In a surprise move earlier this month, OPEC announced further oil production cuts of about 1.16 million barrels per day. Analysts projected the cuts could raise the price of oil by $10 per barrel. Peter Schiff recently appeared on NewsMax’s Wake Up America and explained why these production cuts will further complicate the Federal Reserve’s efforts to fight price inflation, and more broadly, how global moves like this and others undermine the dollar.

Peter Schiff appeared on TraderTV to talk about the failure of Silicon Valley Bank and Signature Bank, the bailout, and what might lie ahead. Peter emphasized that this banking crisis isn’t over. In fact, it is just the beginning of a much worse financial crisis.

The dollar may be king, but its throne is getting a little tippy. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the slow but steady erosion of the dollar’s global dominance and the possible ramifications. He also explains how Federal Reserve monetary policy is like poison.

In the aftermath of the failure of Silicon Valley Bank and Signature Bank, many rushed to blame their demise on a lack of regulation. In particular, they focused on the fact that these banks were not required to undergo a Federal Reserve stress test.

Indeed, small and midsize banks are exempt from the stress test requirement. Did that lead to the current banking crisis?

Energy prices have moderated and the price of some goods has dropped in recent months, but the cost of services continues to rise at a red-hot pace and is at the highest level since 1984.

As a result, the core personal consumption expenditures price (PCE) index rose by 4.6% year on year. This is yet another signal that the Federal Reserve is not anywhere close to winning the inflation fight.

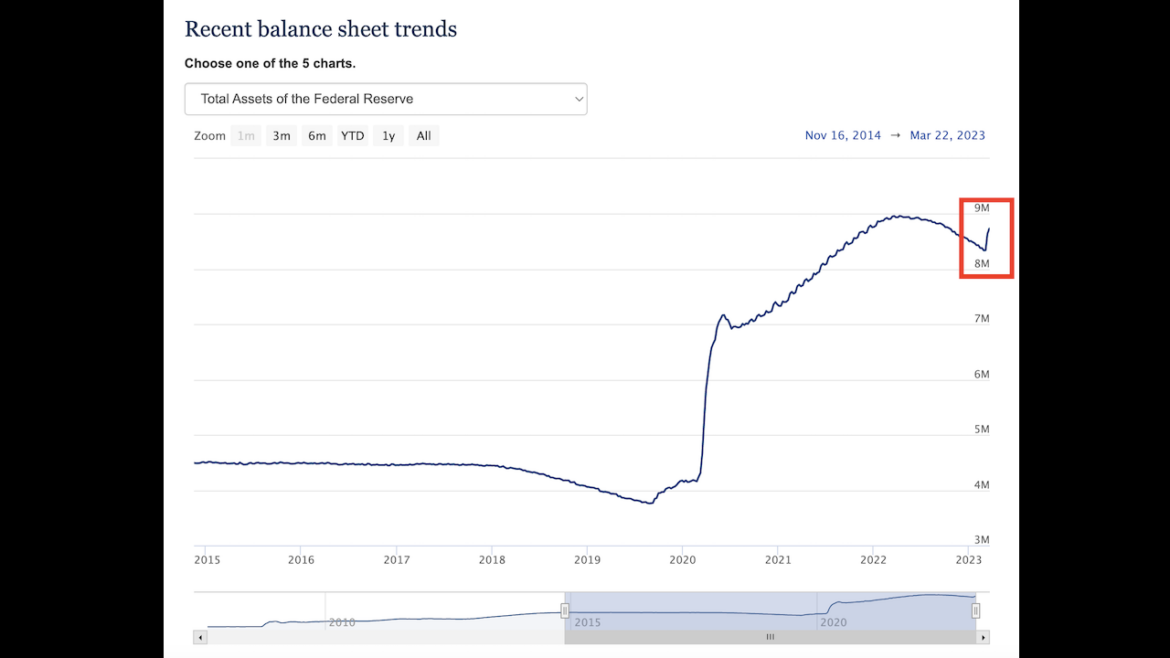

The Federal Reserve has added nearly $400 billion to its balance sheet in just two weeks while simultaneously claiming to still be in the inflation fight. While things seemed pretty quiet this week after the bank bailout, Friday Gold Wrap host Mike Maharrey says it’s only a matter of time before the next shoe drops. What will that be? In this episode, he talks about one possibility. He also talks about some interesting demand news in the silver market.

Peter Schiff appeared on NTD News to talk about the bank bailout and the March Federal Reserve meeting. During the conversation, Peter explained that everybody is going to pay for these bailouts because they will ultimately devalue the dollar as inflation skyrockets.

In the week before it raised interest rates another 25 basis points to fight inflation, the Federal Reserve added more than $94 billion to its balance sheet. This was on top of the nearly $300 billion it piled onto the balance sheet in the first week of its bank bailout.

The balance sheet reveals that Fed has loaned banks nearly $400 billion in money created out of thin air in just two weeks.

Peter Schiff appeared on Real America with Dan Ball to talk about the bank bailout, the unfolding financial crisis, the Fed and inflation. He said this is a sequel to 2008 and like all sequels, it’s going to be worse.

On Wednesday, the Federal Reserve raised interest rates again despite the problems in the banking system. In this episode of the Friday Gold Wrap, host Mike Maharrey talks about the Fed’s inflationary efforts to paper over the problems in the financial system while still keeping up the pretense of an inflation fight. He says it’s like trying to thread a needle with rope.