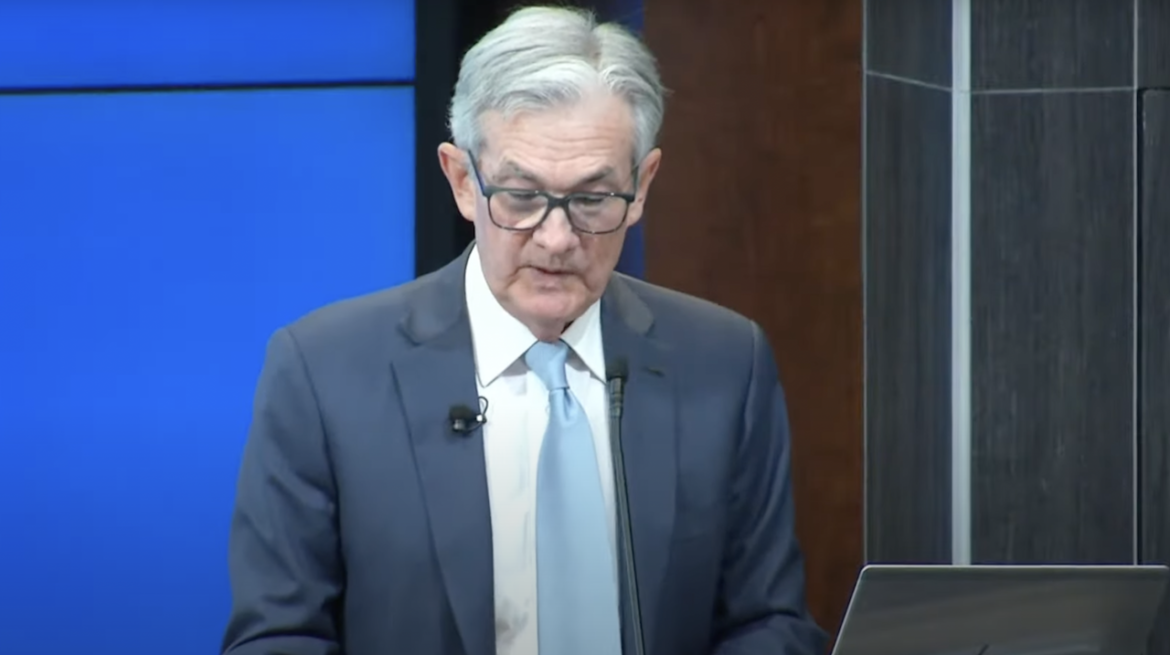

Federal Reserve Chairman Jerome Powell came out this week and indicated the central bank is set to pivot away from its aggressive rate hikes. But he couched the announcement in hawkish terms. The markets bought the pivot and ignored the hawkishness. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey puts Powell’s remarks in a broader context and speculates about what might be coming down the pike.

Inflation was running rampant for months before the Federal Reserve launched its inflation fight. As you’ll recall, we were told over and over again that inflation was transitory. But now that the central bank is on the job, most people are confident Powell and Company can get rising prices back under control.

Perhaps they shouldn’t be so confident.

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

In another bad sign for a housing bubble that is quickly deflating, investor purchases of single-family homes tanked in the third quarter.

Meanwhile, overall home sales continue to tumble and prices are falling.

When people talk about “inflation” today, they generally mean rising prices as measured by the Consumer Price Index (CPI). But historically, “inflation” was more precisely defined as an increase in the amount of money and credit causing advances in the price level. Inflation used to be understood as an increase in the money supply. Rising prices were a symptom of inflation.

I find this change in definition problematic. But many disagree with me. They argue that I’m being pedantic and the definition doesn’t really matter all that much.

Interest rate hikes get most of the attention as the Federal Reserve fights inflation, but balance sheet reduction is arguably more important. And it’s not going well.

Since the Fed stopped buying Treasuries and started letting bonds fall off its books as they mature, the bond market has experienced increasing volatility and liquidity problems. In fact, there is already talk about the possibility of the central bank abandoning quantitative tightening.

The collapse of the FTX crypto exchange has been in the news. As SchiffGold analyst Tony wrote, “FTX isn’t the canary in the coal mine (that was Celsius, or one of the other firms that crashed this year). FTX is the coal mine, and it just collapsed.”

People in the financial media tend to talk about inflation as an academic exercise. As a result, it’s easy to forget that rising prices cause real pain for real people. And Americans are feeling that pain today. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey highlights some ways inflation is impacting regular people. He also explains why he thinks stagflation is the most likely outcome of this inflation fight.

Markets have rallied since we got cooler-than-expected CPI data for October. But in his podcast, Peter Schiff said we are in the eye of the inflation hurricane, and investors have been lulled into a false sense of security.

The October CPI data came in a bit cooler than expected, but the market reaction was hot and furious. Peter Schiff broke down the CPI data and the market reaction to it in his podcast. Despite the spin, Peter said the Fed isn’t making any progress in fighting inflation.