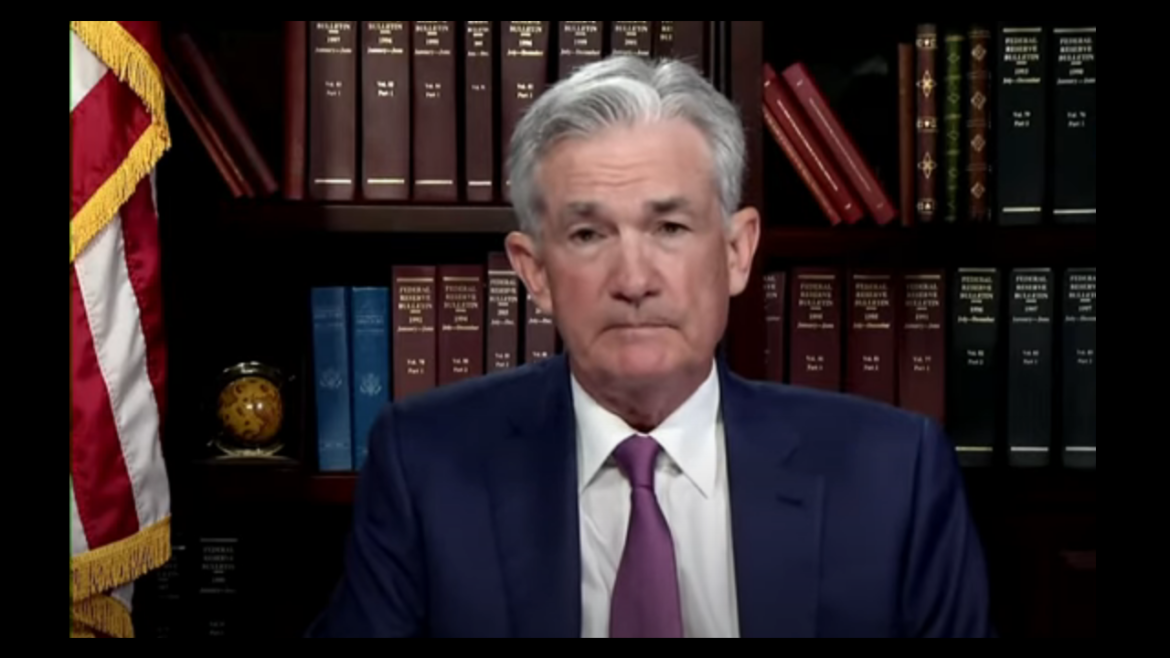

Federal Reserve Chairman Jerome Powell spent most of his Jackson Hole speech continuing to try to convince everybody that inflation is transitory. As Friday Gold Wrap podcast host Mike Maharrey points out in this episode, whether it is or isn’t transitory, inflation is a real thing that has a real impact on real people. In this show, he also breaks the news on the August jobs numbers and discusses taper talk.

There’s been a lot of talk about the Federal Reserve tapering quantitative easing. So far, it’s been nothing but talk.

A lot of people expected Federal Reserve Chairman Jerome Powell to offer some details and perhaps a timeline for the taper during his Jackson Hole speech. We got no such thing. Instead, he tapered the taper talk. In fact, Powell never uttered the word “taper.” he spent most of the speech trying to prop up his “transitory” inflation narrative.

Jerome Powell delivered his much-anticipated speech virtually during the Jackson Hole summit on Aug. 27. Peter Schiff talked about the speech during his podcast. Everybody expected a hawkish speech outlining the Fed’s plan to taper quantitative easing. Instead, Powell tapered the taper talk.

Jerome Powell will speak today at the Jackson Hole economic summit. Everybody is on pins and needles in anticipation of the Fed chairman’s speech. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey discusses the Fed’s messaging and then moves past the talk to discuss the “here and now” reality. He also spends some time talking more fundamentally about gold as part of an investment strategy.

During a Q&A with students and teachers, Federal Reserve Chairman Jerome Powell praised the bad economics that drove the government response to the coronavirus pandemic. In this clip from his podcast, Peter Schiff breaks down everything Powell got wrong.

During the Zoom event, Powell went out of his way to praise Congress for passing the “CARES Act.” The Coronavirus Aid, Relief, and Economic Security Act was the first $2.2 trillion stimulus plan Congress passed in response to the pandemic back in March 2020.

Dallas Federal Reserve President Robert Kaplan has been one of the more hawkish Fed members. On Aug 11, he said the Fed should announce a quantitative easing taper in September and begin slowing asset purchases in October. But two weeks later, Kaplan backed off that assertion, saying that with the surge of COVID-19, he was open to adjusting his view. In an interview on CNBC’s “Squawk Box,” financial analyst Jim Grant explained why the Fed is playing with fire.

As prices continue to spiral upward and the Federal Reserve maintains its inflationary monetary policy, a lot of people in the mainstream keep talking about inflation as a good thing. Peter Schiff said it seems like they’re trying to soften us up and make us willing to accept higher inflation. But as he explains in this clip from his podcast, these pundits are missing a fundamental truth — no matter how much money the Federal Reserve prints, it can’t print actual stuff.

While there is a lot of talk about the Federal Reserve tapering its asset purchases, no such tapering is actually happening.

In the week ending Aug. 18, the Fed pushed its balance sheet to yet another record with the addition of another $85.4 billion in Treasuries and mortgage-backed securities. The balance sheet now stands at a record $8.34 trillion.

There’s been a lot of talk about the Federal Reserve tapering its asset purchases. Peter Schiff talked about it during his podcast, saying even if the Fed does get around to tapering, that doesn’t equate to a legitimately tight monetary policy. Furthermore, any tapering today sows the seeds for its own destruction.

This week marked the 50th anniversary of President Richard Nixon slamming shut the “gold window” and cutting the last tether between the dollar and gold. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey explains exactly what Nixon did and the impact of 50 years of monopoly money. He also covers some of the week’s economic data and the release of the Fed’s July minutes.