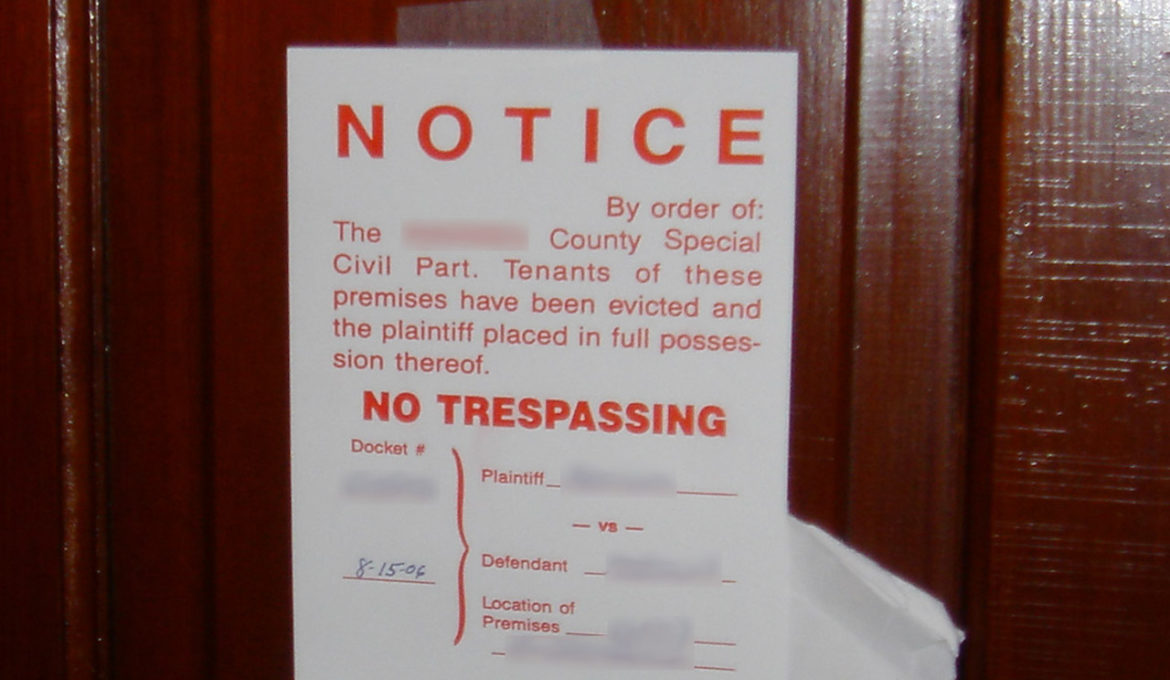

The economy is fine, so we’re told. There is no recession, so we’re told. The Federal Reserve has everything under control, so we’re told. Meanwhile, 3.8 million Americans say they could face eviction in the next two months.

It doesn’t sound like everything is fine.

The dollar index recently hit a 20-year high, so this might seem to be an odd time to talk about a dollar decline. But Rockefeller Institute Chairman and Financial Times columnist Ruchir Sharma recently wrote an article arguing that a post-dollar world is coming.

Jerome Powell delivered his much-anticipated speech at Jackson Hole on Friday. He continued with the hawkish talk we’ve been hearing in recent weeks, pledging the Fed will “use our tools forcefully” to attack inflation. Powell even promised some pain. As Peter Schiff discussed in his podcast, the markets immediately delivered on the promise of pain. But the question remains: do Powell & Co. really have the pain tolerance they claim?

Last week, President Joe Biden announced a student loan forgiveness scheme. Peter Schiff appeared on NewsMax Real America with Dan Ball to talk about the cost of forgiving student debt and the growing recession.

Peter said that despite all of the claims to the contrary, this is just going to add to the inflation problem.

This week, President Biden announced a plan to forgive $10,000 to $20,000 in student loan debt. It sounds nice and some people will certainly benefit, but as SchiffGold Friday Gold Wrap podcast host Mike Maharrey explains, we’re all going to pay for this. In this episode, Mike also talks about Jerome Powell’s upcoming Jackson Hole speech, the state of the economy and some interesting gold market news.

An audacious communications campaign from Democrats in Washington is currently underway that is attempting to convince the public that:

In yet another sign the economy is tanking, private-sector business activity contracted for the second straight month in August.

The S&P Global flash composite purchasing managers index (PMI) dropped to 45 this month from a reading of 47.3 in July. A print below 50 indicates a contraction in economic activity.

The tanking housing market is starting to put a strain on the mortgage industry with some lenders already going out of business. Analysts project the wave of failures coming down the pike could be the worst since the housing bubble burst and triggered the Great Recession.

The central bankers at the Federal Reserve continue to talk tough about fighting inflation. But is it a fight they can win?

The numbers say no.

The four-week win streak in stocks came to an end last week with all of the major indexes down significantly on Friday. As Peter explained in his podcast, it appears the markets are coming to terms with the fact the Powell Pivot may not come as quickly as anticipated. That means interest rates may go higher as the inflation fight continues. But Peter says the markets still don’t get the big picture. The Fed can’t win this inflation fight without wrecking the bubble economy.