After charting its biggest increase since 2007 in the third quarter, household debt surged again in Q4 as Americans try to borrow their way out of the squeeze soaring price inflation has put on their wallets.

Total household debt rose by $394 billion in the last quarter of 2022, according to the latest New York Fed Household Debt and Credit report. It was the biggest quarter-on-quarter rise in two decades.

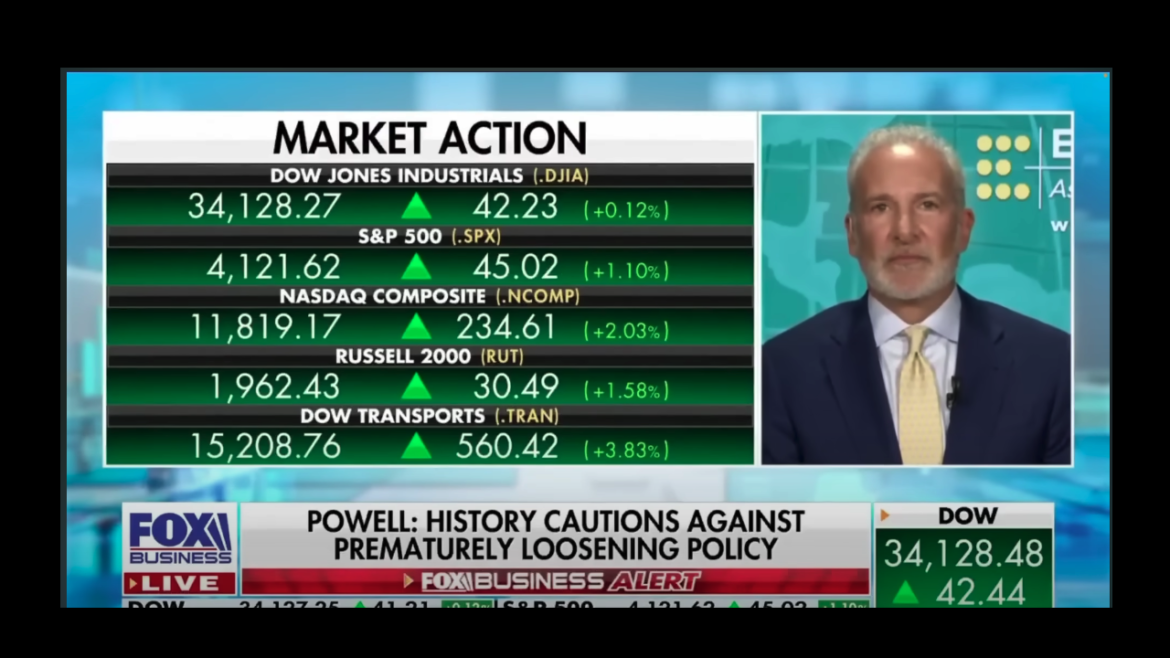

Despite the hotter-than-expected CPI report, the mainstream still seems convinced that the Federal Reserve can get inflation under control and bring the economy to a soft landing. But Peter Schiff argues that the central bank can’t win this fight – at least not without crashing the economy. Since the Fed isn’t willing to do that, it won’t go all-in. In effect, the Fed brought a knife to an inflation gunfight.

Garbage in, garbage out. The phrase is usually associated with computers, but it also applies to the formulas used to generate government economic data. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey goes over the January CPI and retail sales data with that phrase in mind.

Retail sales came in much stronger than expected in January after declining the previous two months. Mainstream financial media pundits immediately declared that this “jump in consumer spending” was a good sign for the economy. The Wall Street Journal called the robust sales report “evidence that US economic growth picked up at the start of the year.”

But there is a dark side to this retail sales report.

There is apparently a new economic buzzword out there – supercore inflation.

CNN says this is a buzzword we all need to pay attention to.

Why?

You’ve probably heard the saying that history might not repeat, but it often rhymes. If that’s true, looking back at the runup to the 2008 financial crisis and Great Recession should cause concern. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey looks at some of the parallels between then and now. He also digs deeper into the January jobs report and explains why you should be skeptical.

If you have any skepticism of government narratives at all, you have to question last week’s non-farm payroll report from the Bureau of Labor Statistics. Given the number of layoffs and the general slowing of the economy, the notion that 517,000 jobs were created in January just doesn’t make sense.

Turns out that your skepticism is warranted.

Consumer debt grew at a slower pace in December, but Americans continued to rely heavily on credit cards to keep up with high price inflation.

The mainstream seems more and more convinced that the Federal Reserve can bring inflation back down to 2% without creating any significant problems in the economy. After the February FOMC meeting, Fed chair Jerome Powell even suggested that the economy would avoid dipping into a recession. But in an interview on Fox Business with Liz Claman, Peter Schiff argued that the Fed won’t beat inflation or get a soft landing. He said the looming economic slowdown will fuel the inflation fire.

The better-than-expected non-farm payroll report for January along with the smaller interest rate hike delivered by the Federal Reserve at its February meeting increased optimism that the central bank can bring price inflation back to 2% without tanking the economy. But the shrinking money supply undercuts this soft landing narrative.