After President Biden announced he was reappointing Jerome Powell for a second term as Federal Reserve Chairman, Powell went hawkish, saying it’s time to retire the word “transitory” when it comes to inflation and talking about speeding up the taper. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the Powell transformation and questions whether a dove can really change his feathers.

It appears American consumers are going to have a red Christmas this year.

Red — as in going deeper into debt.

The transitory inflation narrative is dead.

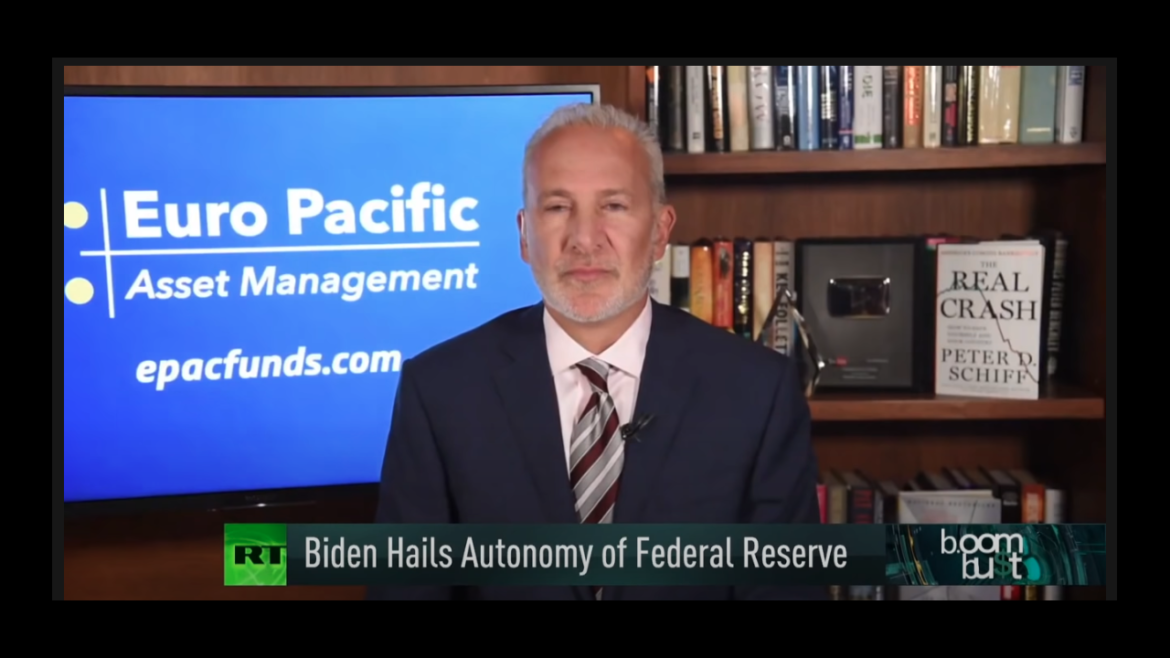

During an appearance before a Senate committee along with Treasury Secretary Janet Yellen Tuesday, Federal Reserve Chairman Jerome Powell said it was time to retire the word transitory. As Peter Schiff explains in his podcast, Powell came close to admitting he was wrong. But the question remains — what is the Fed going to do about this non-transitory inflation?

Black Friday was a black and blue Friday as US stock markets saw their sharpest declines since April 2020.

The selloff was spurred by a new COVID variant and fear of new lockdowns. The markets recovered on Monday, but the sudden stock dip was telling.

Peter Schiff debated Marxist professor Richard Wolff on RT Boom Bust. Wolff just can’t grasp that socialism isn’t the solution to America’s problems. Socialism is America’s problem.

Last Friday was Black Friday and it was a black and blue Friday for investors. Just about everything was down and markets panicked over a new COVID variant. Peter Schiff talked about the market reaction in his podcast. Did the markets overreact? And what would happen if we did go into another global lockdown?

The Dow suffered its worse day since April 2020, the height of COVID lockdowns.

Earlier this week, President Joe Biden announced Jerome Powell will serve a second term as chair of the Federal Reserve. In effect, Biden stuck with the status quo. But the markets reacted as if big changes are afoot. Gold sold off hard, falling back below $1,800 an ounce. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about Powell’s appointment and the market’s reaction to it.

The retail sales numbers for October came in even better than expected. The mainstream reported this as fantastic news — proof that the economy is booming. Meanwhile, Janet Yellen went on national TV and put a new spin on the transitory inflation narrative. In this week’s Friday Gold Wrap, host Mike Maharrey explains why you shouldn’t fall for all this mainstream and government spin.

A Peter Schiff put it, double-barrel inflation is locked and loaded. But after yet another month of hotter thane expected CPI, the central bankers at the Federal Reserve continue to insist that inflation is “transitory” and blame it on everything except their monetary policy.

These central bankers lack any sense of self-awareness. If they did, they would recognize, as Ron Paul does, that their policies are a complete and utter failure.

Retail sales surged at a higher than expected rate in October, rising 1.7%.

The mainstream reported this as fantastic news signaling a strong economy. American consumers are out there buying lots of stuff. The stock market rallied and gold fell.

But the mainstream narrative isn’t giving you the full picture.