Gold demand will increase modestly in 2018 as mine production remains flat, according to an industry report.

Metals Focus released its Gold Focus 2018 report this week. It projects a 1% increase in gold demand this year with stronger physical investment, jewelry and industrial demand partially offset by a drop in central bank buying.

Twitter has announced a ban on cryptocurrency ads.

The social media company’s announcement is more bad news in what has turned into several bad months for cryptocurrencies.

Last Thursday, the Dow Jones fell 724 points. It followed up with a 424 point decline on Friday. Meanwhile, the Nasdaq fell 2.43% Friday.

Most analysts blamed the plunge on fear of an all-out trade war between the US and China. But the Federal Reserve rate hike on Wednesday also likely played a part in the stock market decline. The markets don’t like the prospect of having their easy-money punch bowl taken away.

So, could we be on the verge of a gold breakout as stocks break down?

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Stock markets have settled down after an awful couple of weeks earlier this month. On Feb. 5, the Dow Jones suffered its largest-ever drop in terms of points. It was down 1,600 at one point and ultimately lost 1,175.21 points, a 4.6% drop that day. At one point during that week, the Dow was off 10% in correction territory. But everything is calm now and most of the mainstream is once again feeling bullish and optimistic.

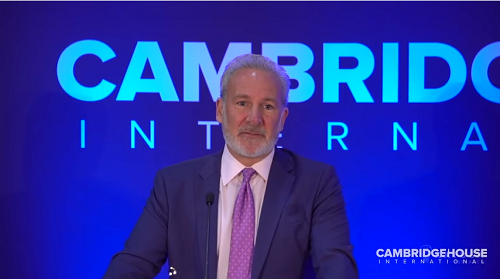

Peter Schiff spoke at the Vancouver Resource Investment Conference 2018 last month before the market tanked. But his message remains relevant in the aftermath of the plunge and the subsequent recovery because the dynamics in the market remain pretty much the same. Conditions are still ripe for a 1987-style market crash.

Investors have not been this optimistic…since 1987. They are even more optimistic than they were at the height of the technology bubble, the dot-com bubble, the new era. Of course, 1987 didn’t end well, right? We had a stock market crash, and there’s a lot about what’s happening today that reminds me about what was happening in ’87.”

It turns out Friday’s 666-point Dow Jones plunge was just a prelude. On Monday, the Dow suffered its largest-ever drop in terms of points. It was down 1,600 at one point and ultimately lost 1,175.21 points, a 4.6% decline. According to Reuters, declines for the benchmark S&P 500 index and the Dow Jones Industrial Average were the biggest single-day percentage drops since August 2011. Monday’s crash ranks in the top-20 of all time Dow Jones drops in percentage terms.

Peter Schiff actually predicted a Monday crash in his podcast last Friday. Yesterday, he took to the microphone again, noting that even with the precipitous fall in the stock markets, the mainstream “fake financial news” remains clueless.

Gold can serve as an important diversifier and increase returns for “buy-and-hold” investors such as pension funds, endowments, insurance companies and sovereign wealth funds.

Why should you buy gold?

A report published this week by the World Gold Council pinpoints four key reasons.

Gold is a highly liquid yet scarce asset, and it is no one’s liability. It is bought as a luxury good as much as an investment. As such, gold can play four fundamental roles in a portfolio.

All kinds of factors impact the price of precious metals, but supply and demand are the most fundamental. With that in mind, the stage seems to be set for silver to have a strong year in 2018.

According to the Silver Institute 2018 Market Trends report, the silver market faces growing demand and shrinking supply in 2018.

The World Gold Council has released a report highlighting four market trends that will impact gold in the coming year. Although the WGC tends to embrace a pretty mainstream economic point of view, there is some good food for thought in the report, and some reason to be bullish on gold in 2018.

The WGC notes that gold performed remarkably well in 2017. Investors continued to add gold to their portfolios. It pointed to inflows of $8.2 billion worth of gold into gold-backed exchange- traded funds as one example of strong gold demand. In fact, gold outperformed many asset classes in 2018, despite a rising interest rate environment and surging stock markets.