The federal debt spiral continues.

The 2018 fiscal year ended Sept. 30 and the US government closed out the year with its largest budget deficit since 2012. Uncle Sam ended 2018 $779 billion in the red, adding to the ballooning national debt.

Keynesian central planners suffer from what Peter Schmidt calls “fatal conceit.” Paul Krugman serves as the poster child for central planning arrogance. But it’s the Federal Reserve that gives the central planners power, as Schmidt highlighted in the first article in a series highlighting this fatal conceit. Schmidt built on this theme in the second article, telling the story of Benjamin Strong and his role in blowing up the 1920s stock market. In this third installment of the series, Schmidt tackles the question no one dares to ask.

In the wake of the stock market plunge last week, Pre. Donald Trump said the market drop wasn’t because of his trade war. Trump said, “That wasn’t it. The problem I have is with the Fed. The Fed is going wild. They’re raising interest rates and it’s ridiculous.” He also said the Fed is “going loco.” In a Thursday interview, the president doubled down, saying “I’m paying interest at a high rate because of our Fed. And I’d like our Fed not to be so aggressive because I think they’re making a big mistake.”

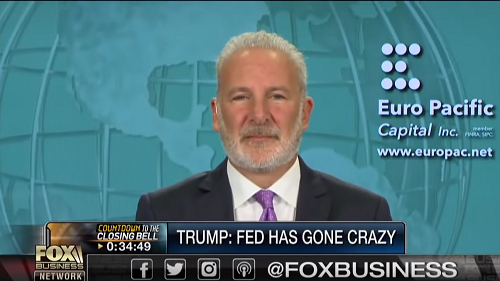

Peter Schiff appeared on Fox Business Countdown to the Closing Bell along with National Alliances head of fixed income Andy Brenner to talk rate hikes, the stock market and where things might go next.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The Dow Jones fell 831 points Wednesday, a decline of more than 3%. Meanwhile, the S&P 500 charted its biggest daily decline since February and the Nasdaq Composite dropped 4.08 percent. This follows on the heels of a 200-point drop in the Dow last week after the 10-year US Treasury yield hit the highest level since 2011.

In a podcast last week, Peter Schiff said rising interest rates could serve as the pin that pricks the stock market bubble. In his most recent podcast, Peter said the stock market rout seems to confirm his feeling and warned a recession will follow.

The mainstream is giddy about the “booming economy.” We have rising stock markets, continued job creation and solid GDP growth. But Ron Paul recently appeared on CNBC Futures Now and threw a big bucket of cold water on the mainstream narrative. He said we are barreling toward a recession.

Americans continue to pile up debt, adding to numbers that were already at record levels.

US consumer debt increased by $20.1 billion in August, pushing total consumer credit to a record $3.94 trillion, according to the latest numbers from the Federal Reserve. That comes to a 6.2% annual growth rate.

The end of last week was tough on US stock markets. The Dow fell off about 200 points on Thursday and another 180 on Friday. But despite those drops, the Dow was only down slightly on the week. The NASDAQ, on the other hand, fell more than 3% last week and the S&P 500 was off about 1%.

As Peter Schiff pointed out in his most recent podcast, the catalyst was rising interest rates, which the markets have been basically ignoring up until last week. Granted, the stock market drops weren’t steep compared to an October crash, but there is still plenty of time left in the month. Peter noted that high interest rates served as the backdrop for Black Monday in October 1987.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Death-spiral — The downward, corkscrew-motion of a disabled aircraft which is unrecoverably headed for a crash.

The US federal government may well be in a death spiral – or perhaps we should call it a debt-spiral.