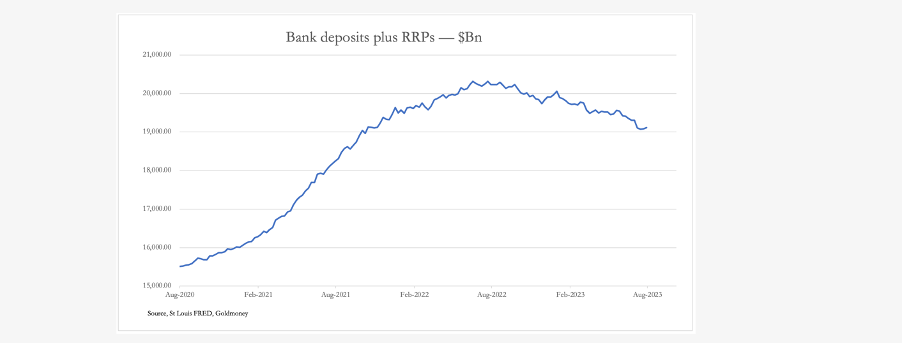

Globally, further falls in consumer price inflation are now unlikely and there are yet further interest rate increases to come. Bond yields are already on the rise, and a new phase of a banking crisis will be triggered.

This article looks at the factors that have come together to drive interest rates higher, destabilising the entire global banking system. The contraction of bank credit is in its early stages, and that alone will push up interest costs for borrowers. We have an old-fashioned credit crunch on our hands.

The European Central Bank (ECB) raised interest rates another 75 basis points last week. In his podcast, Peter Schiff explained how the ECB inflation fight could create big problems for the Federal Reserve and the US dollar.

Inflation and rapidly spiking prices aren’t just a problem in the US. It’s gotten so bad in Europe that that perpetually dovish European Central Bank (ECB) has been forced to go hawkish.

But not really. Just hawkish for the ECB.

Last week the ECB raised interest rates for the first time since 2011. The bank surprised markets, raising all of its policy rates by 50 basis points. That pushes its deposit rate all the way to — zero.

We’ve heard all kinds of excuses for inflation. It was COVID. It was Putin’s price hikes. It’s greedy corporations. This week, we learned it’s the millennials’ fault. As host Mike Maharrey explains in this week’s Friday Gold Wrap, all of these notions miss the mark. And they let the real culprit get off scot-free. How? They’ve redefined inflation. Words matter!

During a recent podcast, Peter Schiff talked about how the Bank of Japan lied about inflation being too low in order to justify its reckless monetary policy and keep interest rates artificially low in order to prop up the country’s massive debt. In a subsequent podcast, Peter talked about similar lies coming out of the European Central Bank.

The price of gold whipsawed this week, driven up and down by various headlines. In this episode of the Friday Gold Wrap, host Mike Maharrey covers some of the big news that moved the markets. But he said that we need to keep our eyes on the big picture. All of this is happening in front of a backdrop of surging debt driven by central bank policy. How much do we owe and what does it mean for the future? Mike talks about it.

Jim Grant recently appeared on the Santelli Exchange on CNBC and the conversation quickly turned to this notion that “intellectuals” have the wherewithal to run the economy. Friday Gold Wrap host Mike Maharrey recently explained two very important economic principles that make it impossible for central planners to ever truly succeed. As he put it, they might be smart, but they aren’t smart enough to know they’re not smart enough. Nevertheless, this doesn’t seem to dampen the fatal conceit and hubris of central bankers who think they can micromanage a complex economy.

Grant put it another way. He called it the ignorance that knows not it’s ignorant.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Central bank quantitative easing is a little like a zombie. It dies – but it never really dies.

There’s been a lot of focus on the Federal Reserve raising interest rates and unwinding its balance sheet. Sometimes it’s easy to forget the Fed isn’t the only game in town. While most people consider QE dead and buried in the US, it remains alive and kicking in other parts of the world.

Yesterday, the European Central Bank (ECB) announced it would extend its bond-buying program deep into 2018, continuing the flow of easy money into the European Union. ECB President Mario Draghi said the central bank would cut its bond purchases in half beginning in January, a faint hint at eventual normalization. But the central bank president left the door open to backtracking.