Jerome Powell still insists the Federal Reserve can beat inflation while bringing the economy to a “soft landing.” But there are underlying issues in the economy that make it extraordinarily doubtful that the economy can avoid a major downturn – despite Powell’s claims to the contrary.

One of the biggest problems facing the Fed is the amount of debt in the global economy.

For the last several years, we’ve enjoyed the fruits of an economic bubble blown up by easy money and debt. But ultimately, that debt is going to be the economy’s undoing. Simply put, these debt levels are unsustainable without runaway inflation.

So, pick your poison.

Last month, the New York Fed launched a pilot program for a “digital dollar.” Could this be the first step toward monetary totalitarianism?

Will the Federal Reserve pivot? That’s the question on everybody’s mind.

But why does it matter so much?

Inflation was running rampant for months before the Federal Reserve launched its inflation fight. As you’ll recall, we were told over and over again that inflation was transitory. But now that the central bank is on the job, most people are confident Powell and Company can get rising prices back under control.

Perhaps they shouldn’t be so confident.

The collapse of the FTX crypto exchange has been in the news. As SchiffGold analyst Tony wrote, “FTX isn’t the canary in the coal mine (that was Celsius, or one of the other firms that crashed this year). FTX is the coal mine, and it just collapsed.”

There are plenty of signs that the economy is teetering on the brink as the Federal Reserve ratchets up interest rates. The air is coming out of the housing bubble, PMI has tanked, more Americans are living paycheck to paycheck, and debt is spiraling upward. Those claiming the economy remains strong have one peg to hang their hats on – the “strong” labor market.

But in fact, the labor market is anything but strong.

Most people have a sense of history that goes back about two weeks. This is especially true in the world of investing and finance. As a result, people have a hard time seeing the big picture. For instance, a lot of people think the current inflation crisis was only due to the Fed failing to respond fast enough. As Peter Schiff pointed out, this inflation was in fact decades in the making.

And as James Anthony pointed out, the current inflation problem along with all of the big economic crises that occurred in the 20th and 21st centuries have one commonality — progressive government coupled with monetary policies run by the Federal Reserve.

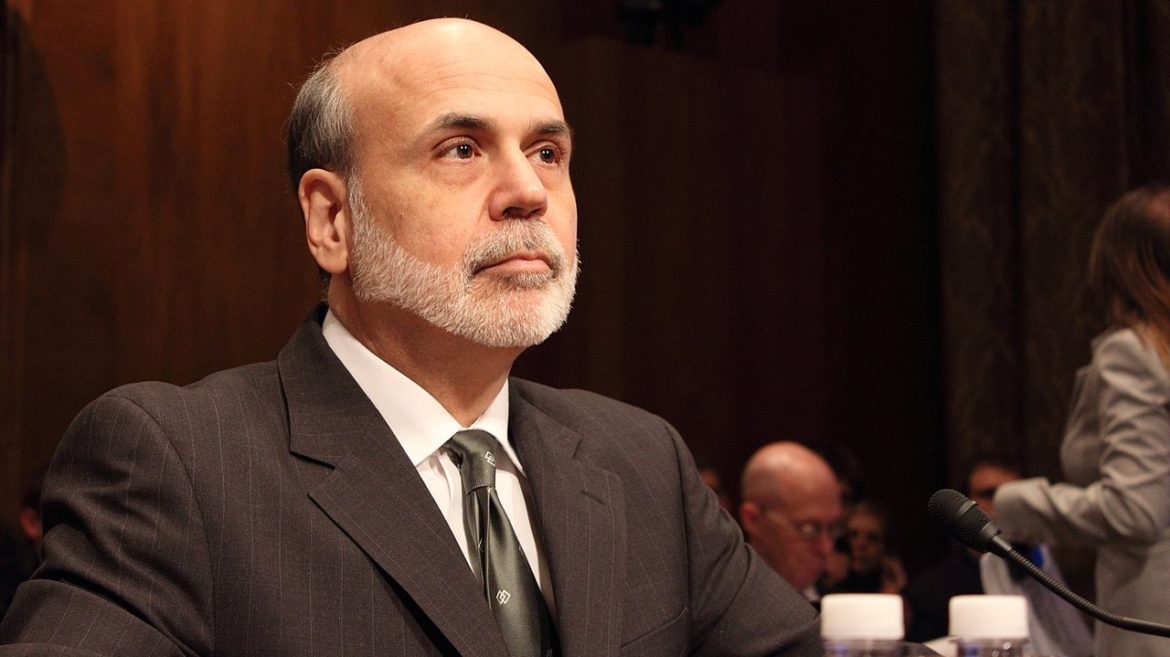

Ben Bernanke was one of the architects of the inflation you’re suffering from today. He won a Nobel Prize for his efforts.

Bernanke rolled out quantitative easing to rescue the economy in the wake of the 2008 financial crisis. At the time, he swore it was a temporary emergency measure and that the Fed would eventually sell all of the bonds it was accumulating on its balance sheet. He insisted that it was not a debt monetization scheme.

Gold is nature’s money.

Aristotle listed four characteristics of sound money: it must be durable, portable, divisible, and have intrinsic value. Gold possesses all of these characteristics, which is why gold has served as money for thousands of years.