Through the last several presidential administrations, the US has maintained a “strong dollar” policy. As Peter Schiff pointed out in his most recent podcast, it wasn’t so much that you could pinpoint the specific tenets of the policy. It was more about the rhetoric that came out of Washington D.C. Everybody talked about the strong dollar being in the national interest.

Having the belief that there was some kind of hidden strong dollar policy helped to create confidence in the dollar. Even periods where the dollar was declining, perhaps it would have declined even more had it not been for the belief that there was some kind of strong dollar policy.”

But times have changed. As Peter put it, “It should be pretty obvious that Donald Trump has a weak dollar policy.”

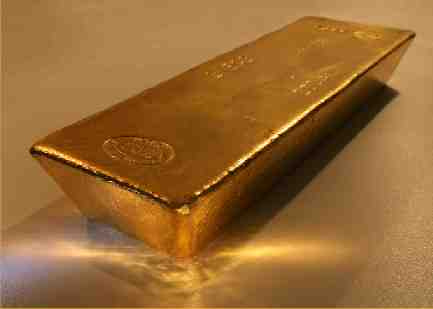

There is plenty of bad news out there. We have a trade war. Geopolitical tensions between the US and Iran and the US and Russia are high. Turkey is in the midst of a currency crisis that some fear will spread beyond that country’s borders. So, why aren’t people seeking safe haven and buying gold and silver?

The CEO at Australia’s Perth Mint has a theory. Richard Hayes said bad news has become so prevalent nobody really pays attention to it anymore. In a nutshell, bad news has become the norm. As a Bloomberg report put it, “Investors have grown immune to the economic and geopolitical risks that typically drive haven demand for gold.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Turkey has been in the headlines over the last few weeks as a currency crisis has rocked that country. But as Peter Schiff pointed out in his most recent podcast, all of the things commentators are frying Turkey over are happening in the US as well.

All of the criticism that is being leveled against Turkey – that their deficits are too big, that they have a current account deficit, they’re keeping interest rates artificially low, they’re keeping interest rates below the rate of inflation – all of that criticism can be applied to the United States.”

The International Monetary Fund dissed the dollar in its annual External Sector Report, saying the greenback is overvalued.

According to a Reuters report, the IMF report also said that “nearly half of global current account balances are now excessive, adding to growth risks and trade tensions.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The price of gold hit six-month lows in recent days, primarily driven down by a surging dollar. Peter Schiff has been saying investors shouldn’t get too caught up in greenback hoopla. This is likely an upside correction in a dollar bear market. As it turns out, Peter is not alone in this assessment. At least a few mainstream analysts agree, and they see gold rallying by the end of the year, according to Bloomberg.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

If you saw the headlines about the latest retail sales figures, you probably noticed adjectives like “hot,” “booming” and “sizzling.” Total retail sales including food services were up 5.9% year-on-year in May.

That’s an impressive number until you factor in inflation. In fact, a decline in the dollar’s purchasing power accounted for nearly half the gains in retail sales.