On several podcast episodes, Peter Schiff has talked about the warning signs we’re seeing on Wall Street through the struggles of so-called unicorn companies.

Unicorns are privately held companies valued over $1 billion. Companies like Lyft, Chewie, Uber and WeWork were the darlings of WallStreet. Their IPOs were much-anticipated by investors. They are also the poster children for easy-money induced market mania, and their IPOs were crucial for maintaining the bubble.

In particular, the demise of WeWork’s much-anticipated IPO provides a good object lesson revealing the problems of the Federal Reserve’s easy-money policy.

Stock markets hit new highs again this week. If you believe the headlines, the bullishness on Wall Street is mostly a function of trade deal optimism. But there’s another factor driving stocks higher – easy money courtesy of Federal Reserve (not) quantitative easing. In this episode of the Friday Gold Wrap, host Mike Maharrey talks about the impact QE4 is having on the markets and some delicious irony courtesy of a paper published by the central bank that admits its own policy might just be a problem.

Peter Schiff hit a number of subjects in his most recent podcast, including bitcoin, the stock market, wealth inequality, the Fed and the voting age. He also said we should be thankful for capitalism.

A paper by Scott A. Wolla and Kaitlyn Frerking for the Federal Reserve Bank of St. Louis warns that the Fed’s own policy could lead to “economic ruin.”

The paper titled “Making Sense of National Debt” explains the pros and cons of national borrowing in typical Keynesian fashion. In a nutshell, a little debt is a good thing, but too much debt can become a problem.

But in the process of explaining national debt, Wolla and Frerking stumble into an ugly truth — Federal Reserve money printing can destroy a country’s economy.

It’s been a pretty dreary week on Wall Street with another round of trade war pessimism. Otherwise, there hasn’t been a lot of economic news to roil markets and precious metals have remained pretty much rangebound. But host Mike Maharrey has a silver lining for you on this episode of the Friday Gold Wrap podcast, along with a little Fed analysis.

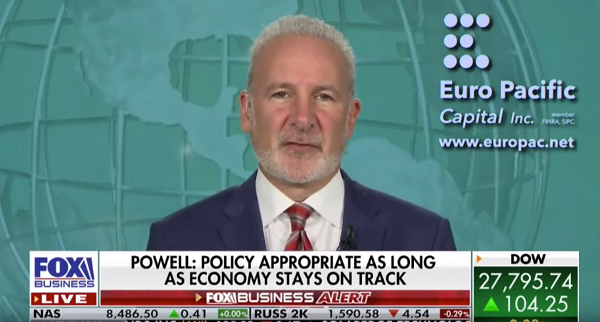

On Nov. 18, Peter Schiff appeared on RT Boom Bust to talk stock markets, trade war and Federal Reserve policy. He said that right now the Fed is doing a good job stimulating the bubbles, but ultimately, it’s going to end very poorly.

On the trade war front, there seems to be a lot of conflicting information and continual yo-yoing between pessimism and optimism. The Chinese seem less confident while White House economic advisor Larry Kudlow says a deal is close.

Peter said he thinks China is posturing for negotiations.

The Dow pushed above 28,000 on Friday. The Nasdaq also closed on a record high above 8,500, and the S&P 500 made a new record high of 3,120. This despite some more gloomy economic data that came out during the day. Industrial production dropped more than expected, falling by 0.8 in October. Inventory numbers were also revised down. All of this led the Atlanta Fed to revise its Q4 GDP estimate down to 0.3.

In his most recent podcast, Peter Schiff said that it’s QE and Federal Reserve policy that is driving the stock market, not a great economy. In fact, the Fed is creating all kinds of bubbles. And like all bubbles, they will eventually pop.

Jerome Powell lectured Congress about the national debt last week, calling it unsustainable. The Federal Reserve chairman is concerned. He admitted that with interest rates already close to zero, the central bank has very little room to cut rates in the event of an economic downturn. Peter Schiff appeared on the Claman Countdown, along with Milken Institute economist Bill Lee to talk about Powell’s comments.

Peter said that while Powell is lecturing Congress, it’s really the Fed’s fault.

Here’s a strange headline for you: “Gold prices near daily highs despite better-than-expected inflation in October.”

This headline is bizarre on a couple of levels. First, since when are rising consumer prices and good news? And second, why wouldn’t inflation be good for gold?

You really have to buy into the mainstream narratives to write that headline.

Fiscal 2020 started just like fiscal 2019 ended – with a massive federal budget deficit. And that has Federal Reserve Chairman Jerome Powell worried. In an ironic bit of political theater, Powell lectured Congress about the spending he helps facilitate.

The budget shortfall last month was 34% higher than the October 2018 deficit, coming in at $134.5 billion, according to the latest Treasury Department report. That starts fiscal 2020 off on track to eclipse a $1 trillion deficit.