The year 2020 will not go down as a banner year, but it was fantastic for gold and silver. Both metals charted their best years since 2010.

On New Year’s Eve 2019, gold was trading at $1520.90. It closed the year at $1892.90 for a 24.5% gain.

There aren’t many people sad to see 2020 in the rearview mirror. But there’s no guarantee that 2021 is going to be any better. In his podcast final podcast of 2020, Peter Schiff said that hopefully, the upcoming year will be better healthwise in terms of COVID-19, but economically, this could be the year the chickens come home to roost.

Not just the ones that we let out in 2020 but the ones we have been letting out for the years and years and years that preceded 2020.”

The year 2020 is coming to a merciful end. As it was with pretty much everything, it was a nutty year for the economy and the precious metals markets. We all hope 2021 will be better, but it seems unlikely that it will be any less nutty. In this special Thursday episode of the Friday Gold Wrap podcast, host Mike Maharrey takes a look back at 2020 and speculates on what could lie ahead in 2021.

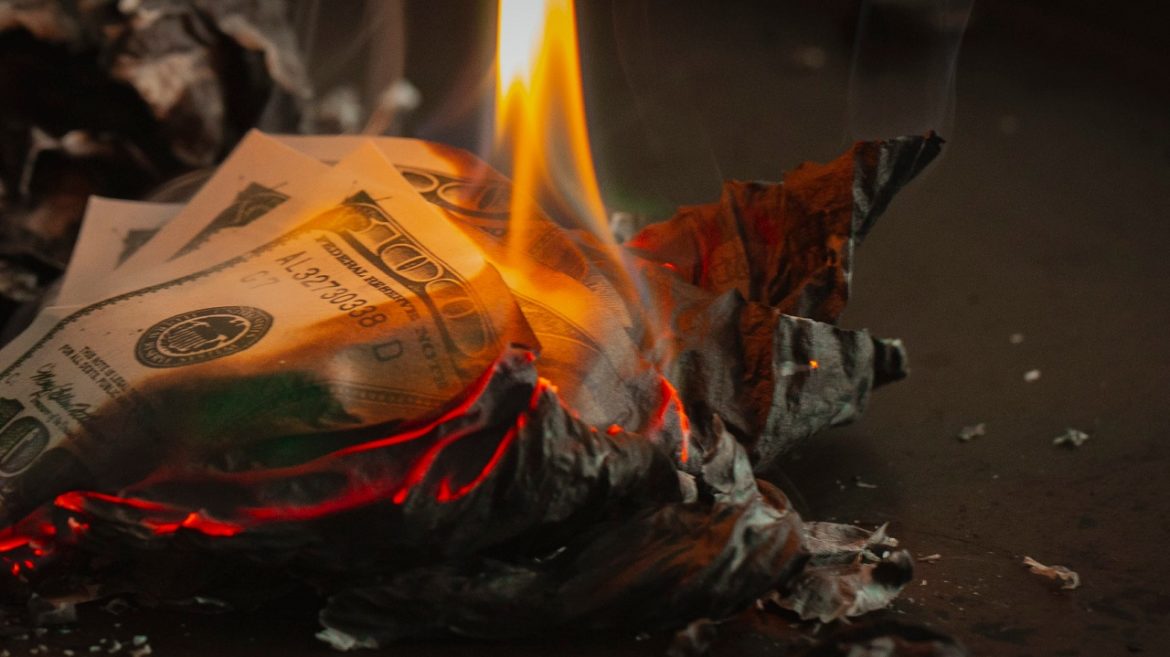

Peter Schiff has been driving home the fact that the Fed’s extraordinary monetary policy isn’t helping the economy. In fact, it’s setting the stage to destroy it.

Peter points out that the Fed seems to think inflation is the cure for what ails us. That means the monetary and fiscal policies that resulted from COVID are here to stay.

Peter Schiff shared his son’s Christmas list and drew a rather disconcerting conclusion – a lot of Americans think like a 7-year-old kid.

The money supply grew by 37.08% year-on-year in November based on the True Money Supply Measure (TMS). It was effectively the same rate of growth we saw in October and remains near September’s all-time high rate of growth.

The staggering growth in the money supply becomes more clear when you compare this year with last. TMS growth in November 2019 was just 5.9%.

The big story last week was the dollar’s slow meltdown. The dollar index broke below 90 for the first time since the spring of 2018.

The financial media hasn’t ignored the dollar weakness, but Peter said they don’t seem to grasp the significance of what’s going on, nor do they realize how much further the dollar has to fall. In fact, a lot of the talk has focused on the positives of dollar weakness. In his podcast, Peter argues this growing dollar weakness is not America’s win.

The Federal Reserve held its last meeting of the year this week. There were no big surprises policy-wise. But Jerome Powell and company made it clear that the easy-money spigot will remain wide open pumping trillions of dollars created out of thin air into the economy. In this episode of the Friday Gold Wrap podcast, Mike Maharrey talks about the Fed meeting and the ramifications of its monetary policy.

In its last meeting of 2020, the Federal Reserve made it clear the easy-money spigot will remain wide open into the foreseeable future. During his post-meeting press conference, Federal Reserve Chairman Jerome Powell seemed clueless about the ramifications of this policy – particularly the impact of inflation. Peter Schiff talked about the Fed meeting and Powell’s comments in his podcast, saying Powell’s ignorance won’t be bliss.

The US dollar has been showing significant weakness over the last several weeks. The dollar index closed at 90.814. Just two weeks ago, it was in the 94 range. Compared to the Swiss franc, the dollar is at a 6-year low. In his podcast, Peter talked about the dollar weakness and the Federal Reserve policy that’s causing it. The crazy thing about the rising inflation expectation is that the Fed appears poised to try to fight it with even more inflation.