President Joe Biden has announced the first round of economic sanctions on Russia as tensions in Ukraine continue to mount. The sanctions came in response to an announcement by Russian President Vladimir Putin recognizing two breakaway republics in Ukraine and his decision to send troops into those regions.

Sanctions are meant to punish Russia, but in his podcast, Peter Schiff explained how these economic moves could also impact the US dollar and create even more inflation.

With little fanfare, the national debt crossed the $30 trillion threshold this week. That is an unfathomable number. And as host Mike Maharrey explains in this week’s Friday Gold Wrap podcast, it’s worse than that. Most people aren’t concerned. Maharrey argues that they should be, likening the federal government’s borrow and spend policy to a monetary Jenga game.

The national debt quietly pushed past $30 trillion on Jan. 31. But that is only the tip of the debt iceberg. The American taxpayer is on the hook for a lot more than that. In his podcast, Peter Schiff said US government borrowing and spending has turned the dollar into monopoly money propped up by a massive Ponzi Scheme.

December gave us another big jump in consumer prices. But despite a lot of talk about an inflation war, accommodative monetary policy remains in play. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey breaks down the CPI data, Jerome Powell’s Senate testimony, and Joe Biden’s plan to fix rising meat prices. That story has a fun plot twist.

Peter Schiff and Santiago Capital CEO Brent Johnson got together on the Rebel Capitalist podcast to debate the trajectory of the dollar in 2022. Johnson is bullish on the dollar. Peter thinks the greenback is going to tank.

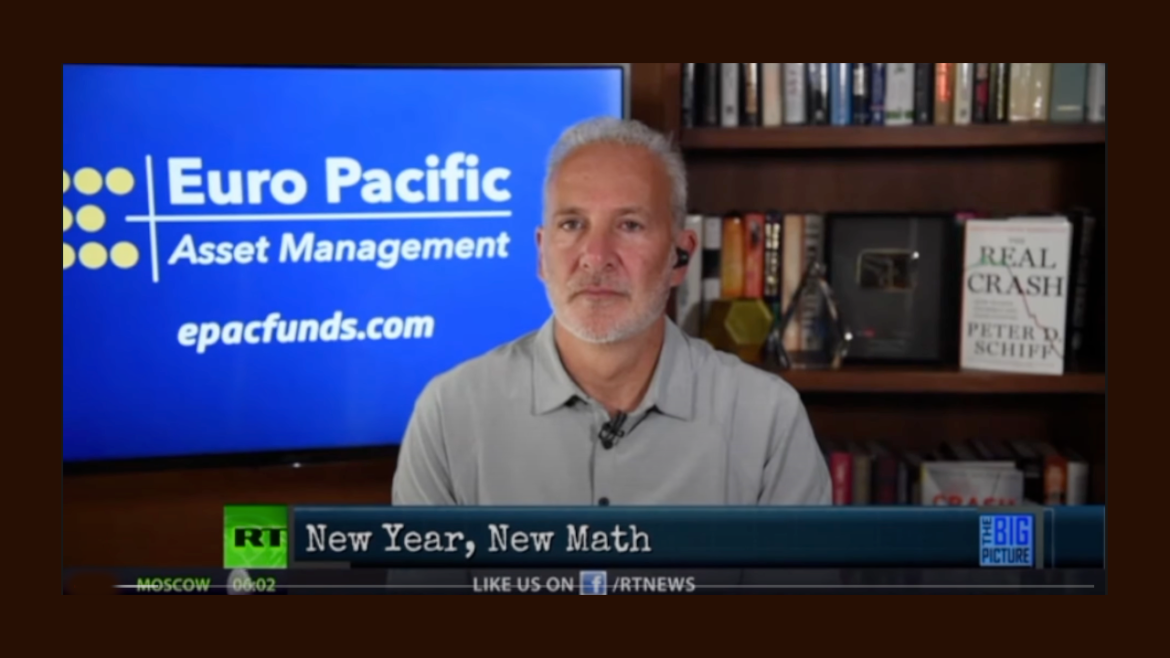

How are the dollars and cents of your life changing as we move into 2022? Peter Schiff joined University of Miami Business School Dean John Quelch and host Holland Cooke on RT’s “Big Picture” to talk about the year ahead. Peter left us with an ominous warning. 2022 will be worse than 2021 as inflation continues to mount.

September CPI came in above expectations. At this point, even the central bankers at the Federal Reserve are having a hard time sticking to the “transitory inflation” narrative.

In his podcast, Peter Schiff talked about the CPI report. He said it reveals that we’re entering an inflation super-cycle and perhaps the markets are starting to figure this out.

Peter called this the “government report card on inflation,” noting that it’s not particularly reliable because the government is grading itself.

A surge of imported services drove the trade deficit to a new record in August. Peter Schiff appeared on NTD News to talk about the trade imbalance. He said it is not a sign of a strong economy and not the kind of records we want to be breaking.

The fake debt ceiling fight rages on.

Last week, the US Senate agreed to a small increase in the borrowing limit, but it only kicked the can down the road a couple of months. The $480 billion increase raises the debt limit to $28.9 trillion, but that’s only going to last until Dec. 3.

Peter Schiff recently appeared on RT Boom Bust to debate economist Steve Keen and Professor Richard Wolf on the debt ceiling and more broadly the US economy.

Peter Schiff says gold will explode and the dollar will implode when the markets figure out the Fed is crying wolf when it comes to monetary tightening.

The Federal Reserve wrapped up another meeting without making any changes to its current extraordinary, loose, inflationary monetary policy. But the central bank did hint that it may start tapering its quantitative easing program “soon.”