It wasn’t long ago that all of the pundits were telling us that the economy was strong. As a result, a lot of people seem to think that once the coronavirus situation is resolved, the economy will quickly go back to normal. In his podcast Friday, Peter Schiff said that’s not going to happen. The coronavirus is actually going to reveal that the “great” economy was an illusion — a big, fat, ugly bubble that has now been popped.

It’s been another week of selloffs in the markets. It’s not just stocks. Everything is selling off. The only thing really gaining right now is the US dollar. Meanwhile, the government is promising bailouts for all. In this episode of the Friday Gold Wrap, host Mike Maharrey looks ahead at the possible ramifications of all this “stimulus” money. He also puts the recent drop in the price of gold into some historical perspective.

It appears we’ve pretty much reached complete panic mode.

The longest bull market in history came to an abrupt end on Wednesday. Wall Street followed up with another massive sell-off on Thursday. The S&P 500 had its worst day since Black Monday in 1987. Even gold was down. Meanwhile, the Fed tried to stem the tide, announcing a new round of quantitative easing. But the tide wasn’t stemmed. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey gives an overview of the week’s events and talks about the elephant in the room.

The 11-year bull run is over.

After a rebound on Tuesday based on hopes of government fiscal stimulus, US stock markets plunged again Wednesday and officially moved into bear territory.

Last week, we told you about the rising level of subprime auto loan delinquencies. Well, there is a similar thing happening in the subprime credit card market.

Is this the proverbial canary in a coal mine?

While impeachment proceedings kicked off at home President Trump was in Davos, Switzerland, talking up the US economy. He called it the best economy in American history. Is it though? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the economy, what’s really driving it, and why this might be a good time to think about gold.

Are consumers getting close to the end of their road of debt?

There are some indications that they might be and that’s not good news for an economy built on consumers spending money they don’t have.

Stocks closed out November on a high note with the hope of a trade deal fueling Wall Street. But is this warranted? And are consumers really doing a well as the mainstream would have us believe? Peter Schiff appeared on RT Boom Bust last week to talk about it. He said it’s all a house of cards and it’s going to come crashing down on American consumers.

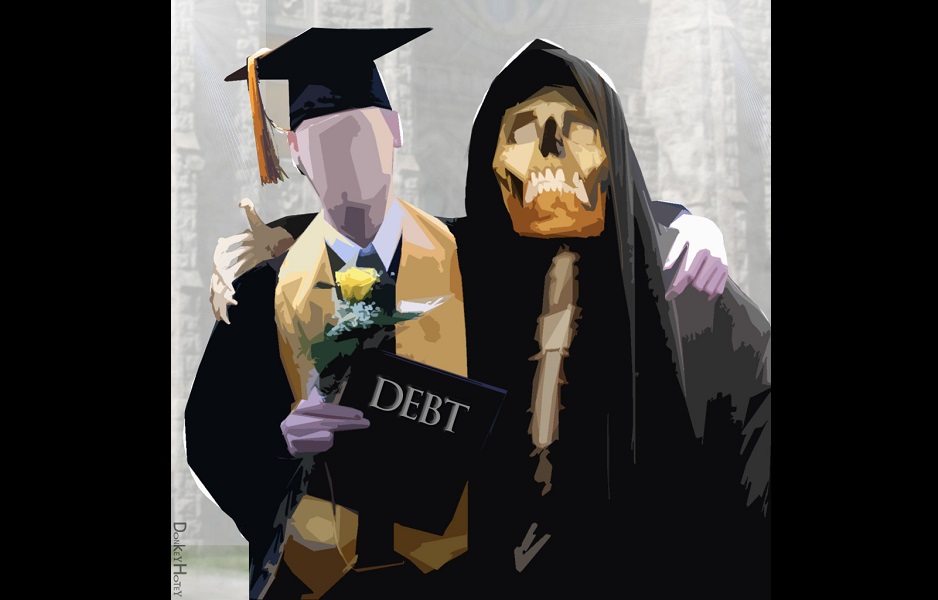

Have you heard? The Democrats are going to fix the student loan mess! They’ve brought up the issue in almost every Democratic Party presidential debate. All we need is a good government program and we can easily solve this $1.64 trillion problem.

Never mind that government programs caused the problem in the first place.

Just how big is the problem? And how did we get here? And most importantly, why should you care? You can get all of the details in SchiffGold’s fully updated report “The Student Loan Bubble: Gambling with America’s Future.“

Consumer debt set another record in September, but the pace of borrowing appears to be slowing. This could signal trouble for an economy built on American consumers spending money they don’t have.

Total consumer debt grew by $9.5 billion in September, according to the most recent data released by the Federal Reserve. That represents an annualized increase of 2.8% and pushed total consumer indebtedness to a new record of $4.15 trillion (seasonally adjusted).