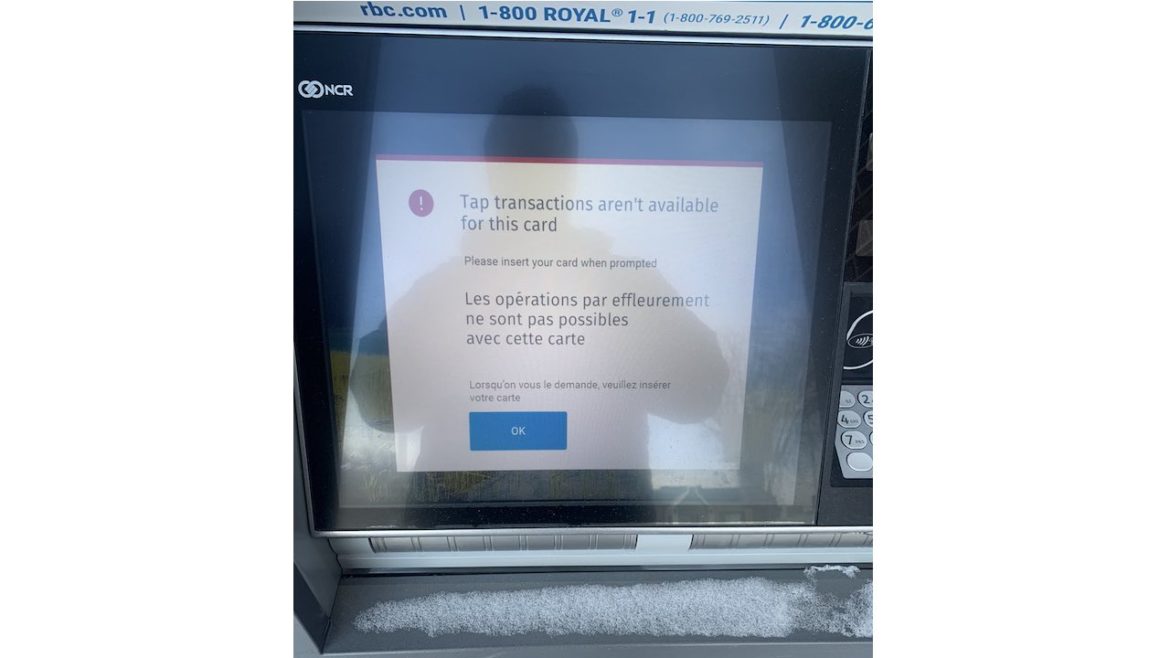

What would you do if you went to the ATM and found that you couldn’t access the money in your bank account?

Many Canadians recently suffered this unsettling experience. Customers of five major Canadian banks reported mysterious online banking outages last week after Canadian Prime Minister Justin Trudeau announced he was invoking emergency powers in response to a massive trucker protest. This gave the Canadian government the authority to freeze bank accounts.

Last week, the Federal Reserve released a “discussion paper” examing the pros and cons of a potential US central bank digital dollar. According to the Federal Reserve press release, the central bank hopes to get public feedback on the idea.

“We look forward to engaging with the public, elected representatives, and a broad range of stakeholders as we examine the positives and negatives of a central bank digital currency in the United States,” Federal Reserve Chair Jerome H. Powell said.

We’ve written extensively about the “war on cash.” In a nutshell, governments would love to do away with cash in order to better track and control their citizens. There have been numerous moves closer to a cashless society in recent years, from capping ATM withdrawals to doing away with large-denomination bills. Last year, China launched a digital yuan pilot program and the US has floated moving toward a digital dollar.

Last year, China launched a digital yuan pilot program. The Chinese government-backed digital currency got a boost when the country’s biggest online retailer announced the first virtual platform to accept the Chinese digital currency. China isn’t the only government exploring the possibility of digital money. Sweden has developed a digital currency of its own. The European Central Bank is pushing for a digital euro. And Russian central bank governor Elvira Nabiullina recently told CNBC that digital currency is “the future of our financial system.”

So, how long before a digital dollar comes to the United States? Well, it’s already in the pipeline.

China made a big splash when it rolled out its digital yuan and it got a boost when China’s biggest online retailer announced it has developed the first virtual platform to accept the Chinese digital currency. But China isn’t alone in exploring the possibility of digital money. Sweden has developed a digital currency of its own and the European Central Bank is pushing for a digital euro.

We’re told digital currency should replace unwieldy physical cash. It will be more convenient and help governments stop criminals. But there is a more sinister motive behind this government pivot toward digital currency.

The People’s Bank of China was the first central bank to roll out a digital currency. The digital yuan recently got a boost when China’s biggest online retailer announced it has developed the first virtual platform to accept the Chinese digital currency.

Digital currency is nothing more than a virtual banknote or coin that exists in a digital wallet on your smartphone instead of a billfold or a purse. Digital currencies issued by central banks are backed by the state, just like traditional fiat currency.

Last summer, the Chinese government launched a pilot program for a digital version of the yuan. The virtual currency ups the ante in the war on cash and creates the potential for the government to track and even control consumer spending.

Last week, the digital yuan got a boost when China’s biggest online retailer announced it has developed the first virtual platform to accept the Chinese digital currency.

There has been a lot of talk lately about central banks implementing their own digital currencies.

Why?

The economy has gone through the quickest and arguably the deepest collapse in history, but the stock market has been rallying. How can this be? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey says look no further than the Federal Reserve. Despite the economic chaos, it has managed to blow up stock market bubble X.0 He also talks about a move China recently made that ups the ante in the “war on cash.”

The Chinese government has launched a pilot program for a digital version of the yuan. The virtual currency ups the ante in the war on cash and creates the potential for the government to track and even control consumer spending. It also raises some concern that the Chinese could threaten dollar-dominance.