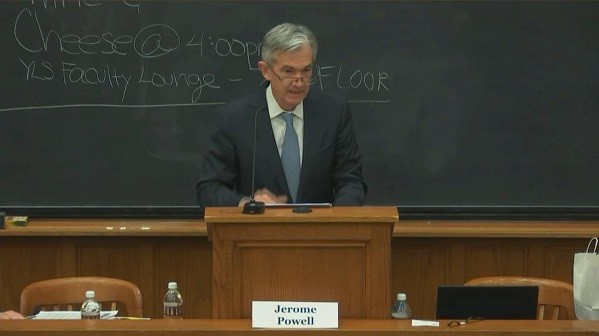

Jerome Powell will take the reins of the Federal Reserve next year. After all the speculation about big changes at the Fed with Trump in the White House, it appears the new boss is pretty much the same as the old boss.

So much for draining the swamp. Powell is a swamp creature. As Peter Schiff pointed out, “He has pretty much voted in lockstep with Janet Yellen the entire time she has chaired the Fed. The only real difference between the two is party affiliation. Powell is affiliated with the Republican Party, even though he was nominated to be on the Fed by Barack Obama. So, obviously not that strong a Republican if he was acceptable to Barack Obama.”

In an article published on the Mises Institute blog, Ryan McMaken expanded on this theme, echoing Hunter Lewis who said Powell is more like Chuck Schumer than Donald Trump.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Trump said he was going to drain the swamp.

Apparently, the drain is clogged.

Trump picked another swamp creature to chair the Federal Reserve. Jerome Powell got the nod to replace Janet Yellen when her term as Fed chair ends in February. As Tho Bishop at the Mises Institute put it, “this means Trump will ensure that, while the stationary at the Eccles Building will change, the monetary policy guiding it likely will not.”

Speculation continues to swirl around the question of who President Trump will appoint as Federal Reserve Chair when Janet Yellen’s term comes to an end in February.

Trump will reportedly meet with Yellen this week to discuss the possibility of her staying on as the head of the central bank. During the presidential campaign, Trump was highly critical of Yellen, saying she is “obviously political,” and accusing her of “doing what Obama wants her to do.”

Last week, Janet Yellen announced the Federal Reserve will begin the much anticipated “tapering” of its massive balance sheet. The Fed chair also hinted another interest rate hike is in the works. After the most recent FOMC meeting, we raised the question: Is this a viable path forward, or is the central bank playing a game of monetary chicken? Peter Schiff has argued that the Fed ultimately won’t be able to reduce its balance sheet to any significant extent. So, despite the Fed’s hawkish stance, the path forward seems far from certain.

In a recent article published on the Mises Fed Watch, Tho Bishop also raised some poignant questions about how the Fed will actually move forward with monetary policy.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The Federal Reserve took a hawkish stance at its latest Open Market Committee meeting, announcing plans to begin unwinding its balance sheet next month. Fed chair Janet Yellen also indicated she plans to raise interest rates one more time this year.

Here’s the question: Is this a viable path forward, or is the central bank playing a game of monetary chicken?