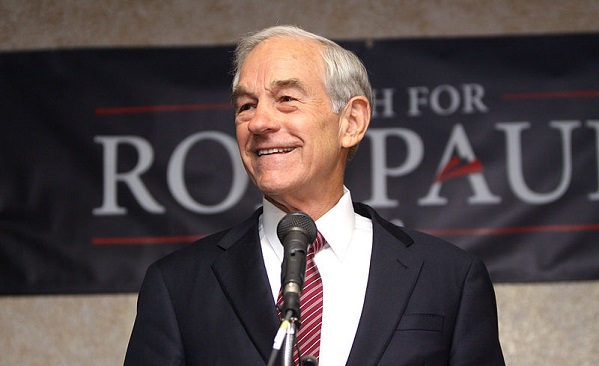

To date, gold is up nearly 10% in 2017, but as Ron Paul pointed out in his recent Market Update video, most people aren’t paying much attention.

Why not?

Because a lot of other things such as the stock market and cryptocurrencies are going up faster. Nevertheless, Paul thinks there are good reasons to believe what he calls the “third bull market” in gold has started.

Ron Paul has identified an increase in what he calls the “most insidious tax” buried in the GOP tax reform bill.

A lot of Americans have put a lot of hope in tax reform. As Peter Schiff said in a recent Fox Business interview, the prospect of economic growth spurred by tax reform and other Trump policies have generated a great deal of optimism. But the question remains: can the GOP Congress deliver? And even if Congress does get a reform package passed, some question whether it will actually lead to the economic growth promised. Absent spending cuts, the tax plan will increase the federal debt even further. Evidence indicates high debt levels retard growth.

In a recent article published on the Mises Wire, Ron Paul identified another problem with the Republican tax plan. It actually increases the most insidious of all taxes – the “inflation tax.”

Stock markets continue to surge higher on a seemingly endless upward trajectory. On Tuesday, the Dow Jones crossed the 23,000 mark for a time and closed just below that threshold at 22,997.

It almost seems like this can go on forever, but Ron Paul said it would eventually come to an end during an interview on CNBC Futures Now last week. He said it reminds him of “delusions and the madness of crowds.”