Analysts expect continued strong investment demand for gold in China this year.

According to Xinhua News, gold as an investment will likely “glitter” in 2019 and gold jewelry sales are expected to get a boost in the Chinese lunar Year of the Pig. It also appears the People’s Bank of China is on a buying spree.

China ranks as the world’s top gold consumer.

Over the past 12 months, the US federal government has added $1.5 trillion to the national debt.

As of Jan 30, the debt stood just under the $22 trillion mark at $21.97 trillion, according to the latest Treasury Department data. As WolfStreet put it, we’re seeing these rapidly increasing levels of debt during “good times when the economy is hopping. At the next recession, this is going to get cute.”

But even as the US added to its debt load, foreign holders of US Treasurys are gradually selling them off. So, who’s buying up all of this debt? And is it sustainable?

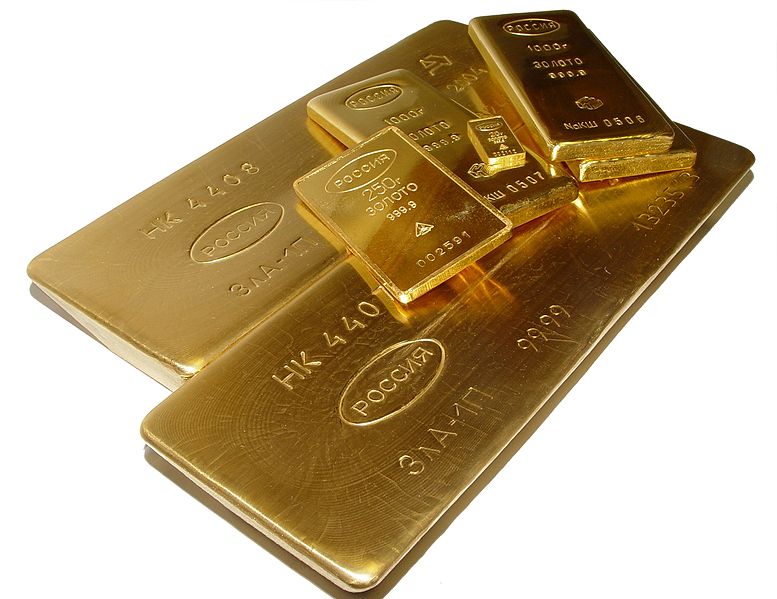

During a speech at the lower house of the Russian parliament, the CEO of the country’s key trading floor suggested Russian investors should replace investments they’ve made in dollars with gold.

“Let’s offer an alternative to the US dollar in the form of Russian gold, which we produce… investment gold,” Moscow Exchange (MOEX) CEO Alexander Afanasiev said.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

China officially added gold to its reserves last month for the first time in two years. Meanwhile, the Chinese have been shrinking their holdings of US Treasuries. According to the Nikkei Asian Review, the moves are intended to reduce dependence on the US dollar.

According to data released by the People’s Bank of China, the country’s gold reserves totaled 1,862 tons at the end of 2018. That represents a 10-ton increase from the previous month and the first rise in the country’s hoard since June 2016.

Russia added another 36.6 tons of gold to its reserves in November, according to the latest data released by the World Gold Council.

This follows on the heels of a 29.9-ton increase to its hoard in October and a 37.8-ton increase in September.

China and Japan dumped more US Treasuries in October, even as the federal government continued to run up its debt.

Chinese holdings of US Treasuries dropped for the fifth straight month, sinking to the lowest level since May 2017, according to data recently released by the Treasury Department. The total amount of US debt held by China fell from $1.15 trillion to 1.14 trillion. Over the past year, the Chinese have shed $50 billion in US debt.

How much gold does China really have?

The short answer is we don’t really know.

Officially, the Chinese central bank’s reserves stand at 1,842.6 tons. But the People’s Bank of China has not announced an increase in its gold hoard since October 2016. But it has almost certainly added gold to its reserves since then. Just how much is anybody’s guess.

Peter Schiff appeared on RT America Friday to talk about the big stock market selloff in the wake of the arrest of Meng Wanzhou, a Chinese businesswoman accused of violating US sanction laws. The markets reacted negatively, fearing the arrest could derail apparent progress in the trade war.

Peter said Wanzhou’s arrest may have provided the catalyst sparked the sell-off, but it wasn’t the underlying cause.

This is a bear market. That’s why the market went down. If it wasn’t that, they would have found another excuse. If we were in a bull market, I think the market would have shrugged it off. So, we’re going lower.”

The Russians have an alternative money transfer system up and running, and according to a report in RT, it has now surpassed SWIFT in popularity in that country. This is part of a broader effort by countries like Russia and China to limit their dependence on the US dollar and set up alternative financial channels outside of the global dollar system.