US equities are at an all-time high. Investors are bullish about the future. A lot of people are excited about the potential for economic growth with the passage of GOP tax cuts. There’s a lot of optimism.

In a recent interview on The Street, Peter Schiff said he thinks 2018 may start out the same, but he sees clouds on the horizon, especially when it comes to the dollar.

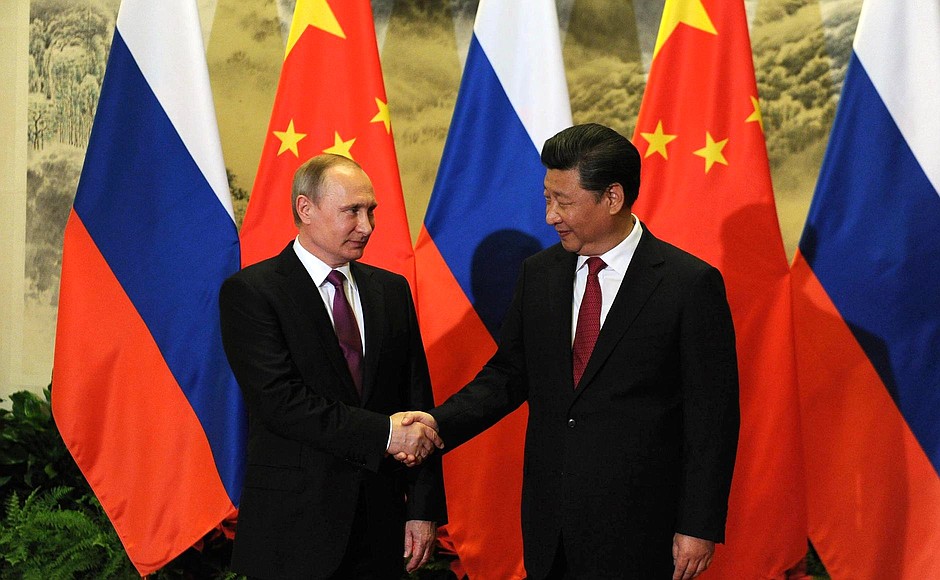

China wants to dethrone the dollar and it could take a step in that direction before the end of the year.

According to numerous reports, China is prepared to launch a yuan-denominated oil futures contract before Christmas. Last week, the Shanghai International Energy Exchange successfully completed a fifth round of yuan-backed oil futures testing. According to a report by RT, the organization has met all the listing requirements and is set for an official launch.

The US national debt stands at over $21 trillion and neither political party in Washington D.C. seems inclined to do anything about it. In fact, the GOP tax plan winding its way through the political process will add an estimated $1.5 trillion more to the debt over the next decade. And that doesn’t even account for the increases in spending that Congress will certainly approve over that timespan.

Of course, all of this government debt has serious ramifications. Corporations are also piling on credit. Last month, Mint Capital strategist Bill Blain predicted that “the great crash of 2018 is going to start in the deeper, darker depths of the credit market.”

Now consider this. China has an even bigger debt problem than the US, and analysts say it could threaten global financial security.

Loose monetary policy has dumped billions of dollars of easy money into the world’s financial systems over the last eight years, pumping up a whole slew of bubbles. We are still on the upside of the business cycle, with stock markets hitting record levels it seems like on a daily basis. But if history serves as any kind of indicator, a crisis is on the horizon.

What will precipitate it? That’s the proverbial $64,000 question.

Jim Rickards has compared financial crises to an avalanche. Snow piles up becoming increasingly unstable. Eventually, it reaches the point when all it takes is one more snowflake to set off an avalanche.

In a recent column, Rickards highlights three potential “snowflakes” that could set off the next deluge.

Turkey is buying gold.

The question is: why?

According to a Bloomberg report, the Turkish central bank added 3.8 million ounces of gold worth almost $5 billion to its reserves this year.

Gold exports from Australia surged from August to September, according to data released by the Australian Bureau of Statistics (ABS).

Non-monetary gold exports rose 17% in the period, an increase of $217 million in seasonally adjusted terms.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The Chinese are buying gold again after a slump in consumer demand last year.

Meanwhile, Chinese gold production is falling.

According to data released by the China Gold Association, gold demand rose 15.5% through the first three quarters of 2017. Demand totaled 815.9 tons, pushed upward by a resurgent jewelry market.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

China wants to dethrone the dollar. But of course, it’s not alone. Russia would also love to knock the US off the top of the economic mountain. Putin is also positioning his country to free itself from the dollar-dominated global financial system. Like its neighbor to the east, Russia is using gold to pave the way to economic independence.