The mainstream investment world is starting to worry about the federal debt.

Goldman Sachs sees a tidal wave of red ink — and it may drag the US economy into its undertow.”

Goldman recently released a note to clients saying virtually the same thing Peter Schiff has been saying for months. The US economy won’t likely get the promised economic growth out of GOP tax cuts – at least not over the long-haul.

Stock markets have settled down after an awful couple of weeks earlier this month. On Feb. 5, the Dow Jones suffered its largest-ever drop in terms of points. It was down 1,600 at one point and ultimately lost 1,175.21 points, a 4.6% drop that day. At one point during that week, the Dow was off 10% in correction territory. But everything is calm now and most of the mainstream is once again feeling bullish and optimistic.

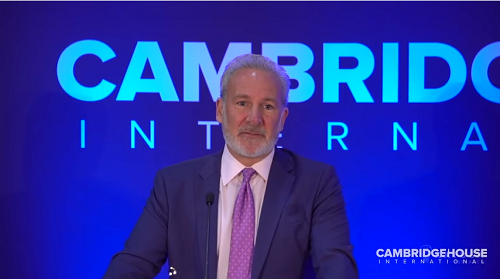

Peter Schiff spoke at the Vancouver Resource Investment Conference 2018 last month before the market tanked. But his message remains relevant in the aftermath of the plunge and the subsequent recovery because the dynamics in the market remain pretty much the same. Conditions are still ripe for a 1987-style market crash.

Investors have not been this optimistic…since 1987. They are even more optimistic than they were at the height of the technology bubble, the dot-com bubble, the new era. Of course, 1987 didn’t end well, right? We had a stock market crash, and there’s a lot about what’s happening today that reminds me about what was happening in ’87.”

The US dollar dropped to its lowest level in three years Friday.

Extending losses on Thursday, the dollar index against a basket of six currencies dropped to 88.253. This marks its lowest level since December 2014.

A Reuters report noted that “Traders’ confidence in the dollar has also been eroded by mounting worries over the United States’ twin budget and current account deficits.” Interestingly, just last month Peter Schiff said these twin deficits may ultimately doom the stock market.

The Babylon Bee captured the current state of the Republican Party in all of its hypocritical glory. The satirical website proclaimed “Republicans announce plan to pretend to be fiscally conservative again the moment a Democrat takes office.”

The GOP said it would begin to decry deficit spending and the $20 trillion debt in order to win votes as soon as political power swung back to the opposing party.

“‘The second a Democrat is back in the White House, we will once again start yelling about fiscal responsibility,’ Speaker Paul Ryan said in an address to the House of Representatives Friday. ‘For now, we will continue to vote for unsustainable and irresponsible budgets that your children’s children’s children will pay for for centuries to come.’”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The bears were running on Wall Street again Thursday, as the Dow Jones suffered another steep tumble. After a record drop of 1,175 points Tuesday and a rebound Wednesday, the Dow shed another 1,333 points.

The Dow Jones dropped 6.5% in four days. That’s the steepest decline in any week since October 2008. The S&P 500 has shed 6.6% of its value this week, its second-worst drop since 2008. The NASDAQ has also tanked, giving up all of its 2018 gains.

As Peter Schiff put it in his most recent podcast, “This market is looking ugly.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

The dollar continued to tank Wednesday, hitting a 3-year low after Treasury Secretary Steven Mnuchin said he welcomed a weakening dollar.

The dollar index measuring the greenback against a basket of six major currencies slipped below 90 for the first time since December 2014. Meanwhile, gold climbed, hitting its highest level since August 2016.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.