Russia has added more gold to its foreign reserves, making December the ninth month in a row that it has bought the yellow metal. Russia’s gold holdings are now the largest they’ve been in two decades, according to the International Monetary Fund.

Smaller countries have also been stocking up on the yellow metal. Kazakhstan added to its reserves for the 27th straight month. Malaysia, Belarus, Greece, Kyrgyz Republic, and Serbia also bought gold.

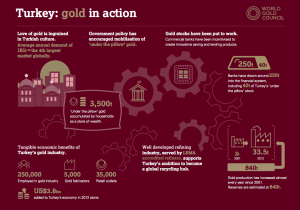

The World Gold Council has released a fascinating new report on Turkish gold demand and gold culture. Many gold investors are aware that China and India have been the top gold consumers in the world, but Turkey has a thriving gold economy as well. In fact, Turkey is the world’s 4th largest gold consumer, and in many ways, gold is even more integrated into the Turkish economy.

- At least 3,500 metric tons of gold is saved “under the pillow” of Turkish citizens.

- Turkey works actively to encourage wise investment and savings of this gold.

- Gold ATMs are common in Turkey, making it easy for consumers to buy high-quality physical bullion.

The World Economic Forum’s meeting in Davos ended this past weekend, and much of the mainstream news focused on the hypocrisy of the world’s wealthiest individuals discussing the plight of the global economy. Research released by Oxfam in the middle of the conference shows that the richest 1% own 48% of the world’s wealth. Politicians love broad statistics like this, which they can use to justify more government “solutions” to this inequality.

However, it’s these same successful (and rich) businessmen who are sounding the alarms about the destructive policies of global central banks. These monetary policies are the single biggest contributor to income inequality, because they enrich the financial elite while destroying the economic fundamentals that allow the lower and middle classes to prosper. Renowned business magnate George Soros made the news at Davos when he stated the obvious:

Peter Schiff gets a bit riled up in his latest podcast while responding to Obama’s State of the Union Address. Of course, Peter has good cause to get upset as he picks apart the outright lies in Obama’s speech, including Obama’s claim that he has reduced America’s debt and that the middle class lifestyle is better off thanks to big government.

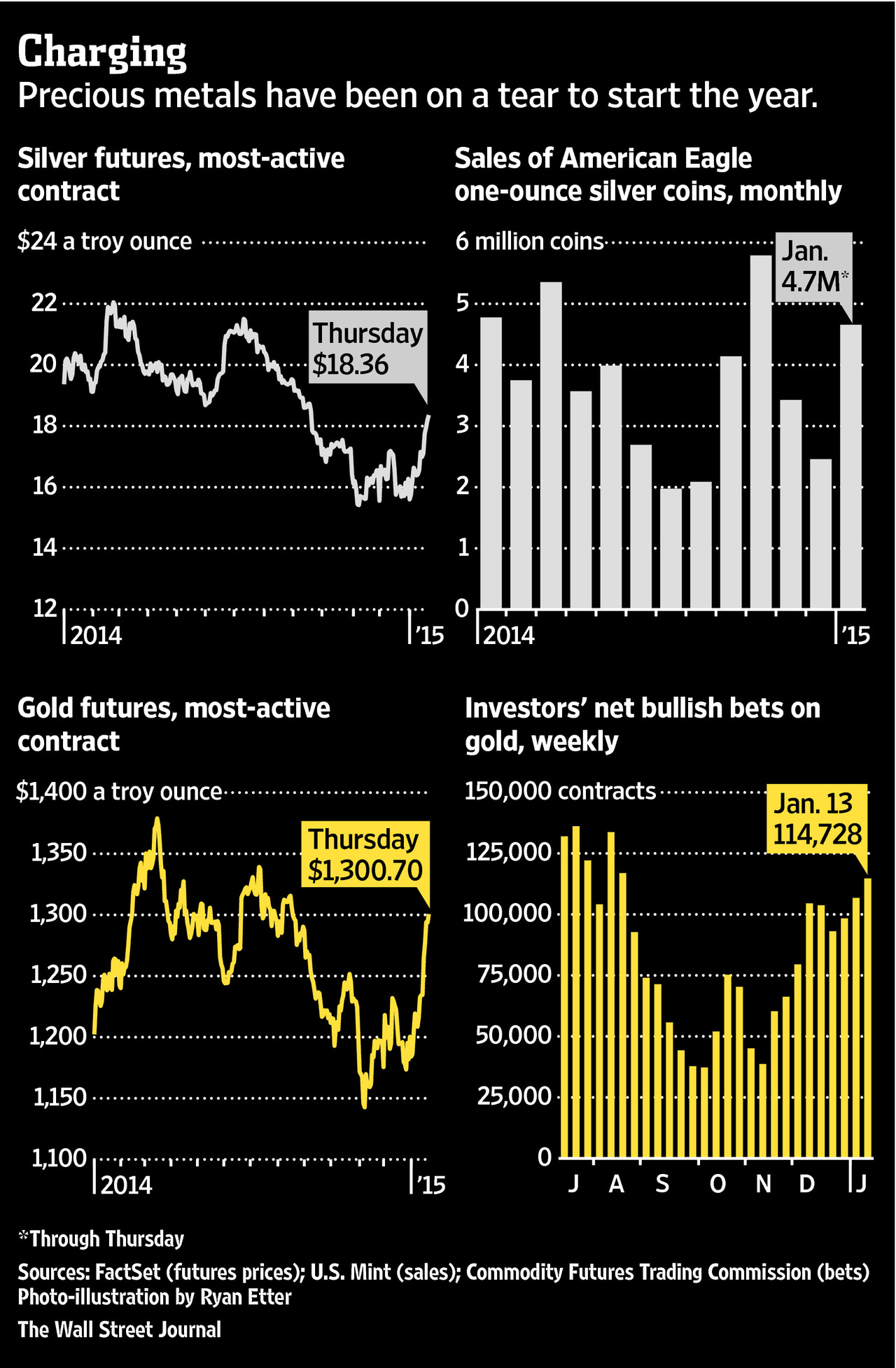

As of this morning, gold is up more than 10% and silver is up more than 16% since the beginning of the year. Gold stocks have also been strong, especially in the mining sector. While the S&P 500 has dropped about 1%, the Arca Gold Miners Index is up nearly 25%. Unsurprisingly, the mainstream financial media is starting to jump on the gold bandwagon.

In an article on the front page of its business section, The Wall Street Journal looks at all the factors influencing bullish sentiment for precious metals thus far in 2015. These include:

Peter Schiff appeared on RT this morning to share his opinion on the ECB’s announcement of a new quantitative easing program.

The European Central Bank (ECB) will begin a new quantitative easing (QE) program in March. The central bank announced this morning that it would buy at least 1.1 trillion euros worth of euro-denominated bonds from governments and private institutions across Europe. It will begin its monetary manipulation at the rate of €60 billion a month, which will last into the fall of 2016. If you’ve got a few minutes to waste, you can watch ECB President Mario Draghi deliver the news himself:

Like Janet Yellen, Draghi uses the bogus excuse of low inflation as one of the primary justifications for the program. This renewed commitment to creating European inflation boosted to gold, pushing it over $1,300.

Peter Schiff appeared on Bloomberg TV yesterday to explain why China is going to be forced to remove its peg to the dollar, just as Switzerland abandoned its euro peg. When this happens, the big losers are going to be American citizens, while Asians will likely enjoy a higher standard of living.

Peter Schiff appeared on CNBC World earlier this week, continuing his crusade of warning the financial media that central bank money printing is ultimately going to be a disaster for the economy. He also commented on President Obama’s hopes of raising capital gains and inheritance taxes. Peter slammed the president for his fundamental lack of understanding of how to responsibly grow an economy.

Marc Faber appeared on CNBC’s Futures Now yesterday to encourage investors to get into gold. His reasons are the same as Peter Schiff’s – 2015 could be the year that the markets lose confidence in central banks’ ability to artificially prop up the economy. In fact, he strongly believes that gold could rise 30% this year.

At 1:58, the interview gets uncomfortable when Faber calls out the financial advisors and CNBC specifically. The anchor goes quiet and quickly ends the interview when Faber remarks bluntly that the financial sector would love it – Main Street be damned – if Yellen printed way more money:

It is clear to me that the financial sector – including CNBC – loves central banks, because by printing money, they lift stocks… I also get higher fees from rising stocks… Yellen should print twenty times more money… Then stocks will go up and it will impoverish the population.”