices in the Financial Accounting Manual and GAAP is the presentation of all System Open Market Account (SOMA) securities holdings at amortized cost rather than the fair value presentation required by GAAP.

Amortized cost more appropriately reflects the Reserve Banks’ securities holdings given the System’s unique responsibility to conduct monetary policy.

Although the application of fair value measurements to the securities holdings may result in values substantially above or below

their carrying values, these unrealized changes in value have no direct effect on the quantity of reserves available to the banking system or on the prospects for future Reserve Bank earnings or capital.Both the domestic and foreign components of the SOMA portfolio may involve transactions that result in gains or losses when holdings are sold prior to maturity. Decisions regarding securities and foreign currency transactions, including their purchase and sale, are motivated by monetary policy objectives rather than profit. Accordingly, fair values, earnings, and gains or losses resulting from the sale of such securities and currencies are incidental to the open market operations and do not motivate decisions related to policy or open market activities.

The Reserve Banks do not present a Statement of Cash Flows because the liquidity and cash positions of the Reserve Banks are not a primary concern given the Reserve Banks’ unique powers and responsibilities.

(Translation: unique, unconstitutional powers to assure the primacy of member banks is the agenda, period — 22:35- minute mark to 27-minute mark. To wit: “let us control the money of a nation, and we care not who makes its laws.”)

Mortgage assets, above all the “troubled variety” that the Fed bought and likely still holds a sizable clutch of, tend to suffer from substantial write-downs or write-offs during recessions, as history readily attests. Our point: the Fed’s upcoming realized losses or reduced transfer values of mortgage-backed securities to Freddie, Fannie, and Ginnie will in all likelihood tower way over 0.9% of stated asset value, which would push its equity deeply into negative numbers. Let us list a few triggers for potentially sizeable reductions in the value of the Fed’s mortgage assets. At the same time, we must admit that the breakdown of the Fed’s mortgage-backed securities beyond the subprime nature of historical purchases in 2009 and 2010 remains lacking even as the timing of the accumulation of the majority of its ballooning mortgage-backed securities position — from zero exposure to nearly $1.2trn — remains telling. Below possible catalysts that could result in substantial realized losses from mortgage-backed securities sales:

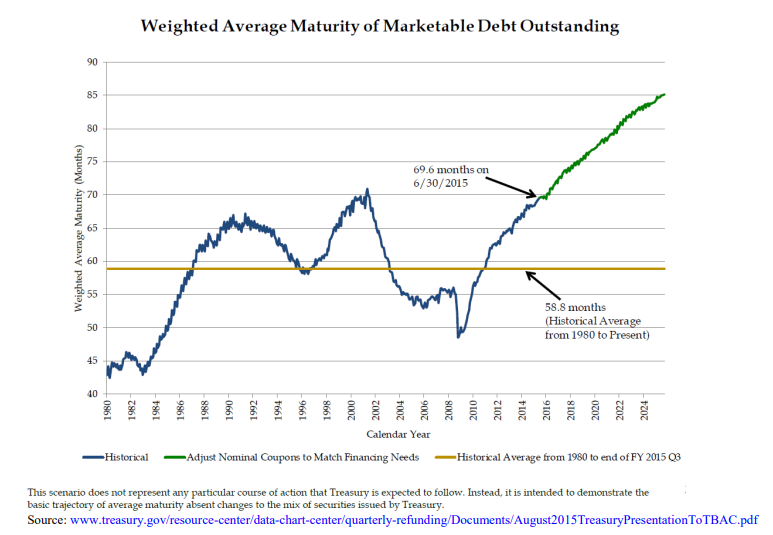

▪ With nearly $68trn in debt at all levels juxtaposed against a GDP of $19.7trn, the American economy is extremely interest rate sensitive. The huge and growing federal government deficit, an expanding $600bn trade deficit, artificially low, financial repression-engineered interest rates, too much short-term federal funding (some 6 years on average as is visible below) despite record low interest rates long on offer, and markets’ penchants for reversion beyond the mean only magnify the “global” (re)financing risk that will eventually engulf many mortgage holders.

▪ Rising interest rates increase adjustable rate mortgage (ARM) rates/monthly payments, sometimes even if interest rates don’t go up. As ARMs typically get underway with lower initial mortgage rates than conventional, fixed-rate mortgages, yet “fleece” borrowers with incredibly high “closing fees,” they are often purchased by home buyers that have lower incomes, less secure jobs, and less savings. In short, they are higher risk loans.

▪ Rising interest rates could also bite ARMs in the “jumbo mortgage market,” in which ARM market share is double that of conforming (conventional) loans.

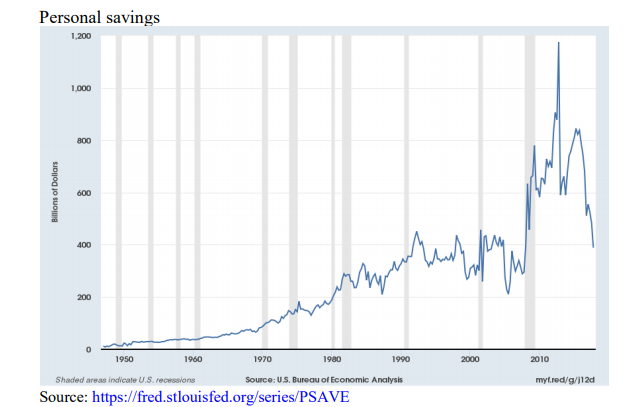

▪ Americans’ private savings rate of 3.2% is near an all-time low and household debt at $13.2trn is at an all-time high. Meanwhile, the civilian labor force participation of 63% remains near a four-decade low while low-paying, part-time, healthcare/benefits-lacking jobs abound. Upshot: existing mortgages, specifically in the sub-prime category, may well be more susceptible than usual to drifting into “non-performing” status in the coming recession as aggravated by either additional full-time job losses and/or higher mortgage rates.

▪ (The new tax law looks like “a wash” for the majority of American homeowners in that reduced itemized mortgage and property tax deductions will be offset by higher standard deductions, thus we don’t see it materially impacting the financial standing of the Fed’s mortgage assets.)

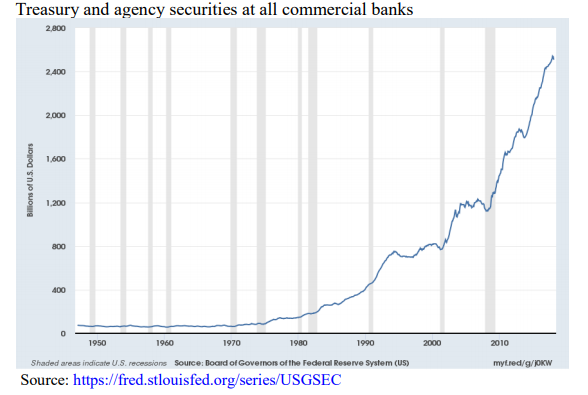

To repeat, only a small percentage of $1.76trn in mortgage assets would need to become non-performing or outright default to create accrual accounting balance sheet issues for the hyper-leveraged Fed balance sheet. The ensuing transfer and assumption by the de facto public institutions Fannie, Freddie, and Ginnie of such “assets” at substantially lower levels than current Fed balance sheet carrying values would trigger “realized loss” accounting by the Fed using any conventional accounting methodology or even a “stretch” of same. Against a Fed equity sliver of $39.2bn, one could be forgiven for thinking that Fed will try to prevent an “interest rate explosion” both for the health of its extremely geared balance sheet (even if it doesn’t have to mark declining Treasuries to market, realized losses of any magnitude on its huge mortgage-backed securities position exposure could “sink” its balance sheet on their own!) and arguably for the benefit of hugely exposed commercial banks, whose balance sheets “house” $2.5trn in Treasury and agency bonds:

But even here, thanks to FASB’s Financial Instruments (FI) amendment in January 2016, public financial entities have gained tremendous latitude in terms of valuation accounting. The amendment “eliminates the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet.” Upshot: the “corridor” within which to come to terms with market value is wide. But what if the long bond price plunge proves reversion beyond the mean huge and sticky? Or what if banks are forced to sell highly liquid securities under price pressure?

To add another dimension to how disruptive a rising interest rate world could be, let’s recall that while government-backed agencies stand behind insolvencies, what this really means is that the taxpayer or future taxpayers will stand behind them. And, as the average American’s (327m population) savings are around $1,200 (down over 50% in three years; see aggregate figure below) and approximately 45% of American households don’t pay any federal income tax, just how will limited means and a relatively small number of American taxpayers be able to amortize potentially huge losses associated with non-performing mortgage backed securities, which would amount to yet more redistributionism and cronyism?

The short answer: they won’t, so non-performing mortgage debt, which was toxic in nature prior to the Fed assuming it, will ultimately be added to a $20.5trn federal debt tally, which has been growing by $1.16trn p.a. on average over the past decade, and is set to balloon due to cyclical (recession overdue), policy (p.6), and demographic reasons. However, assumption of a possibly stout portion of mortgage-backed securities tabulated on the Fed’s balance sheet at a face value of $1.76trn will then be exposed at transfer (market) values on GSE books.”

Surely, as a recession hits amidst huge new bond issuance (we continue to estimate $2trn plus including attempted QT) and market-determined interest rate tightening fueled by both “front-running” the Fed and by rising insolvency and monetary inflation concerns, mortgage valuations will come under pressure. As regards the Fed’s junk mortgage-backed security portfolio, if a portion is sold or transferred, it will likely change hands at significantly below face value prices! Let’s brashly speculate that the Fed’s entire mortgage-backed securities portfolio is assumed at 80 cents on the dollar by one or all the GSEs listed above. This would yield a loss on transfer value of $352bn, or 9x the Fed’s capital (equity) of $39.2bn. Not in the cards! From vestigial QT back to record QE, and perhaps quickly?

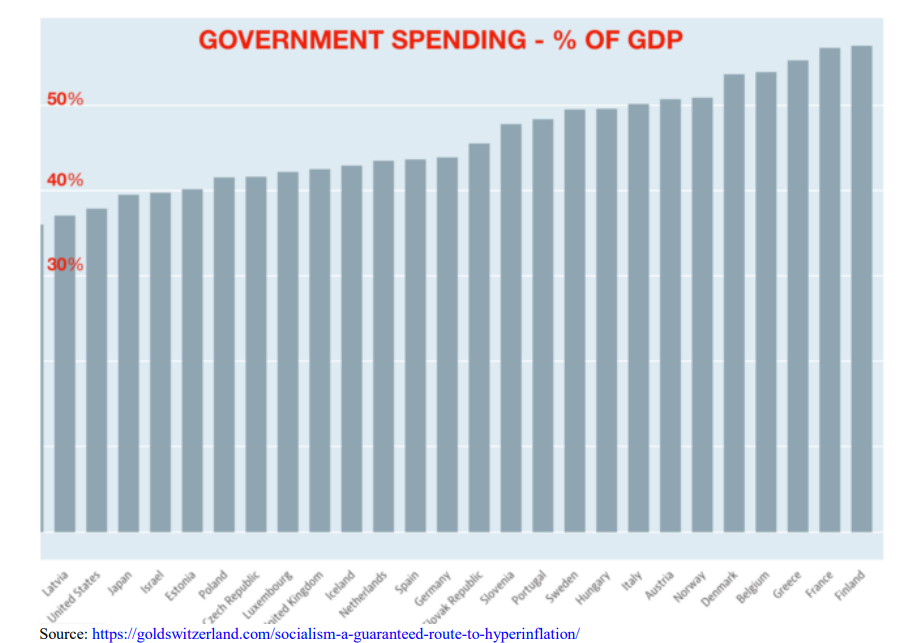

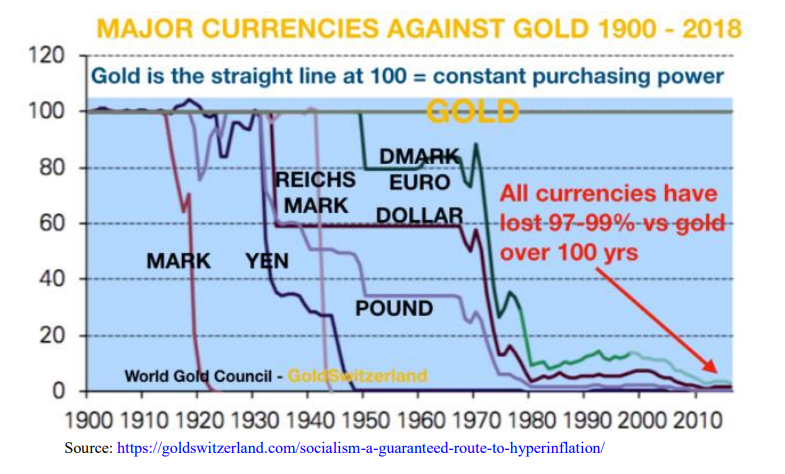

Instead of QT dead ahead, politics also favors the odds of a QE blast from the recent past. The extremely privileged “1%” serial Keynesian money printers and their Davos crowd plutocrat pals (effectively) running our global monetary, financial, and economic system (into the ground for the “99%”) will not give up their positions of national sovereignty and national solvency gutting power, and their associated wealth, easily. Translation: they will endeavor to double down on more statism (even higher government control and spending for the “good” of the people) and more globalism financed, you guessed it, by more currency debasement, i.e., much more money printing! Founder and managing partner Egon von Greyerz of Matterhorn Asset Management summarized it so well: “Socialism — a guaranteed route to hyperinflation.” Socialism looks like this:

And yes, Virginia, socialism enabled by fiat currency (not PM-backed/limited) is a guaranteed route to hyperinflation because it short-circuits human nature and the invisible hand of Adam Smith. After adding more than $91trn in global debt within a decade on the back of $15trn in printed money over the same period, the stranger than fiction truth that this debt that can only be “repaid” with yet more currency-debasing (an inflationary default) QE comes home to roost.

Below a historical preview of upcoming (further) fiat currency debasement attractions, such as 2% – 4% fiat currency stubs springing from our current 2% – 4% currency stubs (you can still lose 98% on a residual value of 3!):

In the meantime, …

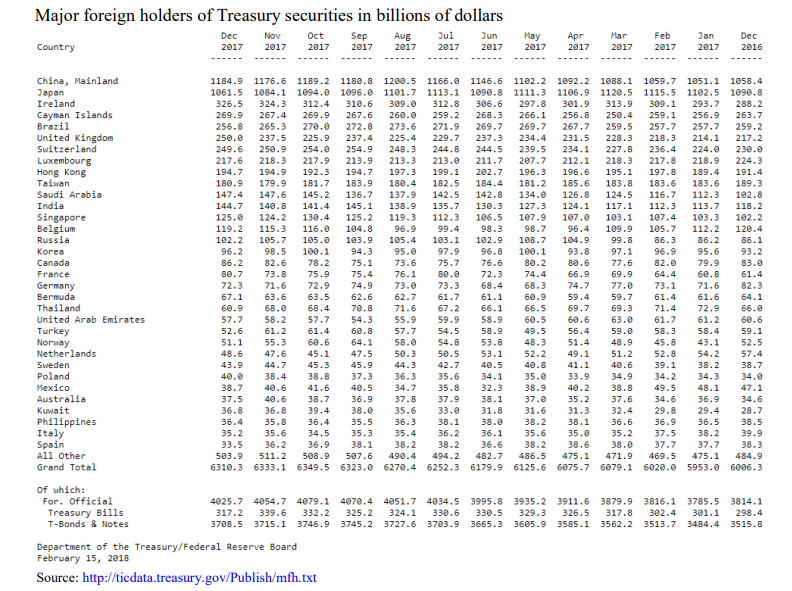

… all long duration bond holders (e.g., creditors currently owning 10-year or 30-year bonds) remain susceptible to a valuation implosion when interest rates head north, above all foreign owners of US bonds. This constituency (please see below) is doubly exposed, capital loss-wise: bond losses and currency translation losses (a weakening USD), which ironically their Treasury sales would worsen:

Moreover, private sector or managed accounts, which are known to engage in leveraged bond bets also known in the industry as “risk parity,” a lower bond volatility MPT sham, face market-to-market or “reality 101” accounting and will be eager to “front-run” the Fed, should its QT truly ramp up to $600bn in annual balance sheet contraction:

Our balance sheet will decline gradually and predictably. For October through December, the decline in our securities holdings will be capped at $6 billion per month for treasuries and $4 billion per month for agencies.

These caps will gradually rise over the course of the following year to maximums of $30 billion per month for Treasuries and $20 billion per month for agency securities, and will remain in place through the process of normalizing the size of our balance sheet.

Our balance sheet is not intended to be an active tool for monetary policy in normal times. We, therefore, do not plan on making adjustments to our balance sheet normalization program. But of course, as we stated in June, the Committee would be prepared to resume reinvestments if a material deterioration in the economic outlook would warrant a sizeable reduction in the federal funds rate.

Plus, managed accounts, whose managers collectively have fiduciary responsibility for a substantial chunk of $233trn in global debt, can’t do central bank historical cost accounting with bond holdings under duress while they simultaneously have to avoid “insolvency losses.” As such, and particularly in light of the financial industry’s quarterly performance pressure, bonds that come under too much valuation pressure could well be sold or be part of

a “loss mitigation” strategy that results in automatic sales if certain bond prices are reached or pierced on the downside. To the degree that leveraged bond ownership valuation exposure concerns and anxiety about our hugely indebted, interest rate sensitive, yet serially currency-debasing global economy accelerate, we could continue to see surprisingly sharp increases in yields. In short, stoutly rising long bond rates could become “self-reinforcing,” i.e., the flip side of a secular bond bull market.

How does one spell “front-running” a Fed serious about shrinking its balance sheet by $600bn p.a.? How does one spell rapidly rising yields?

Speaking of rapidly rising yields, consider these numbers. The 10-year Treasury yields 2.9% today, up 107% from an all-time low of just 1.4% on July 6th , 2016. The unlucky buyer/holder of a 1.4% yield Treasury has a 12.9% unrealized loss on his hands. If the yield moved to 4.6%, he/she would have a 25.4% loss on his/her hands. And by the way, over the past 147 years, the 10-year US Treasury’s mean yield was 4.6%.

Reverting to our “there’s always reversion beyond the mean” refrain, Treasury yields will likely go much higher than 4.6% — consider that if “the market” demanded a 7.6% yield, that same 10-year Treasury bought on July 6th, 2016 would trade at 57.1% of its par or face value, a 42.9% loss! This would be due to the bipolar nature of Mr. Market. It could, and likely would, also be due to unprecedented global “fast-burn” illiquidity risks, which could manifest themselves and spread like wildfire (contagion) at any time if confidence in the unsustainable, brittle status quo snaps. Or, it could be due to “slower-burn” loss of capital risk, otherwise known as (monetary) inflation in a fiat currency world suddenly “catching fire.” At current valuations, your exposed capital, as well as your real return prospects, are imperiled — by “all of the above.”

Conclusion:

As sure as night follows day, before all too long the world’s leading central banks will be abandoning both fledgling interest rate increases and QT fantasies (reducing the size of their balance sheets by selling bonds and stocks) out of “status quo necessity.” Specifically, central bankers’ incredibly arrogant, utterly ignorant, and pathetically misguided conviction that sustained asset bubbles, advanced by the two-headed dragon also called “monetary-Keynesianism,” are the wellspring of the “wealth of nations” has increased debt and made our economies very interest rate sensitive. As such, when price discovery threatens to trump dissipating financial repression by pummeling bond and stock valuations to reflect heightened risk, our “Frankenstein” central bankers/central planners will revert to ZIRP and QE.

This is especially true given the huge financial repression-induced damage to the global economy over the past decade, such as: $91trn in new debt, $233trn in total debt, over $30K per capita debt, deficit-financed redistributionism, a decline in homeownership juxtaposed against real estate bubbles, gigantic misallocations, and vanishing productivity growth. Paradoxically, central bankers will need to resort to unprecedented money printing in an effort to protect their own extremely leveraged, asset bubble-exposed balance sheets and to convince speculators and investors that “they have their bond and stock valuation backs” once confidence in financial repression is lost, which is not a question of “if,” only “when.” While there is no guarantee that relatively puny central banks will be able to overwhelm reawakening “bond vigilantes” that hit the sell button shortly before QT gets started (if it happens at all), there is a virtual guarantee that they will try. This should be our “currency and bond debasement on steroids” allocation guide!

In a related sense, we couldn’t resist sharing these discerning, timely thoughts:

My generation gave former tenured economics professors discretionary authority to fabricate money and to fix interest rates.

We put the cart of asset prices before the horse of enterprise.

We entertained the fantasy that high asset prices made for prosperity, rather than the other way around.

We actually worked to foster inflation, which we called ‘price stability’

We seem to have miscalculated.

Source: Jim Grant’s November 2014 speech at the Cato Institute

And sadly, that miscalculation will be doubled down on given that a decade-long, absolutely unrivaled yield deprivation and balance sheet expansion has driven us into a debt, productivity, and growth ditch. In fact, the very engineers of Global Frankenstein Finance (GFF) — degenerate stuff such as yield deprivation and their NIRP perversion — the Feds, the ECBs, the BOJs, and the SNBs of the world, with their hugely interest rate-exposed and terrifically leveraged balance sheets, will likely soon find themselves back in the ZIRP and QE “operating room” for their own sake and that of major/money center banks. That is, if the GFF cabal manages to leave it in the first place.

Two issues will bedevil them. On the one hand, that QT may have “front-running” bond vigilantes drive up interest rates (selling long duration bonds) in a hopelessly interest rate sensitive, debt-addicted, low productivity growth world economy where a one percentage point higher interest rate amounts to 3% of global GDP. On the other hand, they fear, more than anything, that their aggregate $15trn balance sheet expansion-enabled global debt growth of $91trn may unleash debt-induced deflation (versus good, productivity-based deflation). This deflation, in an age of statism, could well result in a political disaster, which of course would have politicians blaming central bankers for the ensuing financial and economic tumult. That is, unless they spike that monetary punch bowl with more QE booze in time to sustain the unsustainable for as long as possible, very much including inflationary socialism, a sneakier piecemeal default until it careens out of control into inevitable hyperinflation and food and energy shortages. From QE to QT aspirations quickly back to stunning QE accompanied by a return to a ZIRP by the Fed? We could think of much more improbable things! In any case, we continue to think that both the dollar and bonds (and thus stocks), in particular dollar bonds, are at a secular bond bull market inflection point. Caveat emptor, as we’re apt to say!

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath. The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]

The Federal Reserve is often viewed as a neutral guardian of the economy, tasked with safeguarding employment and ensuring stable prices. However, the Fed is run by individuals who, like anyone else, are swayed by certain motivations. Do the people behind the Fed truly have the incentive to remain impartial? Our guest commentator demystifies the […]