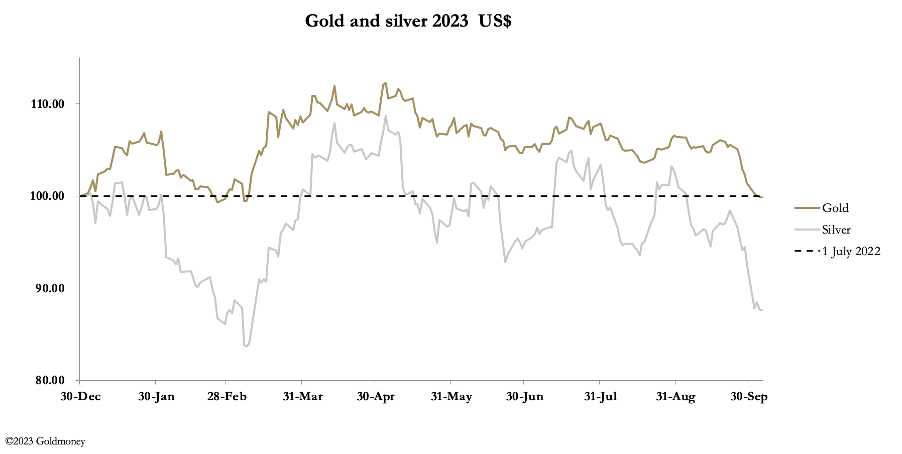

The sell-off in precious metals continued as bond yields continued to rise and a strong dollar persisted. In early trade in Europe this morning, gold was $1822, down another $26, unchanged on the year. Silver traded at $21, down $1.17. Comex volumes in both metals declined from good levels, indicating that selling pressure is declining.

The mainstream wasn’t just wrong about inflation in 2020. It was wildly wrong. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey dissects a 2020 video produced by CNBC to show just how wrong they were. He explains why they were wrong and teaches some economics along the way. He also discusses the carnage in the bond market and tells you who is buying gold.

I recently ran across a video produced by CNBC back in July 2020. It is titled “Why Printing Trillions of Dollars May Not Cause Inflation.”

That aged poorly, didn’t it?

And people wonder why I keep saying you should be skeptical of mainstream narratives.

Price inflation has been even worse than advertised.

Of course, you know that because you’ve lived it. But it is nice when the data crunchers swerve a little closer to reality.

The Bureau of Economic Analysis did just that, revising its Personal Consumption Expenditure (PCE) data higher for the entirety of this inflation cycle.

We keep hearing about a “soft landing.” According to government officials, central bankers, and mainstream financial media pundits, the US economy has dodged a recession.

So why are recession warning signs still flashing?

The markets seem to think that everything is fine. They believe the Fed has effectively beat price inflation and it can mop it up without crashing the economy. In his podcast, Peter Schiff said in reality the Fed is at a fork in the road, and there is an imminent disaster waiting no matter which way it goes. He also warned that the biggest crisis is the one nobody sees coming.

The economy is great! Inflation is dead! We’re on our way to a soft landing! We keep hearing messages like this over and over again from Fed officials, the Biden administration, academics, and financial news pundits. But doesn’t the spin seem a little detached from reality? In this episode of the Friday Gold Wrap, host Mike Maharrey exposes the political class’s gaslighting operation. He also talks about the big selloff in gold this week.

The Federal Reserve has pushed interest rates to over 5%. At the most recent FOMC meeting, it indicated that it may have to hold rates higher for longer. But the mainstream remains unconcerned. The narrative is that the Fed has successfully raised rates to fight inflation and is now guiding the economy to a “soft landing.”

In a nutshell, the mainstream financial media seems convinced the US economy has dodged a recession. Meanwhile, the average American seems less than convinced.

So, who’s right?

All eyes are on the Federal Reserve, and people are wondering, what will it do next? The messaging coming from the central bankers is that they will need to keep interest rates higher for longer. But is that possible given the economic conditions and all of the debt in the economy?

Investment and economics writer Jim Grant appeared on CNBC’s Squawk Box to discuss the Fed’s inflation fight and its impact on the economy. He said we ask too much of the central bankers. After all, they are only human.

The Fed people insist the economy is strong. They upped their GDP growth projections at their last meeting. Joe Biden thinks the economy is strong. He keeps bragging about the marvelous achievements of “Bidenomics.” Mainstream economists keep telling us the economy is strong.

But the average American isn’t buying any of it. (Perhaps price inflation makes it too expensive?)