Donald Trump went on a Twitter rant Friday. In his latest podcast, Peter Schiff said the president basically “lost it.”

There was a lot of news on Friday before Trump went off on Twitter. Jerome Powell gave his speech at Jackson Hole. He was generally upbeat about the economy. Then China announced additional tariffs on $75 billion in American imports. But the real fireworks started with Trump’s tweets in response to the Chines tariff retaliation.

This week has been relatively quiet in the markets. Gold has drifted up and down as traders wait to see what kind of message Fed Chair Jerome Powell will deliver during his Jackson Hole speech. In this episode of the Friday Gold Wrap, host Mike Maharrey covers some tidbits of news and speculates about what Powell will say. Then he pivots and talks a little bit about President Trump and the strange economic tightrope that he’s trying to walk.

The Federal Reserve FOMC met this week. When it was all said and done, the Fed did nothing. We’re stuck in neutral.

As expected, there was no rate hike. Fed Chair Jerome Powell indicated that the central bank would likely maintain this neutral stance into the foreseeable future, staying patient, neither raising nor lowering rates. So, why in the world did markets react like the Fed just jacked up interest rates? On this episode of the Friday Gold Wrap, host Mike Maharrey talks about it. He also gives an overview of the most recent World Gold Council demand report.

Ever since the beginning of the “Powell Pause,” Peter Schiff has been saying it won’t be enough.

If the Fed doesn’t want to upset the markets, soon it will be forced to go back to QE and zero percent interest rates.”

Peter isn’t alone in saying this. After the most recent FOMC meeting, Ryan McMaken at the Mises Institute echoed Peter’s message.

Put simply: the days of quantitative easing are back, and we’re not even in a recession yet.”

The Fed wrapped up another FOMC meeting this week and came out even more dovish than expected. Rate hikes are off the table in 2019 and the central bank now only expects one hike in 2020. In his episode of the Friday Gold Wrap, host Mike Maharrey talks about the meeting and the dirty little secret Reuters let slip out. The goal here is to get you to spend more money and keep the bubble full of air. As Mike put it, “The Fed is trying to feed the debt monster and it wants you to pick up the tab.” He also covered the meeting’s impact on the markets and the latest in political theater.

There’s that word again — patient.

Jerome Powell once again emphasized patience during the most recent FOMC meeting. The Federal Reserve left interest rates unchanged and took any hikes for 2019 off the table. It went a step further and projected just one rate hike in 2020.

During his most recent podcast, Peter Schiff said most people expected a dovish Fed, “But I don’t think they were expecting the Fed to be this dovish.”

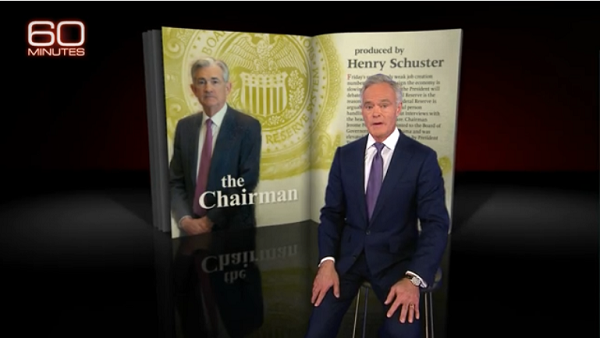

Federal Reserve Chairman Jerome Powell appeared on 60 Minutes last Sunday to reassure us that the US economy is great. There’s nothing to worry about. So, why the sudden reversal in Fed monetary policy? According to Powell, the central bank is just worried about slowing global growth. But as Mike Maharrey discusses in this week’s Friday Gold Wrap, it’s pretty clear the real problems are right here in the good ol’ US of A. Mike also covers the latest in precious metals news, with a focus on silver.

What is the biggest problem in the US economy? As Peter Schiff put it in a recent podcast, “The big, fat, ugly bubble is deflating and the air is coming out.”

And that is precisely why Peter thinks Jerome Powell recently appeared on 60 Minutes.

This is part of a confidence road show – a dog and pony show.”

Federal Reserve Chairman Jerome Powell took his dovish message to the masses during a recent 60 Minutes interview.

Powell continued to talk about “patience” and reiterated that the Fed “does not feel any hurry” to push rates any higher. He also said the interest rate is “roughly neutral” at this point, calling the current 2.25-2.5% rate “appropriate.”

All of a sudden, the Federal Reserve is considering increasing its balance sheet again.

Remember back in September? QE was on “autopilot.” Then we got the “Powell Pause” and suddenly, the talk was that balance sheet reduction could be winding down. Powell confirmed that was the case just a couple of weeks ago when he told a congressional panel the central bank would be in a position to “to stop runoff later this year.”