Gold-buying by central banks has slowed from the record pace we saw in 2018 and 2019, but many countries continue to load up on the yellow metal.

August saw the first net global decline in central bank gold holdings, but the number was skewed by a big sale by one central bank. Overall, seven countries increased their gold reserves by a ton or more in August, tying February for the highest number of buyers in a single month this year.

If you have ever handled gold leaf, you know it’s pretty thin. Paper-thin, in fact. But did you know we can go thinner?

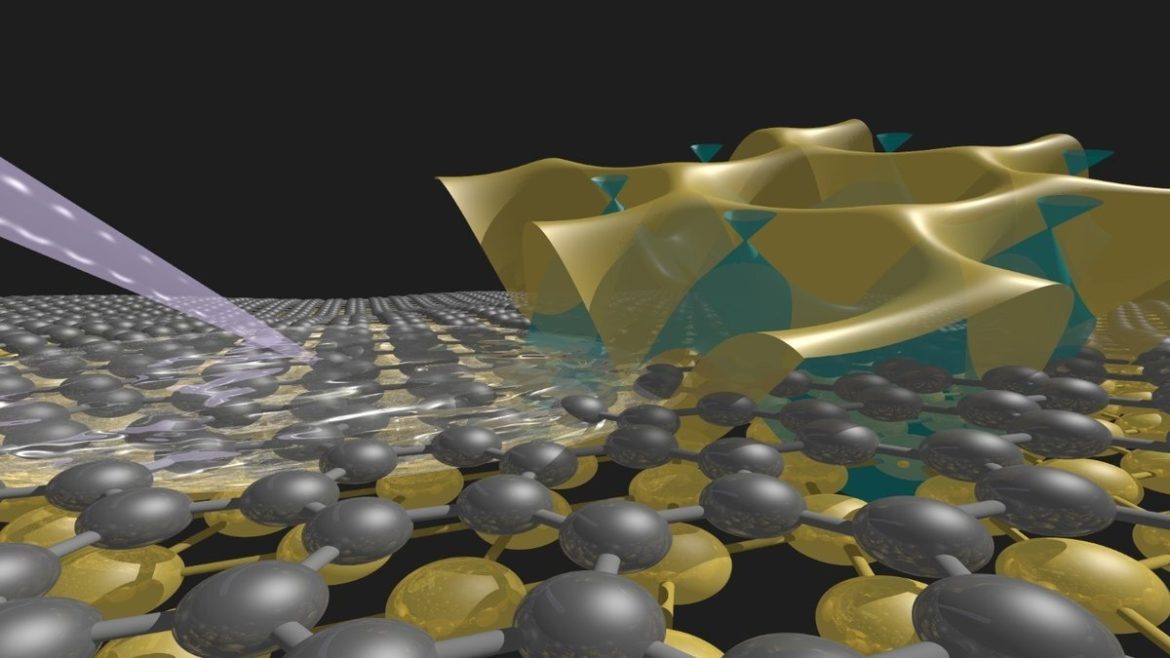

In fact, scientists can take gold and silver into two dimensions. Sounds crazy, eh? Like flat earth or something. But the research team of Ulrich Starke and his former doctoral student Stiven Forti have successfully created a gold layer only a single atom thick. It’s two-dimensional gold, so to speak.

The economy has gone through the quickest and arguably the deepest collapse in history, but the stock market has been rallying. How can this be? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey says look no further than the Federal Reserve. Despite the economic chaos, it has managed to blow up stock market bubble X.0 He also talks about a move China recently made that ups the ante in the “war on cash.”

US stock markets continued their inexplicable rally despite the economic destruction wrought by the coronavirus-induced shutdown. The S&P500 is only down about 3.5% on the year and the NASDAQ is actually up. As a result, a lot of investors seem to be getting out of safe havens, including gold. But in his podcast, Peter Schiff explains why selling gold is a mistake if you understand what’s really going on. In a nutshell, stocks are rising because the Fed is printing money. And no matter what the mainstream says, money printing matters.

Silver just had its biggest monthly gain in nine years.

The spot price of the white metal went into May at $14.96 per ounce and closed on May 29 at $17.98, a 20.7% increase. Silver futures did even better, with the price of silver for July delivery hitting $18.50 per ounce Friday.

The Dow Jones is back of 25,000 and despite increasing tensions with China, people seem pretty optimistic about the economic future as states begin to open back up. SchiffGold Friday Gold Wrap host Mike Maharrey says people should know better. He makes his case by digging into some of the long-term ramifications of the economic shutdown and the government/central bank response to it. He also recaps the last month in the gold and silver markets.

For most of us, these government-enforced coronavirus economic shutdowns have been pretty miserable. I don’t think too many of us feel like we’re overall better off today than we were a couple of months ago – unless maybe you’re in the toilet paper business. Even if they haven’t impacted our pocketbooks, the lockdowns have taken a toll on our psyches. I didn’t like being told to stay inside when I was 10. I don’t like it any better today.

But speaking of 10-year-olds, a couple of young boys in France parlayed the lockdown into big bucks.

Jerome Powell went on 60 Minutes last week and said there was “no limit” to what the Fed could do to support the economy. Of course, that’s not really true. All the central bank can really do is print more dollars. And the economy isn’t just about dollars. It’s about stuff. In this episode of the Friday Gold Wrap podcast, Mike Maharrey talks about the real problem facing the economy – Powell’s “cure.” He also puts silver in the spotlight.

The printing presses are running at full speed as the Federal Reserve creates money out of thin air at an unprecedented rate. Peter Schiff recently appeared on Kitco News to talk about the impact of all money-printing, borrowing and government spending. Somebody has to pay for this and we all will. In fact, a lot of people will be wiped out by the inflation tax.

With the economic chaos created by coronavirus economic shutdowns and the Federal Reserve creating trillions of dollars out of thin air, there is suddenly a lot of interest in buying gold, both as a safe haven and an inflation hedge.

But what is the best way to invest in the yellow metal? Should you buy physical gold? Gold ETFs? Gold stocks? What’s the difference? Are there advantages or disadvantages to each of these options?