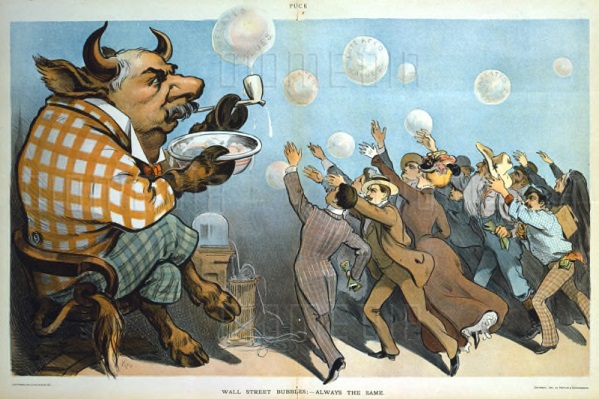

We’ve written extensively about the stock market bubble blown up by artificially low interest rates and Federal Reserve quantitative easing. But stocks aren’t the only asset bubble out there. In fact, 2017 may go down as the year of the bubbles. And the new housing bubble is one that seems to be floating under the radar.

Financial manager James Stack has noticed it. He predicted the housing crash in 2005, and he told Bloomberg the housing market is flashing red again.

It is 2005 all over again in terms of the valuation extreme, the psychological excess and the denial. People don’t believe housing is in a bubble and don’t want to hear talk about prices being a little bit bubblish.”

Last Friday, all three major stock markets hit new record highs ignoring the storm clouds on the horizon. In his latest podcast, Peter Schiff said this reminds him of 1987.

The stock market is rising despite the fact that there are very, very negative factors that are building, that are hiding in plain sight, that everybody is ignoring.”

When it comes to the economy, most people aren’t worried about anything when there is everything to worry about.

Last month, we reported on a Bank of America survey that indicated the mainstream has started to acknowledge that the stock market is a big, fat, ugly bubble.

The latest fund-manager survey by Bank of America Merrill Lynch found that a record 48% of investors say the US stock market is overvalued. Meanwhile, 16% of investors say they are taking on above-normal risk. BoA chief investment strategist Michael Hartnett called this “an indicator of irrational exuberance.”

Now, even the government has taken notice, acknowledging asset prices are floating in dangerous bubble territory.

Last week, Peter Schiff did an interview on The Street and talked about the US stock market, saying, “Well, the bubble keeps getting bigger.” We’ve been talking about this ballooning bubble for months. After a while, it’s easy to blow us off as pessimistic contrarians who just don’t get it. But amazingly, large numbers of investors also believe the stock market is way overvalued.

But they keep buying anyway.

Bank of America called it “irrational exuberance.”

When the Fed launched its aggressive monetary policy in the wake of the 2008 financial crisis, many free-market economists predicted it would result in massive price inflation. That never materialized. As a result, Keynesian economists like Paul Krugman love to finger-point and mock those who criticize easy money policies designed to “stimulate aggregate demand.” They claim the lack of price inflation proves they were right all along. You can massively increase the money supply during a downturn to stimulate the economy without sparking inflation. Free-market people are wrong.

But just because we don’t see price inflation doesn’t mean there isn’t any inflation at all. After all, the new money has to go someplace. If we don’t see it manifested in rising prices, it’s because we’re looking in the wrong place.

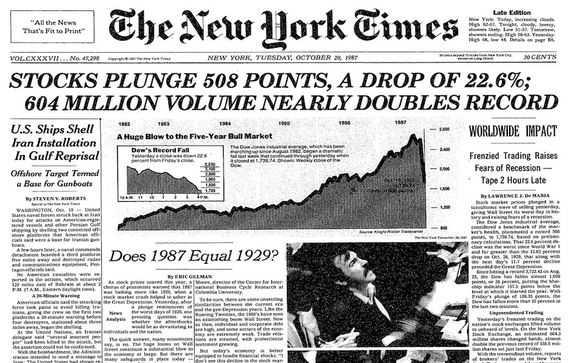

Thirty years ago today, the US stock market had its worst single day in history.

On Oct. 19, 1987, now known simply as “Black Monday,” the Dow Jones Industrial Average lost 508 points. That represented 22.6% of its value.

Over the last couple of year, stocks have enjoyed a meteoric rise. The Dow closed above 23,000 for the first time this week. But in recent months, bankers and investors around the world have expressed started expressing concern about the rapidly inflating stock market bubble and its future impact on the world economy. Just last month, Tiger Management co-founder Julian Robertson unequivocally called the US stock market a bubble and blamed it on the Fed’s interventionist monetary policy.

At some point, the soaring market will fall back to earth, and MarketWatch columnist Howard Gold says the next crash may prove worse than Black Monday.