We have a temporary truce in the debt ceiling fight. On Thursday, President Biden signed a bill increasing the federal debt limit by $480 billion. But this isn’t an end to the debt ceiling fight. Congress just kicked the can down the road. The increase is only expected to keep the US government solvent until Dec. 3.

As Peter Schiff explained in this clip from his podcast, the debt ceiling has turned into a debt floor.

The US government ran a $170.64 billion budget deficit in August, pushing the total fiscal 2021 budget shortfall to $2.71 trillion with one month to go, according to the latest Monthly Treasury Statement.

The mainstream media spun this as good news, noting that the August deficit was 15% lower than the $200 billion spending gap a year ago. This was primarily a function of higher revenues in August 2021 compared to last year. But digging deeper into the numbers reveals the US government hasn’t exactly slowed down its out-of-control spending spree, with spending last month also up compared to last year.

This month marks the 50th anniversary of President Richard Nixon slamming shut the so-called “gold window” and severing the last ties between the dollar and gold.

On Aug. 15, 1971, Nixon ordered Treasury Secretary John Connally to uncouple gold from its fixed $35 price and suspended the ability of foreign banks to directly exchange dollars for gold. Nixon’s order was the end of a path off the gold standard that started during President Franklin D. Roosevelt’s administration, and it set the foundation for the massive government spending and inflation we’re dealing with today.

After a briefly shrinking for two months thanks to IRS tax collections, the US government budget deficit ballooned again in July, hitting the third-highest number of fiscal 2021.

The July budget shortfall was $302.05 billion. The only months with bigger deficits in fiscal 2021 were February ($310 billion) and March ($600 billion).

The US government ran yet another massive budget deficit in July. The shortfall was particularly larger on a month-on-month basis with tax season ending and the flow of money into the Treasury slowing. The following analysis puts digs deeper into the numbers and puts them into some historical context.

The July Consumer Price Index (CPI) data came out this week. For the first time, the numbers were in line with expectations, leading many mainstream pundits to declare “transitory” inflation is already starting to cool down. Peter Schiff broke down the report in his podcast. He said inflation is far from cooling off. In fact, when it comes to rising prices, you haven’t seen anything yet.

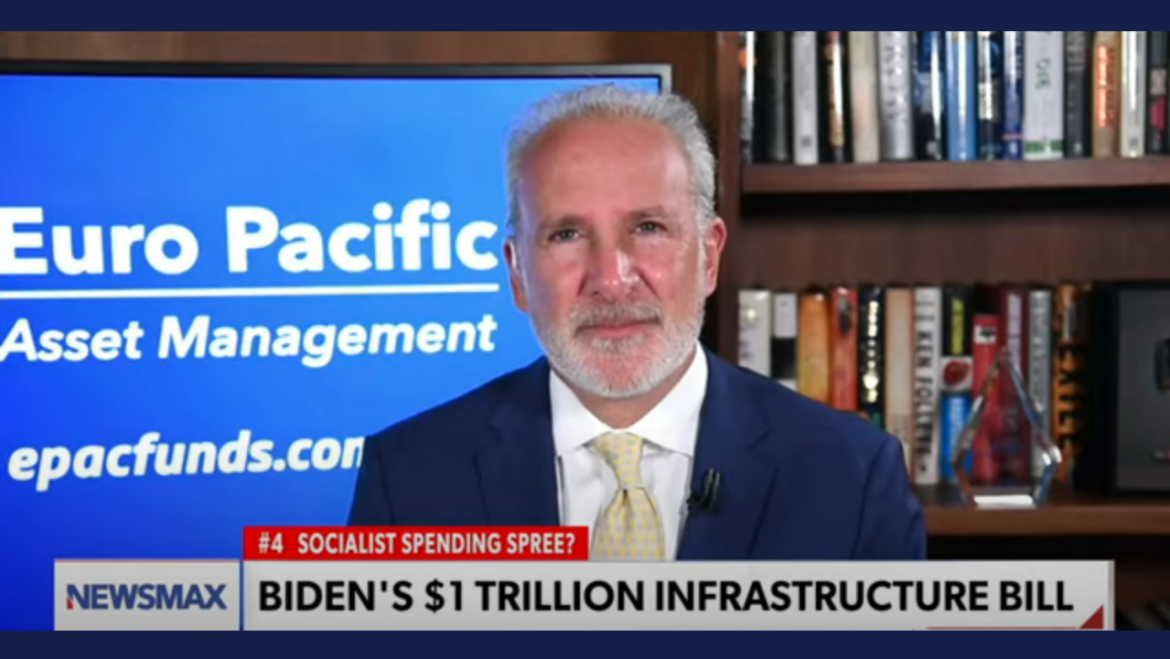

Congress is moving toward finalizing a $1 trillion infrastructure bill. Peter Schiff appeared on Newsmax “The Count” with Jenn Pellegrino to talk about the spending spree.

Biden said spending billions on government projects will help America to “build back better.” Politicians have been promising this for decades. But Peter said it’s the wrong approach. We should get government out of the way and let the free market work.

The mainstream narrative is that the Fed will soon admit that inflation isn’t transitory. At that point, it will raise interest rates and taper its bond-buying program to fight rising prices. But this narrative ignores the elephant in the room – the ever-increasing national debt.

In June, the US government ran another big deficit of $174.16 billion, continuing the trend of overspending and massive budget shortfalls.

The US government has pumped trillions of stimulus dollars into the US economy giving us a massive sugar high. It felt good at the moment, but after the initial rush, you always experience a crash.

It looks as if we’re already coming down off the high. May retail sales disappointed, dropping 1.3% after big stimulus-fueled gains in March and April. Meanwhile, over the last two weeks, weekly unemployment claims have jumped back above 400,000.

Yesterday, President Joe Biden announced Republicans and Democrats have come up with a $1.2 trillion infrastructure deal. But where is Uncle Sam going to come up with the money? And what does this tell you about the likely trajectory of Federal Reserve monetary policy? Host Mike Maharrey talks about it in this episode of the Friday Gold Wrap podcast. He also discusses the latest talk, talk, talk coming out of the Fed.