Peter Schiff uses his latest podcast to dig into the fundamentals of gold production in Canada and the United States. He also explains why mainstream analysts are completely clueless when it comes to understanding how the Chinese yuan is affected by its peg to the dollar. He wraps up by looking at the terrible condition of US student loan debt, and the government policies that empower college students to make terrible career decisions.

The German central bank (Bundesbank) repatriated 120 metric tons of gold in 2014. 85 of those tons came from the New York Federal Reserve, which held nearly half of Germany’s gold at the time. This is in sharp contrast to repatriating just 37 tons in 2013 – only 5 of which came from New York. It would appear that Germany is quite serious about getting its gold back after all.

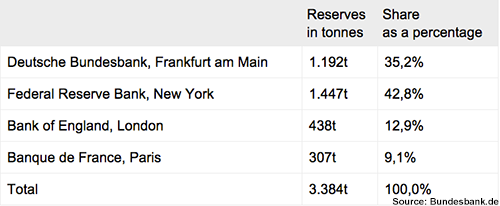

At the beginning of 2013, the Bundesbank announced that it would begin the process of repatriating massive amounts of its physical gold reserves back into Germany. The goal is to have half of its gold back in Germany by 2020. Currently, nearly 65% of its reserves are stored in the New York Federal Reserve, the Bank of England in London, and in the Banque de France in Paris. New York alone holds almost 43% of Germany’s gold:

Jeff Clark of Casey Research spoke with Vanessa Colette at the Vancouver Resource Investment conference hosted by Cambridge House International. Clark explained that gold has been performing exactly as it should in the past year by rising in the price of foreign currencies that have been experiencing inflation and economic trouble. Clark emphasized that there has never been a better time in history to own gold. On top of that, he reminds us that someday the East is going to take charge of the gold trade, and they’ll do that at much higher prices than we’re seeing now.

Precious metals naysayers often fail to keep a global perspective on the economics behind gold and silver. This past week has been a stark reminder that gold is an international asset whose real, fundamental value cannot be found in US dollar terms alone. When the Swiss franc’s peg to the euro was dropped, gold surged against global currencies.

A Kitco commentary by Frank Holmes featuring a variety of currency charts makes the point succinctly. First, here’s gold in euros. Gold is up 14.3% in the past month against the euro. It’s moved nearly 6% since Switzerland decided to abandon the euro.

David Asman interviewed Peter Schiff on Fox Business on Friday. They discussed why inflation created by central banks doesn’t actually create a strong economy, but rather serves to prop up irresponsible governments. Peter also explained why the price of gold is going up even while the US dollar is rising against other currencies.

In his first Schiff Report video of the year, Peter Schiff explains the Swiss news that rattled the foreign exchange markets this week. Peter had predicted that Switzerland would eventually be forced to drop its euro peg, just as he’s been warning that countries like China will be forced to abandon their ties to a weakening US dollar. If investors don’t want to experience even worse losses than Europeans were hit with this week, they need to start preparing for a dollar crisis. Gold has performed very well this year, even while the US dollar and stock market moved higher, which Peter sees as an indicator that a new bull trend has started in precious metals.

In his latest podcast, Peter Schiff provides more in-depth analysis of how the Swiss National Bank’s monetary policy could affect the US dollar in the long-term.

Markets are still reeling from yesterday’s news that the Swiss National Bank has removed the currency cap on the Swiss franc. Still wondering exactly what this means for European and American investors? Peter Schiff explains to RT what this means in the larger context of the international currency war. It’s good news for the Swiss people, but Americans still have a long way to go before losing confidence in the Federal Reserve.

Kitco News spoke with forecaster Gerald Celente about the grand manipulation of global markets by central banks. Celente argues that the only reason the gold price isn’t $2,000 is because of the low interest rates and quantitative easing of the Federal Reserve. He predicts a panic in US equity markets in 2015 and a resurgence in precious metals.

In yesterday’s podcast, Peter Schiff addressed the current stock market volatility, the United States housing market, retail sales numbers, and the American recovery fantasy.