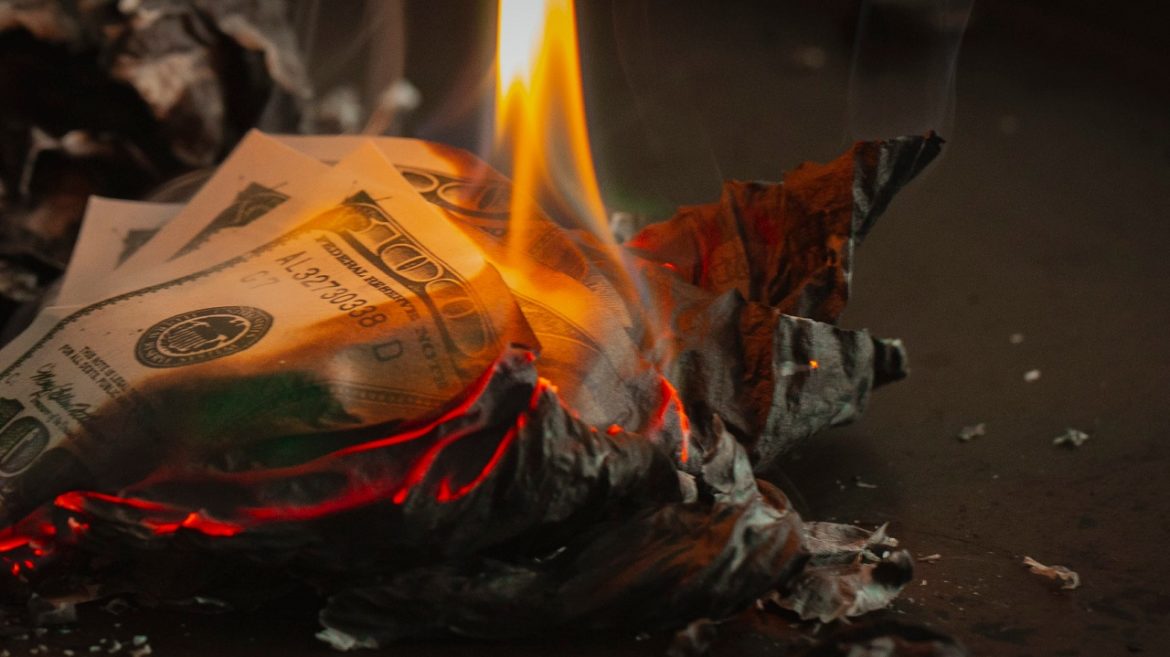

There is a $33.7 trillion elephant in the living room.

I’m referring to the massive national debt.

It’s pretty amazing that we have this massive animal sitting right in the middle of everything and most people are just walking around it as if it isn’t there.

The Biden administration ran a $1.695 trillion budget deficit in fiscal 2023. It was the third-largest deficit in US history. The only time the US government ran bigger deficits was during the COVID years of 2020 and 2021.

The government closed out the year with a $170.98 billion deficit in September, according to the final Monthly Treasury Statement of the fiscal year. That was more than double the projection.

The House recently ousted House Speaker Kevin McCarthy in the wake of the continuing resolution to keep spending money and avoid a government shutdown. Dissatisfied Republicans frustrated with the GOP’s unwillingness to address the federal spending problem banded together with Democrats to send McCarthy packing.

While the outcome might be politically satisfying to some, it’s not going to solve the underlying problem.

Global debt rose $10 trillion to a record $397 trillion in the first half of 2023, according to the Institute of International Finance (IIF).

The big increase in debt occurred despite tightening credit conditions, and it is an increasingly worrisome problem because the “free lunch” of artificially low interest rates is over.

I write a lot about the national debt.

And most people don’t care.

That’s because there’s a widespread belief that the dollar is invincible.

It isn’t.

Twenty days.

That’s how long it took the Biden administration to add another half-trillion dollars to the national debt.

Bidenomics certainly requires a lot of borrowing and spending.

The national debt recently blew past $33 trillion. And yet with the exception of a few intransigent Republicans, there is virtually no discussion about reining in spending.

Congress managed to avoid a government shutdown by passing a continuing resolution that did very little to address spending. But as Ron Paul points out, there was a small victory in the CR that could bode well for the future.

Do you hear that? It’s a ticking time bomb.

Last Friday, the national debt quietly blew above $33 trillion.

As of September 15, the outstanding federal debt stood at a cool $33,044,858,730,468.04.

The federal government charted a surprising budget surplus in August.

But don’t be fooled. The feds didn’t miraculously fix their deficit problem.

The Biden administration continued to spend money at an unsustainable pace last month. The surplus was merely a function of the reversal of student loan forgiveness.

Peter Schiff recently appeared on Fox Digital and poured a bucket of cold water on those who believe the Federal Reserve is winning the inflation fight. In fact, the Fed isn’t making any progress at all.