Last week, Russia announced plans to completely eliminate dollars and dollar-denominated assets from its sovereign wealth fund. Is this another sign of erosion of dollar dominance?

The news from Russia dovetails with a warning by billionaire fund manager Stanley Druckenmiller that the dollar could cease to be the world’s reserve currency within the next 15 years.

Last week, we reported that the Russian National Wealth fund was dumping dollars and turning toward gold. The Russians have engaged in an intentional de-dollarization policy for several years. But it appears this could be part of a broader global move away from the greenback.

The dollar’s share of global currency reserves dropped significantly in the fourth quarter of 2020, falling to its lowest level in 25 years according to recently released IMF data. Globally, the dollar now makes up just 54% of global currency reserves. The last time the greenback’s share was this low was in 1995.

The Russian Finance Ministry has given the green light for the Russian National Wealth fund to diversify and invest in gold and other precious metals. According to a report by RT, this is part of a broader move to de-dollarize the wealth fund.

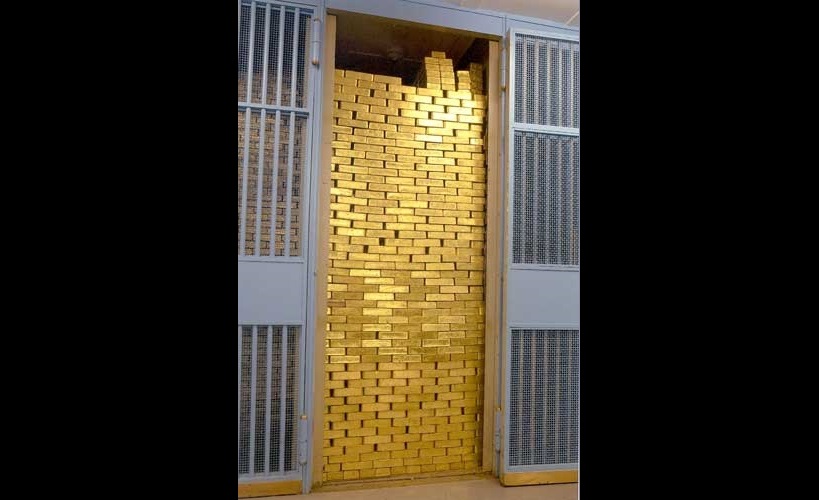

For the first time ever, Russia holds more gold than US dollars.

According to a Central Bank of Russia report published this week and analyzed by Bloomberg, gold made up 23% of the Central Bank of Russia’s reserves as of the end of June. The bank’s share of dollar assets dropped to 22%. In 2018, more than 40% of Russian reserves were in dollars.

Last year, we reported extensively on a push toward de-dollarization by countries like Russia and China and their desire to undermine the ability of the US to weaponize the dollar as a foreign policy tool. Europe was even starting to push to dethrone the dollar as the reserve currency.

With the Federal Reserve running the dollar printing press at full speed and the US government expanding the national debt into the stratosphere, there are renewed calls for a currency to replace the dollar as the world reserve.

China has accumulated more than 100 tons of gold since it resumed buying the yellow metal last December in a quest to diversify its reserves away from the US dollar.

The People’s Bank of China added another 5.9 tons of gold to its hoard in September, according to data on its website reported by Bloomberg. It was the 10th straight month of gold-buying for the Chinese central bank and it added to the 99.8 tons accumulated during the prior nine months.

The percentage of US dollars held as currency reserves globally dropped to the lowest level in nearly six years in the second quarter of 2019 according to the latest IMF data. Meanwhile, Chinese yuan made up the biggest percentage of reserves ever.

The dollar’s shrinking share of global reserves comes as countries like Russia and China move toward de-dollarization in an effort to undermine the ability of the US to weaponize the dollar as a foreign policy tool. The global gold rush on the part of central banks is part of this movement.

We’ve written extensively about a push toward de-dollarization by countries like Russia and China and their desire to undermine the ability of the US to weaponize the dollar as a foreign policy tool. The global gold rush on the part of central banks is part of this movement.

And it’s not just countries like Russia and China. As fund manager Ronald-Peter Stöferle wrote in an article for the Mises Wire, Europe as also joined the de-dollarization party.

China bought gold for the eighth straight month in July, adding another 10 tons to its rapidly growing hoard.

The recent purchases boosted the People’s Bank of China’s gold reserves to 62.26 million ounces – about 1, 945 tons. China has added about 94 tons of gold to its stash over the past eight months.

Central banks added more gold to their reserves last month, continuing a trend that stretches back into last year.

Globally, central banks added another 31 net tons of gold in March, according to the latest report by the World Gold Council based on International Monetary Fund data. That brings the total increase in central bank gold holdings this year to 145.5 tons.