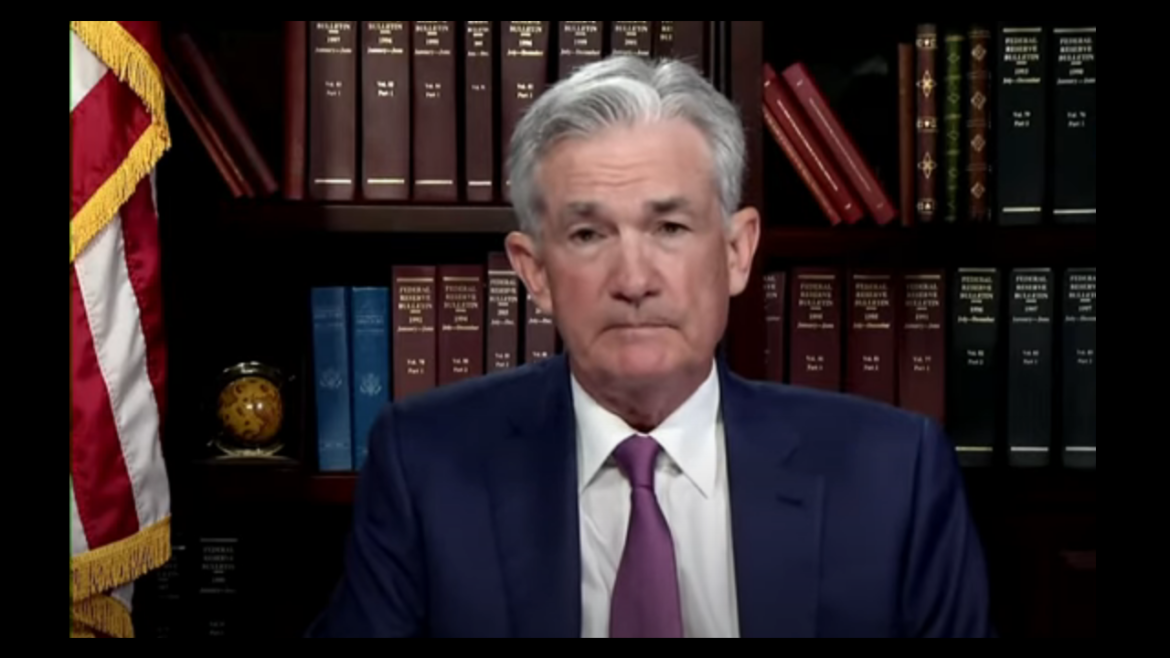

Jerome Powell delivered his much-anticipated speech virtually during the Jackson Hole summit on Aug. 27. Peter Schiff talked about the speech during his podcast. Everybody expected a hawkish speech outlining the Fed’s plan to taper quantitative easing. Instead, Powell tapered the taper talk.

We’ve seen a sharp selloff in both gold and silver. Gold was down over $40 an ounce Friday. Meanwhile, the US dollar saw a sharp increase, along with a rise in long-term Treasury yields. The catalyst for these sharp moves was a better-than-expected jobs report and expectation that it will spark a quick pivot to monetary tightening by the Fed.

The markets are moving on fantasy, not economic reality.

The Federal Reserve and other central banks around the world have pumped trillions of dollars into the global economy and depressed interest rates to artificially low levels to blow up the mother of all bubbles. The recent acquisition of Afterpay by Square reveals the extent of this global bubble economy that will inevitably have to pop.

The Federal Reserve wrapped up its July meeting on Wednesday. Once again, there was a whole lot of talk and no action.

The Fed kept interest rates at zero. The Fed kept its quantitative easing program rolling. The Fed didn’t do anything. But the Fed had plenty to say.

Markets reacted strongly to what many considered “hawkish” messaging coming out of the June Federal Reserve meeting. But is the Fed really taking a “hawkish” position?

Peter Schiff said the Fed was engaging in a “no stick” monetary policy. And in his Friday Gold Wrap podcast, Mike Maharrey argued the Fed was a dove in hawks clothing, arguing we should look at the Fed’s actions, not the messaging.

Central bankers at the Federal Reserve are talking a lot about what’s going to happen in the future. But what do they really know about what lies ahead?

The fact is, they don’t know a whole lot. But we do know one thing for sure – the debt in the US isn’t going away. It’s only going to increase.

The Federal Reserve wrapped up its June meeting this week. The markets are convinced Jerome Powell has gone hawkish. Has he though? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the messaging coming out of the FOMC meeting and reaches a completely different conclusion. He also compares and contrasts three competing narratives about the trajectory of Fed monetary policy.

The US government continues to run massive budget deficits. That means it has to sell bonds to finance the debt. So, who’s buying all these Treasuries?

The Federal Reserve is buying a lot of them as it continues to monetize the ever-growing federal debt. Between March 2020 and March 2021, the central bank monetized more than half of the massive pandemic debt.

Treasury Secretary Janet Yellen sent markets into a tizzy on Tuesday when she said interest rates may have to rise to keep the economy from overheating with all the government stimulus. But later in the day, she walked those comments back, claiming inflation isn’t going to be a problem and insisting that she wasn’t suggesting or predicting rate hikes.

Yellen’s flipflop is telling. Even if inflation is an issue (and it is), there isn’t a darn thing the Federal Reserve can do about it.

The markets seem to think the Fed is going to fight inflation. They believe that the central bank will pivot to tighter monetary policy sooner than expected as inflation heats up, even though Jerome Powell keeps insisting inflation isn’t really a problem. In a recent podcast, Peter Schiff said that the truth is the Fed is between a rock and a hard place. It couldn’t fight inflation even if it wanted to. Doing so would kill the economy. The only other choice is to surrender to inflation.