The US dollar is on shaky ground. There is a growing trend toward de-dollarization. Meanwhile, the Federal Reserve is tinkering with the idea of a digital dollar that could give the government unprecedented control over your spending.

Given the trajectory of the dollar, it might be a good idea to find some alternatives. In other words, we need currency competition.

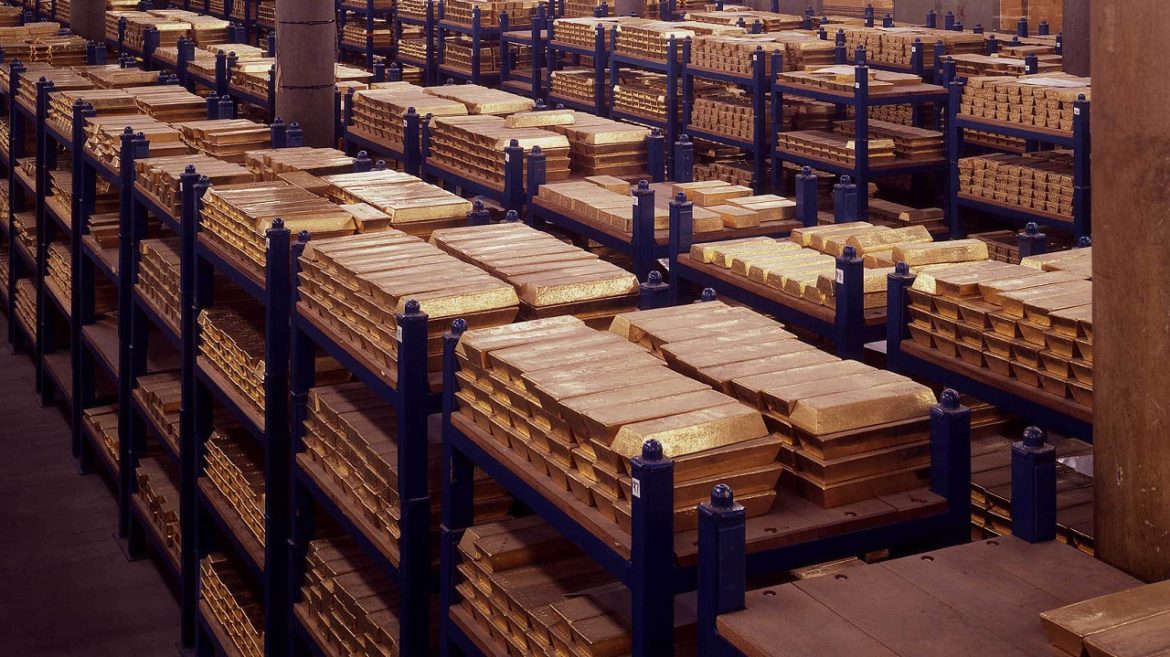

In the wake of Western sanctions on Russia after the invasion of Ukraine, many central banks are bringing their gold home for safekeeping, according to an Invesco survey of central banks and sovereign wealth funds.

Despite a lackluster June, the price of gold rose 5.4% through the first six months of 2023 and was the second-best performing asset class behind only developed market stocks.

Despite doing nothing at the June meeting, Federal Reserve officials continue to talk tough about fighting inflation. The anticipation of another rate hike created headwinds for both stocks and gold this week. But Friday Gold Wrap host Mike Maharrey thinks something is amiss. In this episode, he talks about the disconnect between the central bankers’ rhetoric and their actions. Are they clueless or running scared? This week, he also talks about another big jump in the national debt and the latest on central bank gold buying.

Excluding another big sale by Turkey, central banks were net buyers of gold in May, according to the latest data compiled by the World Gold Council.

Eight central banks added gold to their reserves in May with net purchases totaling 50 tons.

June continued a stock market rally that produced big gains through the first half of the year. But what exactly is driving this rally and is it really justified by the economic fundamentals? Peter breaks it down in a recent podcast and concludes that this is likely a bear market rally.

The Fed managed to reduce its balance sheet by $45 billion last month. The majority of this was in Treasuries of 1-5 year maturities with a reduction of $55B. The next biggest reduction was in mortgage-backed securities MBS totaling $20 billion. This fell short of the target of $35 billion. In fact, the Fed has still never reached its MBS target since balance sheet reduction began.

Meanwhile, the central bank continues to add bank bailout loans to its balance sheet.

There was a lot of economic data this month that seems to signal a strong economy. Does it though? Is everything really fine? In this episode of the Friday Gold Wrap, host Mike Maharrey digs deeper into the data and reveals a less sanguine reality. He also explains the inner workings of the spot price for gold, how it’s determined, and the factors that influence it.

If you listen to the mainstream financial media, you might think gold has fallen out of favor. Most people remain fixated on the surging stock market or the next move by the Federal Reserve. But perception doesn’t always line up with reality – especially mainstream perception.

While the trendy kids are ignoring the yellow metal, there are plenty of people buying gold. In fact, gold demand hit an 11-year high in 2022.

So, what do these folks know that the mainstream might be missing? Are there good reasons to buy gold now?

Seasonally Adjusted Money Supply in May increased $131B. This is the first growth in adjusted M2 since last July and the largest increase since December 2021.